- The US dollar has been hit by negative oil prices.

- The BoE announced plans to set up digital currency managed by the central bank.

- COVID-related deaths have increased by 17% in the UK this week.

The GBP/USD pair traded at a -0.08% price change in pre-trading on April 20, 2021, after closing at 1.3983 the previous day. Employment data in the 3-month moving average (into Q2 2021) in the United Kingdom (UK) increased to -73,000 from a previous reading of -147,000. The employment change data exceeded expectations, with analysts pessimistic at -157,000. The unemployment rate lowered 0.1% from a previous record of 5.0% to 4.9% in Q1 2021.

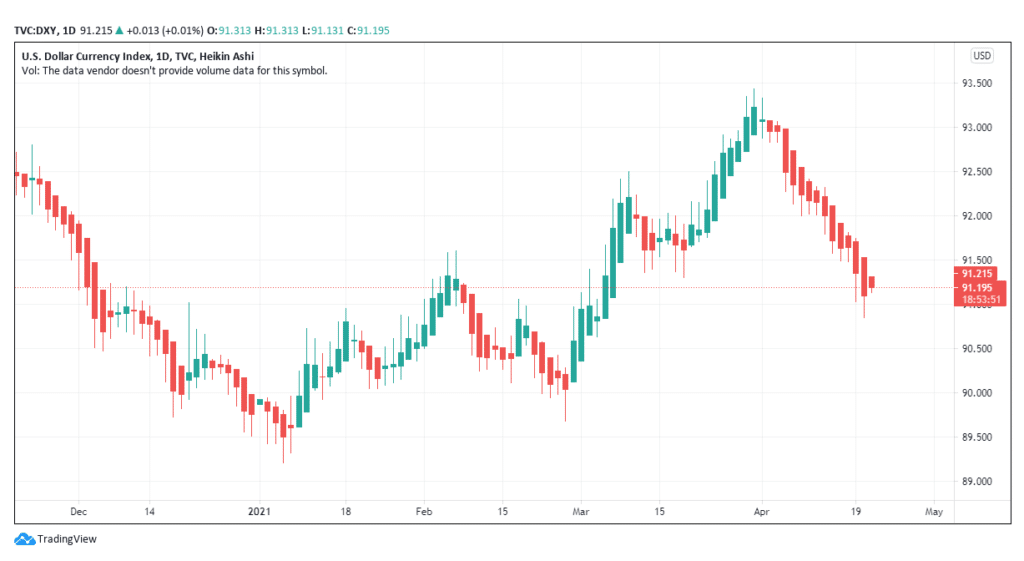

The US dollar index (DXY) decreased -0.13% after opening trading on April 20, 2021.

US dollar index (DXY)

The dollar has weakened against major currencies, dropping 20.02% since April 2, 2021, from $114.04 to $91.21 on April 21, 2021. A report by the American Petroleum Institute (API) indicated that there was an increase in the inventory stock at 0.436 million against an expectation of -2.860 million. This inventory indicated weaker demand for petroleum in the US that was bearish for crude prices and against the dollar.

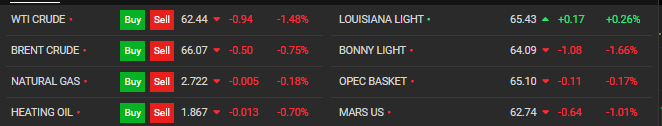

Oil prices fell on April 21, 2021, due to the weakened dollar as the global cases of coronavirus continued to surge.

Oil prices as of April 21, 2021

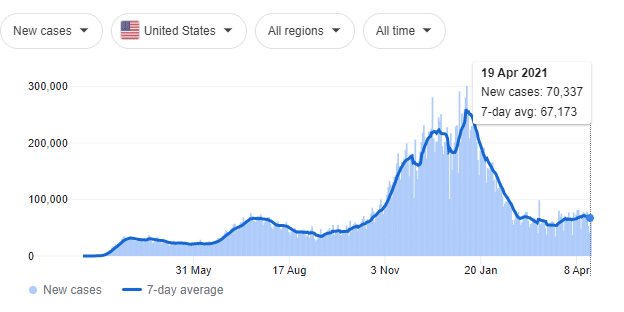

In the US, new coronavirus cases have risen from 62,003 on April 6, 2021, to 70,337 on April 19, 2021 (+13.44%) against a 7-day average increase of +3.60%.

Coronavirus update as of April 19, 2021

The central bank and digital currency

The Bank of England (BoE) kept interest rates at 0.1%, awaiting review on May 6, 2021. The rate is, however, likely to be maintained, seeing the inflation rate is 0.4%, approximately 1.6% off from the target at 2.0%.

The BoE announced a plan to enter the crypto market by setting up digital money managed by the central bank. The hallmark of the digital future was based on the premise that the use of cash in money transactions over the years has declined while credit and direct debit payments have been on the rise.

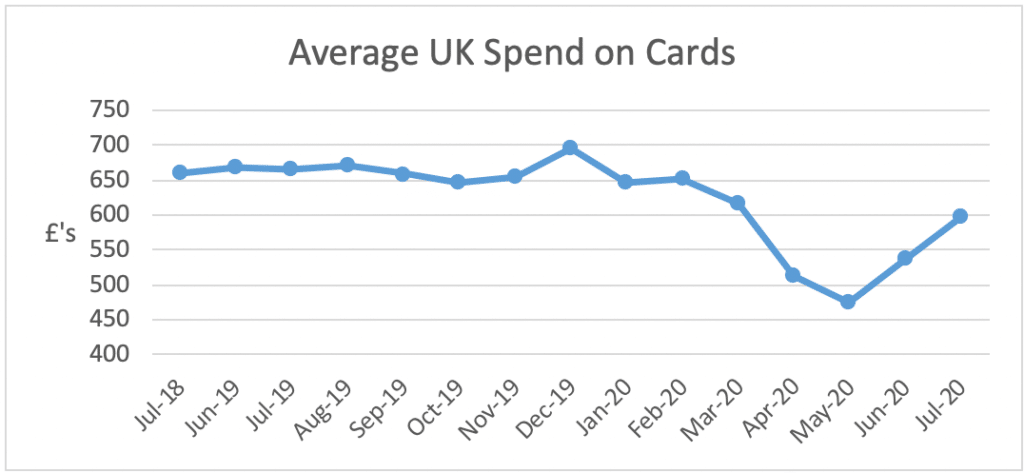

Credit card payments from 2018 and projections to 2028

The above statistics show that credit-card payments in 2018 stood at £3.23 billion against £1.06 made through chips and other contactless methods. The projections in 2018 indicate that by 2028, credit card payments will have increased to £4.12 billion and contactless options by £2.28 billion. It is this forecast that is driving the central bank towards embracing a digital currency option.

Average spending using credit cards decreased 27% from January 2020 through to May 2020 year-on-year as businesses closed down.

Average use of credit card payments in the US from 2018-2020

Usage is expected to increase in 2021 due to the rising consumer confidence and withdrawal of restrictions surrounding the coronavirus. Total fatalities in the UK now stand at 127,307, indicating a decline in infection as the country intensified vaccination to 10,425,790.

The UK, however, reported on April 20, 2021, that there were additional 33 deaths related to COVID-19 while new cases topped 2,524. The death toll increased 17.86% from the previous day slowing the country’s attainment of herd immunity. The pound was unable to stay above 1.4000 and soon tumbled to 1.3927.

Technical analysis

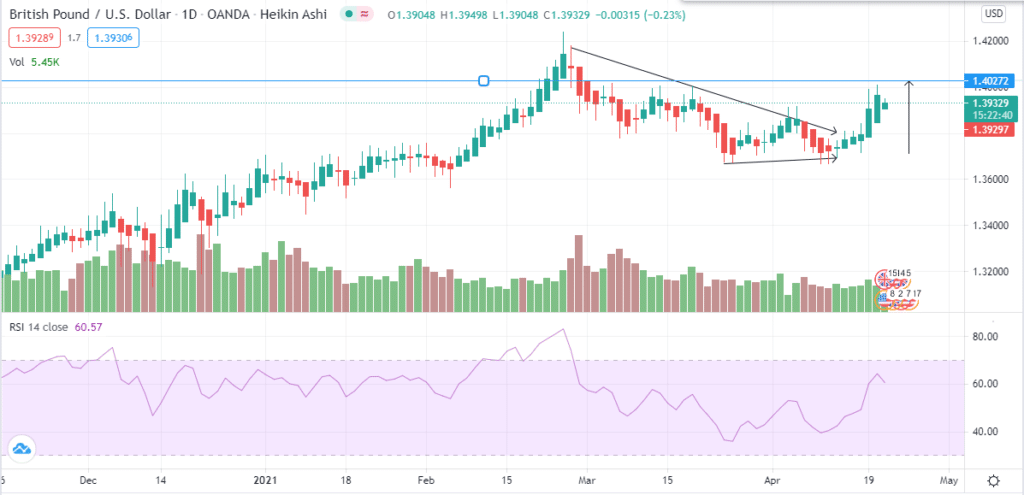

GBP/USD trading chart

The GBP/USD daily chart shows that the pair is responding positively to the falling wedge pattern. We expect the pound’s gain to lift the currency towards new support at 1.4027. Traders that open long at 1.3930 may hope to gain profits of at least 970 pips on April 21, 2021. The 14-day RSI indicates investors have increased their buying options at 60.57 owing to positive news from the UK and the falling dollar.