2020 was a good year for gold. If the price ends the year at the current level, it will have gained more than 20% for the year. That is a better performance than the overall 18% gain in 2019. Gold has also outperformed the S&P 500 and the Dow Jones indices and underperformed the Nasdaq 100. In this article, we will look at what moved gold prices in 2020 and come up with the outlook for 2021.

Gold vs. Nasdaq 100, S&P 500, and Nasdaq 100

Gold performance in 2020

The price of gold started in 2020 on a positive note, rising by about 4% in the first quarter. It ended Q1 slightly below $1,600. Things changed in the first part of Q2 as investors started to worry about the coronavirus pandemic. The sell-off in stocks and other assets and the overall strength of the dollar pushed gold to the year-to-date low of $1,452 on March 20th.

Since then, the price rallied by more than 40% and reached an all-time high of $2,075 in August. In the past two quarters of the year, however, the price has retreated even as the situation has remained conducive for the precious metal. As of this writing, it has dropped by more than 10% from its all-time high, as shown below.

Gold price action in 2020

What moved gold in 2020?

There were five primary movers for gold prices in 2020; Federal Reserve policies, global fiscal stimulus, the overall weaker US dollar, cryptocurrency prices, and the bullish nature of the overall market.

Federal Reserve policies

The Federal Reserve implemented several policies to deal with the pandemic. The bank slashed interest rates to a multi-year low of between 0% and 0.25%. It also announced an open-ended quantitative easing policy that pushed its balance sheet to more than $6 trillion. Further, the bank started buying corporate bonds in its bid to support corporate America.

All these measures had a major impact on the financial market. When interest rates are low, it tends to lead to an increased appetite for risk. It also incentivizes more people and investors to buy financial assets since their savings don’t earn them any returns. Similarly, low-interest rates usually lead to currency debasements. Indeed, as shown below, the US dollar fell to a multi-year low because of these policies.

US dollar index crashed to 2018 lows.

Fiscal stimulus and global debt

In response to the pandemic, governments from around the world rushed to the market to borrow money. In the United States alone, the federal government borrowed more than $3 trillion to support the economy. Other countries like the United Kingdom, Germany, and South Africa also increased their borrowings.

Countries were not alone. Most companies, including those with junk ratings, borrowed billions of dollars in their fight for survival. As a result, according to S&P Global, debt rose by more than $19 trillion to more than $19.3 trillion. In most cases, gold price tends to rise when global sovereign and corporate debt rises because of its role as a hedge against risk.

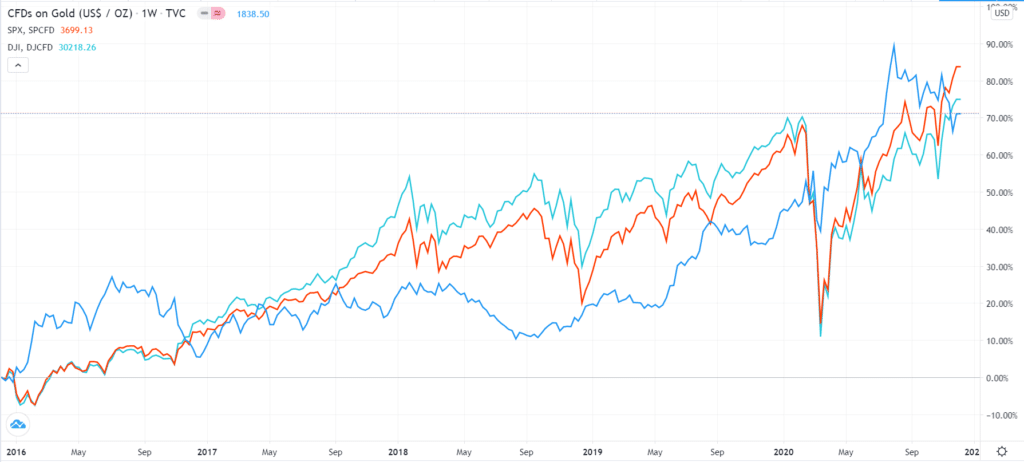

The global rally in stocks

Gold also rallied because of the overall rally in global equities. Historically, the price of gold tends to move in the same direction as equities. Indeed, as with stocks, the price dropped when the pandemic started and then rallied afterward. Similarly, the same price action has happened in the past five years. Also, the rally of other financial assets like copper, silver, and palladium also contributed.

Gold vs. S&P 500 and Dow Jones in the past five years

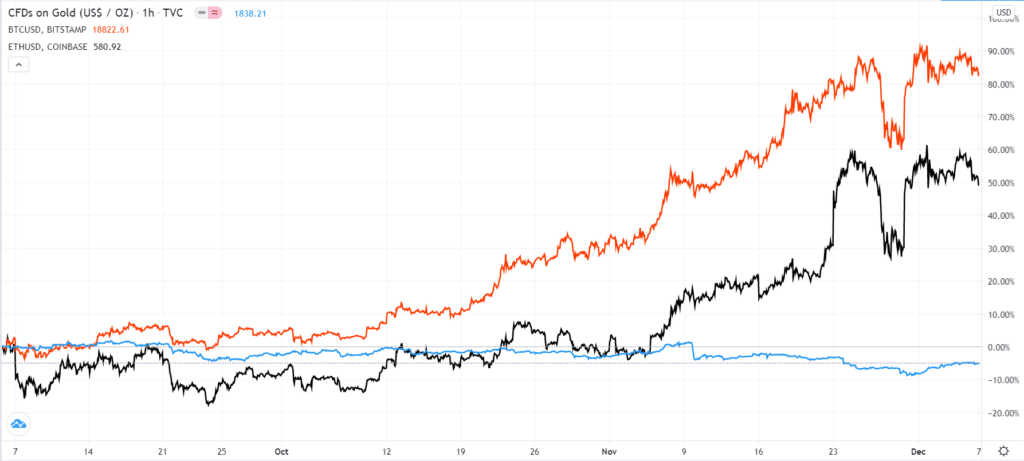

Cryptocurrencies impact on gold prices

Analysts attribute the price action on gold in the final part of the year to the overall rally in digital currencies. Indeed, as the price of cryptocurrencies rallied, most investors started moving from stocks and gold. This is because digital assets had better returns than gold. The chart below shows the divergence in gold prices with that of Bitcoin and Ethereum in the past three months.

Gold vs. Ethereum and Bitcoin prices

What next for gold in 2021?

Analysts are torn about the future of gold prices in 2021. In a recent report, analysts at Deutsche Bank said that they were pessimistic about gold prices in the near term. They cited the fact that there will be a weak demand for gold from institutions and central banks.

Other banks are generally optimistic about the metal’s price, with those from Bank of America predicting that the price will surge to more than $3,000.

In general, the gold price in 2021 will depend on several factors:

- First, it will depend on how strong or weak the dollar will be.

In fact, in 2020, the weaker dollar was one of the main reasons why gold rallied. Therefore, if the dollar continues to slump, it will support higher gold prices. However, if there is an overall reversal in the value of the dollar, I believe that gold will struggle to move higher.

- Second, the Federal Reserve monetary policy will have an impact on gold.

Even with the vaccine, analysts believe that the economy will take a long time to recover. As such, the Fed will possibly leave rates unchanged in 2021, which will be a positive thing for gold. However, gold will possibly struggle if the bank suddenly turns hawkish.

- Third, cryptocurrencies, too, will affect gold prices.

If they continue rallying, as I suspect they will, there is a high possibility that investors will shift their resources from gold to digital currencies.

From a technical perspective, we see that the gold price has formed a descending channel. It is also along with the 38.2% Fibonacci retracement level. Therefore, there is a possibility that the price will continue falling in 2021.

Gold price technical analysis

Summary

Gold has had a mixed year in 2020. While its price rose by more than 20% this year, it has been in a downward trend in the final months of the year. In 2020, this downward trend could continue if the dollar rebounds and the Fed turns relatively hawkish.