- The gold price has found support at the $1,850 mark sparking fears that the golden moment is far from reach.

- The Federal Reserve’s push to maintain low-interest rates may give gold a slight impetus in the first half of 2021.

- An increase in mortgage rates signifies that additional stimulus by the Biden administration may increase interest rates in the long run.

Description

The gold price has gained 19.74% in the past year after rising to a high of $2,070.05 from a low of $1,477.30 per ounce. It has been unable to compete with other metals such as palladium and rhodium that are gaining ground very fast. It crossed the $2,000 mark in August 2020 when it attained the record high, and since then, it has struggled to retain hold at $1,850. With the Federal Reserve promising to keep interest rates low and bond yields rising into the first quarter of 2021, the gold prices are scheduled to struggle to keep the upside of $1,900 per ounce.

The Federal Reserve has indicated that it is not in a rush to hike interest rates in the first quarter of 2021. However, this decision is contingent upon the low inflation rates in the US. Should the inflation rate rise, the FED will have no option but to increase the rates. A decision to hike interest rates will work negatively on gold prices. It will lure investors into brokerage firms, healthcare company stocks (especially those offering COVID-19 vaccines), and technology companies.

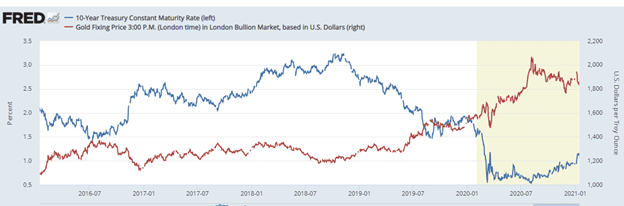

Investors will be attracted to firms with high cash balances compared to those with low cash reserves. We are looking at bond yields that tend to have a negative correlation with the price of gold. Additionally, gold is taking advantage of the US dollar weakness, and investors are seeing an investment opportunity in the commodity later in 2021.

The fixing price of gold has been inversely proportional to the 10-Year Treasury maturity rate. When the 10-Year yields were at 0.57, the fixing price was set at $2,031.150 on August 7, 2021.

Stimulus

The news of the $2 trillion Biden stimulus package made mortgage rates rebound to their highest level since November 2020. Data released on January 14, 2021, indicated that the 10-year fixed-rate jumped to 2.79% (about 0.9%) shy of the rate recorded in 2019.

In the most likely scenario, an increase in interest rates will drive gold prices down. Investors will be attracted to bonds with rising interest rates. The rise in treasury yields has contributed to the high mortgage rates. Investors will prefer to invest in real estate in the long-run compared to putting their money in safe havens such as gold.

Bitcoin

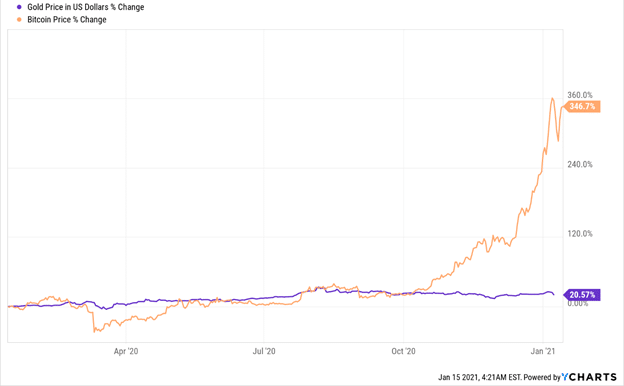

Over the past year, and at the core of the pandemic-gold has surged by almost 21%. This increase is due to investor confidence in the commodity as a store or haven of wealth. However, bitcoin (BTC) has soared by 346.7% in the same period. Bitcoin is quickly overtaking gold as the alternative haven of wealth, and investors have taken notice.

Technical analysis

The 14-day relative strength index (RSI) indicates a gold price against the dollar at 59.513. The stochastic RSI is sharp at 100, showing investors are buying the commodity in tremendous numbers. The 200-day SMA shows a high resistance position at $1,884.43, and the 200-day EMA is at $1,868.78. If the gold broke the $1,900 resistance and is forming support at the 1970 level, there is no need to short the commodity. It is headed to break the $2,000 barrier, but if it lowers support to $1,750, it’s more likely to hit further lows into 2021.