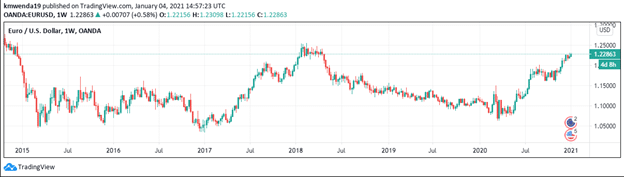

- The Euro has maintained a consistent lead over the dollar as the latter weakens in value.

- The European Central Bank (ECB) may have to overwrite rising budget deficits as individual member states’ budget deficits hit the red-zone.

- The Euro is currently on an uptrend with shallow pullbacks in sight.

The EUR/USD chart hit a high of 1.23090 on January 4th, 2021, with indications rife that the Euro is gaining strength against the dollar in the global market. In 2019, the EU’s inflation rate dropped by 1.44% compared to the previous year’s 1.85%. In the United States, the consumer price index (CPI) increased by 1.92% from 255.902 in April 2020 to 260.817 in October 2020.

The European Central Bank (ECB)

The ECB finished 2020 by extending its bond-buying initiative until December 2021. With this move, the financial powerhouse is expected to inject an additional €600 billion into the European economy. Banks are set to benefit from a new financing scheme in 2021 to add liquidity into the market. The EU intends to keep the CPI below 2% into 2021. In contrast, the USA’s inflation rate has remained above 2.2% for the past decade.

However, keeping the inflation rate below 2% may present a challenge to the EU. With the Euro gaining strength over the dollar and the latter’s weakening due to the stimulus and political upheavals, there may be a slight challenge. Firstly, a strong Euro may mean a decrease in overseas purchases. The decline in purchase-levels may signal an overall appreciation of the currency. The unregulated appreciation of the Euro may lower export activity, thereby increasing the inflation rate.

The ECB’s aim of maintaining low-interest rates in 2021 may not be achieved. A weak US Dollar will necessitate the bank to increase interest rates to curb inflation. Additionally, the €600 billion release will force many European companies to seek initiatives with the highest yield. Overall, the ECB will ease monetary policy to prevent currency depreciation of the Euro.

Is debt sustainable?

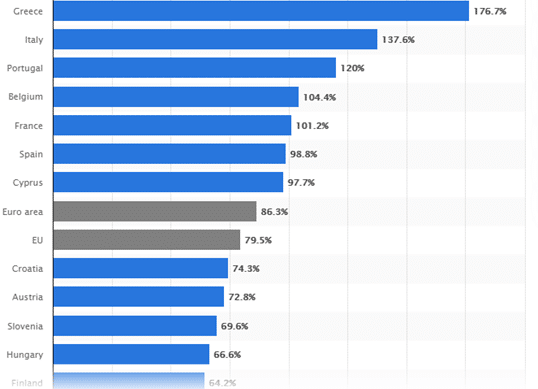

EU countries had a collective budget deficit of 11.4% of their gross domestic product (Q2 2020). The national/government debt of the EU increased by 87.8% in 2020 as compared to 77.6% in 2019. It was back in Q2 2014, when the EU national debt had reached 87.5%, making the reading a 6-year high. Countries like Italy have a debt-to-GDP ratio of 135%, which is clearly in the red-zone. This figure represented 2% of the debt figures given in Q1 2020 (see below).

Figures show Q1 2020 national debt levels of individual member states.

Towards the fourth quarter of 2020, Eurozone countries agreed to increase their budget deficits to €976 billion. This measure was necessary to counter the coronavirus pandemic. At almost €1 trillion, the government debt was level with 8.9% of GDP in 2020. In 2021, governments are expected to lower their obligations to €700 (6% of GDP) after economies rebound. It would be imperative to note that the budget deficit in 2020 is ten times the amount in 2019.

Indications show that the budget deficits will run to €1.5 trillion in 2021 (10% of the GDP). Deficits of countries such as Italy may rise to 160% of GDP in 2021 from 135% recorded in 2021.

Technical Analysis

The featured chart shows a mean reversion of the Euro against the dollar. Some thin pullbacks can be seen, especially in the past year, indicating that the big industry players are waiting for a healthier price to re-enter the market. At 1.23, investors are still interested in the Euro market. The trendline indicates a bullish position against the dollar at this moment. The currency found technical support at 1.163, and it is not near the breaching point. The uptrend can continue well into 2021 as the market adjusts to the post-pandemic era.