- The US core CPI fell 0.3% in July 2021 (MoM).

- Investors are optimistic about New Zealand’s FPI after it rose 1.4% in June 2021 from 0.4% in May 2021.

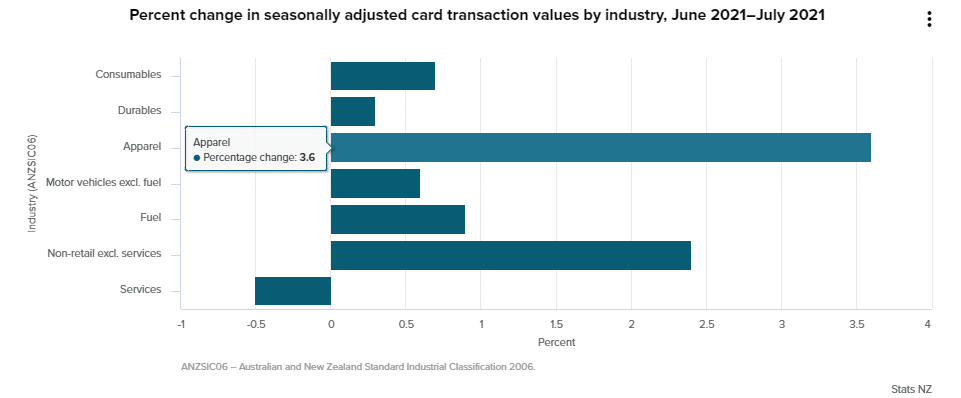

- July 2021 saw credit and debit card usage among New Zealand citizens grow by 0.9% or NZ$77 million compared to June 2021.

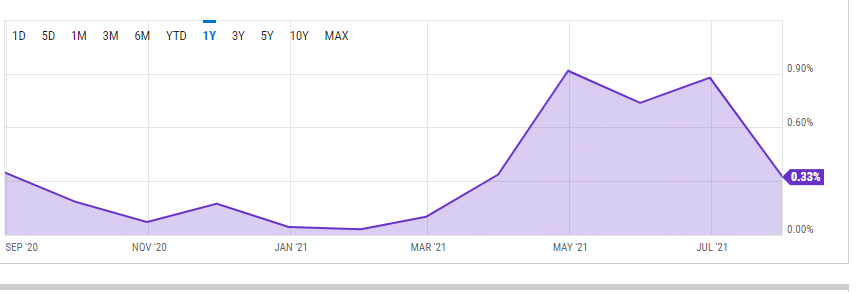

The NZDUSD pair traded to a 0.65% price change as of 12:36 pm on August 11, 2021, from the previous day’s close. It rose to a high of 0.7056 after moving from a low of 0.6992 (representing a 0.92% increase on the trading day).

CPI data

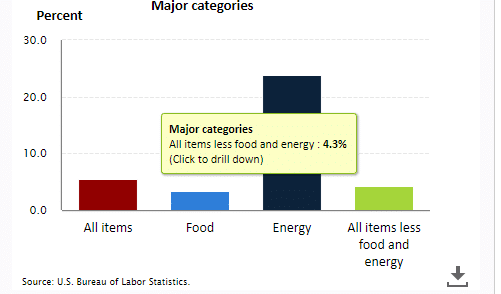

The US dollar declined after the core CPI (for all items excluding food and energy) fell 0.3% in July 2021 (MoM).

This decrease in the core CPI was the least in four months (since April 2021). In exclusion of food and energy, the shelter index gained 0.4% in July 2021.

On annual analysis, the CPI for all items in the US stood at 5.4%, food at 3.4%, energy at 23.8%, and all items (excluding food and energy) at 4.3% (not seasonally adjusted).

On a not seasonally adjusted basis, the CPI index for July 2021 declined 0.48% from the previous score of 0.93%. Real earnings for July 2021 also dropped to -0.1% from the previous record of -0.5%.

The food index took advantage of the ease of restrictions in July 2021 to rise 0.7%. The five main grocery stores in the US contributed to this increase. Openings of restaurants ensured that the index tracking the “food away from home” rose 0.8% in the month.

The decline in crude oil inventories failed to beat consensus estimates when it fell by 0.447 million barrels instead of the expected 1.271 million barrels.

Despite the low decrease in crude oil inventories, the price of WTI Crude oil went up 1.36% to stand at $69.22 per barrel and Brent Crude at +1.12% ($71.42). This price shot up after Biden’s administration assured oil producers that it would not call for an output raise.

Economic releases in New Zealand

The Reserve Bank of New Zealand (RBNZ) is expected to release the country’s food price index (FPI) for July 2021 (MoM). In June 2021, the data stood at 1.4% after rising from the previous score of 0.4%. As of 3:31 pm GMT on August 11, 2021, NZD had gained 0.43% against the Japanese yen.

Greenhouse gas (GHG) emissions in the year ended March 2021 (in New Zealand) declined 4.5% or 3,815 kilo-tonnes to 80,552 KT. In the year ended March 2020, the total emitted GHGs stood at 84,367 KT. This decrease was a result of lockdowns and movement restrictions in the transport and warehousing sectors.

July 2021 saw credit and debit card usage among New Zealand citizens grow by 0.9% or NZ$77 million compared to June 2021. The non-retail sector (entailing medical, travel, and postal among others) drove card spending to NZ$43 million or 2.4%.

The apparel sector was the highest gainer at 3.6%. Card spending on motor vehicle purchases rose 0.6% in the month. In total, e-card expenditures in the month stood at NZ$8.528 trillion.

Technical analysis

The NZDUSD pair hit the support line at 0.6879 on July 20, 2021. It began a pullback after finding support and is likely headed towards the resistance line at 0.7315.

There is an increase in the buying volume with the 14-day RSI at 53.32. However, the volatility is still trending in a low position with the 14-day ATR at 0.00678. We expect the pair to trade in the range of 0.7020 to 0.7200.