- Hopes of big government spending with Democrats in control of the White House and Congress drive stocks.

- Tech stocks rebound as investors see limits for Democrats in heavily regulating the sector.

- Corporate earnings and Trump’s impeachment are to influence stock trading this week.

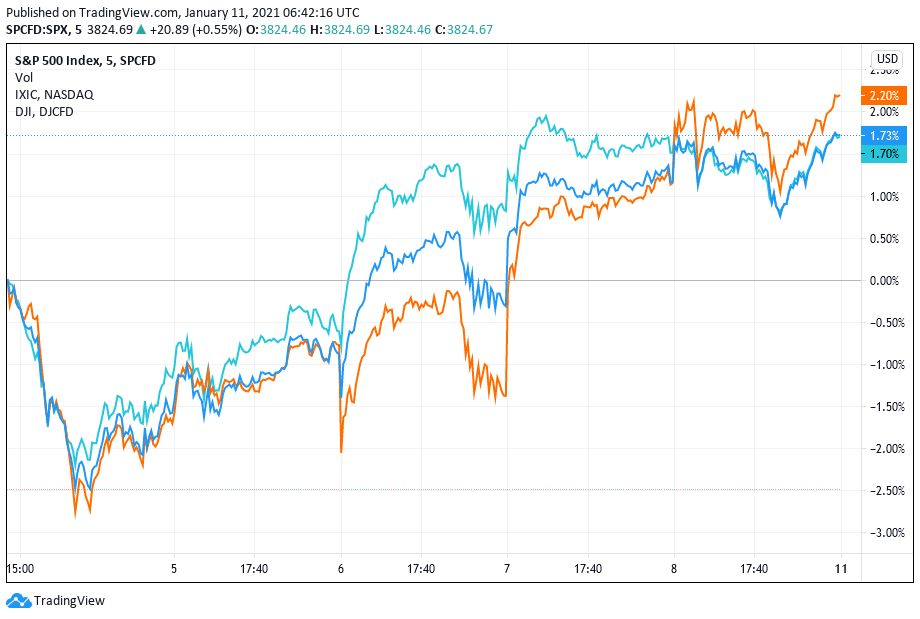

US stocks soared in the first week of 2021, closing at record levels as investors hoped for faster economic recovery. The surge in stocks followed Democratic victories in the Georgia Senate runoff election that is now set to put the party in control of both the White House and Congress.

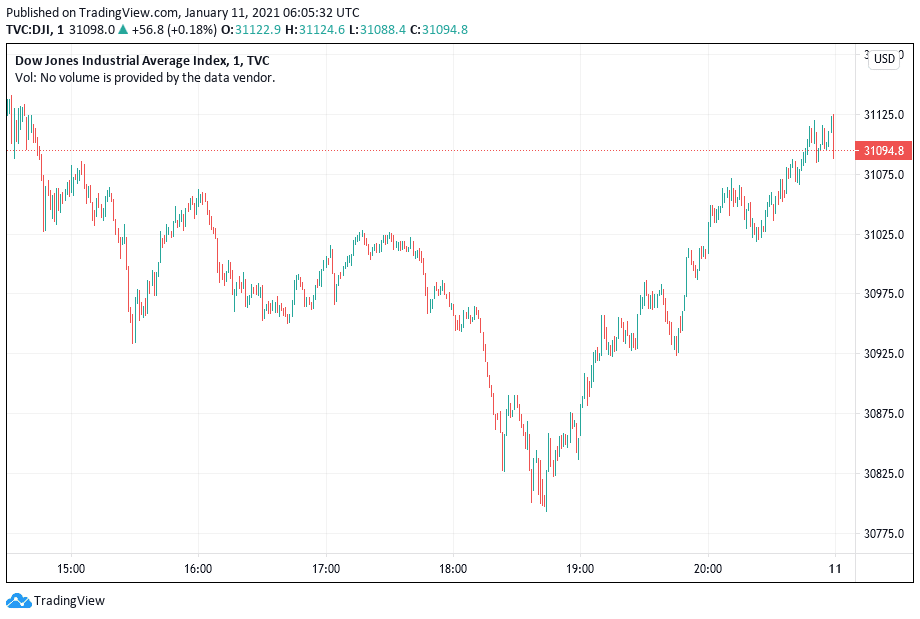

Dow closes at record as investors anticipate huge spending by the democratic administration

The Dow Jones Industrial Average gained 56.84 points or 0.2% Friday to close at a record 31097.97. The index started the day on a high note but faced some pressure in the mid-morning and mid-afternoon sessions, as the chart above shows.

For the week, the blue-chip index gained 1.6%. The index struggled on Monday amid a cautious start to the New Year. It did much better on Tuesday but again faced some pressure Wednesday as chaos hit the US Capitol as lawmakers convened to certify Joe Biden’s presidential election.

The Dow is an important gauge of America’s economic condition. It tracks the stocks of 30 large companies in sectors that are viewed as the country’s economic backbone. Dow companies are likely to be among the major beneficiaries of big government spending, which investors expect under a Democratic administration.

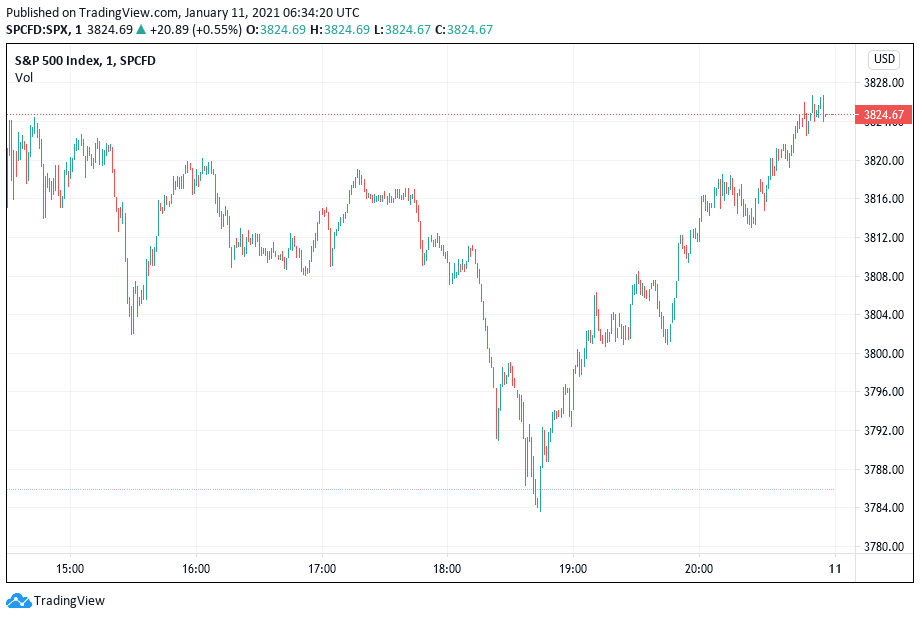

S&P 500 hits record as Tesla stock shines, making Elon Musk the world’s richest person

The S&P 500 index added 20.89 points or 0.5% to close Friday at a record 3824.68. Tesla, a recent addition to the S&P 500, had its mark on the benchmark’s Friday surge. Shares of the electric vehicle company rose 7.8% to $880. Tesla’s surging stock propelled CEO Elon Musk past Amazon CEO Jeff Bezos as the world’s richest person.

For the week, the S&P 500 rose 1.8%, supported mostly by gains in energy, materials, and financial stocks. Investors seem to anticipate bright prospects for these economically-sensitive sectors, with Democrats taking charge of the White House and Congress and pushing through big government spending. The energy sector is particularly in focus, with Joe Biden proposing $2 trillion for climate spending, much of which is expected to go into alternative energy projects.

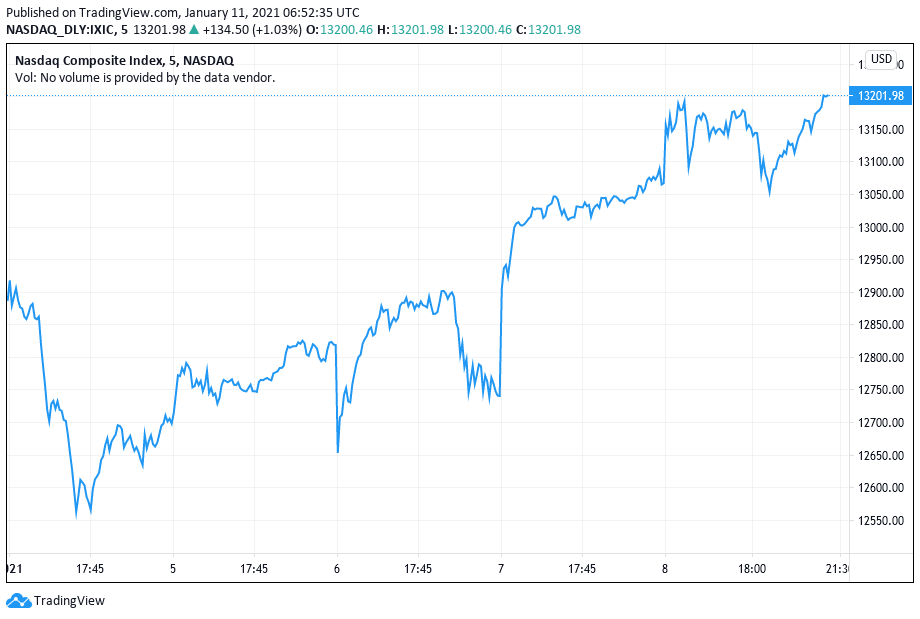

Nasdaq Composite surges as worries of heavy regulation of tech sector subside

The Nasdaq Composite added 134.50 points or 1% Friday to finish at a record 13201.98. For the weak, the index advanced 2.4%, marking a strong start to the year for the tech-weighted benchmark.

Investors traded tech stocks cautiously Monday and Tuesday as Georgians voted in the senate runoff elections that would determine control of Congress. Many investors feared that a victory for the Democrats in stringent oversight of tech companies.

Although the Democrats won the elections, investors now believe that it won’t be easy for them to push through tough tech regulations with only a narrow majority in the Senate.

Russell 2000 index advances as investors hunt for opportunities among small-cap companies

The Russell 2000 index, which tracks small-cap companies, gained 5.9% in the first week of 2021. Many investors believe that some small-cap companies have been left behind in a furious stock market rally of the past year and are plunging into the small-cap universe to hunt for undervalued stocks.

The week ahead for the stock market

This week, corporate earnings, Trump’s impeachment, and coronavirus are among the issues likely to influence stock market trading.

The earnings season is here, and the numbers that the companies put out will influence stock market trading. House Democrats’ bid to impeach President Donald Trump will also be in investors’ minds this week.

Moreover, the COVID-19 pandemic will continue to be a concern, with the US recently reporting record daily deaths from the coronavirus and Japan and some European countries returning to lockdowns.