We Like:

- Competitive spreads

- No deposit and withdrawal fees

- Top-tier regulation

- No trading commissions

- Segregation of funds

- Negative balance protection

- Multilingual client support available 24/7

- It’s a multi-asset broker

- Real-time FX quotes

- State-of-the-art trading tools

- Offers a demo account

- No rolling fees

- Well established broker

We Don’t Like:

- Charges an inactivity fee of $10 every month after three months of account dormancy

- Charges currency conversion fees and overnight fees

- Not available to the US residents

The Verdict:

London-based brokerage company Plus500 Limited leads a stream of brokers located in different regions in serving thousands of customers around the globe. Plus500 Ltd and its subsidiaries under the trademark Plus500 collectively provide online CFDs trading across a wide range of assets. The conglomerate prides itself with over ten years of experience helping 430K+ clients speculate on the prices of products such as forex, indices, shares, and many more.

The broker notes the clientele resides in over 50 countries worldwide and trades CFDs on 1000+ instruments with meager fixed and variable spreads starting from 0.6 pips and leverage of up to 1:300.

The broker also alleges to fuel the trading process with 24/7 multilingual customer support and curbs its customers from major losses by providing negative balance protection and segregating the clients’ funds from its capital.

Company details

Online CFDs trading company Plus500 Ltd made its debut in the financial trading space in 2008, aiming to provide CFDs on multiple asset classes to retail and professional traders. It launched its services in Cyprus and received regulation from the CySEC before expanding to other regions.

Currently, the CFDs provider runs several offices in different pockets of the globe bolstered by the head office in London, Britain, to provide CFDs on 1000+ instruments to more than 430,000 clients worldwide. Plus500 reiterates that these clients trade CFDs on the array of products with spreads starting from 0.6 pips and leverage of up to 1:300.

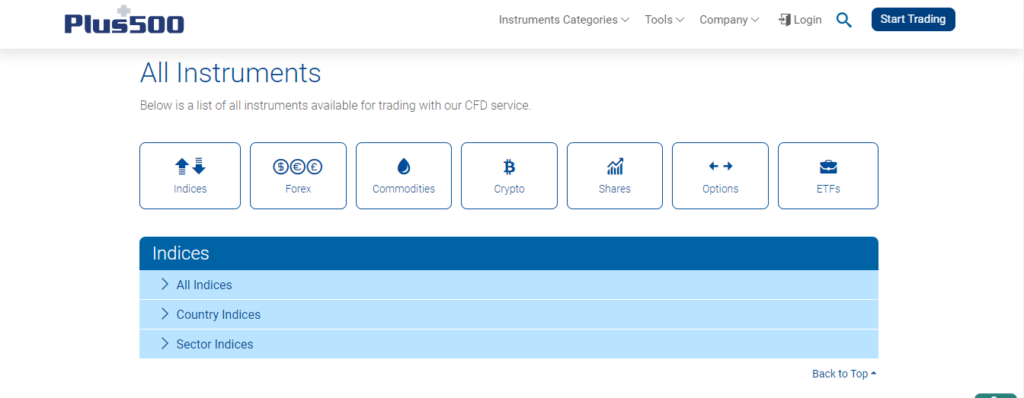

It allows traders to speculate on the prices of the following assets:

- Shares

- Cryptos

- Indices

- Commodities

- FX

- ETFs

- Options

These assets trade with real-time customer support through the broker’s trading platform that integrates powerful tools to provide an effective trading environment. The broker only offers its proprietary trading platform to clients with tools such as an economic calendar, alerts, and market insights.

However, before speculating on these instruments’ prices, traders must fund their accounts with a set monetary size. The min. deposit is capped at $100 or euros for the retail account. It stretches up to 500,000 euros for the professional account. But, Plus500 offers an array of deposit methods and covers most of the transaction fees for clients.

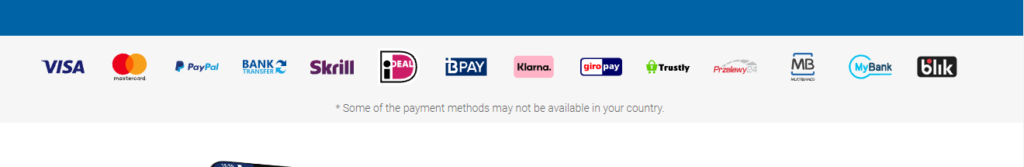

Its payment options include:

- Debit/Credit cards — Visa and MasterCard

- E-wallets — PayPal and Skrill

- Bank wire transfers, among others

After funding, traders explore the broker’s products, knowing they cannot lose more than they invested as the Plus500 confirms offering negative balance protection and tightens clients’ funds’ security by separating its capital from customers’ money. Nonetheless, it says to operate under a reputable regulation backed by the FCA.

The following regulatory bodies survey Plus500:

- The FCA

- The ASIC

- The CySEC

- The FSCA

Regulations

- In the UK, it is regulated by the Financial Conduct Authority by the license FRN No. 509909.

- Plus500 Cyprus adheres to laws imposed by the Cyprus Securities and Exchange Commission.

- It has an AFSL license No. 417727 granted by the Australian Securities and Investment Commission.

- It is also registered as a Financial Services Provider, under the license FSP No. 486026, — issued by the Financial Markets Authority.

- In Africa, Plus500 holds the license FSP No. 47546 from the Financial Sector Conduct Authority.

- The CFD provider also holds the license — CMS100648-1 from the Monetary Authority of Singapore.

Plus500 holds several licenses from reputable regulation bodies led by top-tier agencies such as the FCA making the broker safe to trade with. Generally, the broker abides by the laws imposed by the FCA, ASIC, CySEC, FSCA, among other legitimate regulation bodies. As a result, the broker conducts transparent activities for its clients around the globe.

Trading platforms

The London-headquartered CFDs provider only provides its proprietary trading platform accessible in multiple interfaces. The broker offers the platform as a web-based platform, windows OS software, and a mobile App.

Plus500 proprietary trading platform

- User-friendly interface

- Market watch tools — yes

- Hedging allowed — yes

- Over ten chart types offered

- Multiple time frames

- Over 50 technical indicators offered

- Several drawing tools offered

- Access to economic calendar and live news

- 1000+ instruments

- One-click trading

- Ability to switch from the live account to the demo account

- Ability to interact with the support team via live chat

Range of markets

It is a CFD multi-asset broker allowing traders to speculate on the prices of diverse instruments without winning the underlying asset. Its range of markets holds assets such as forex, providing 70+ instruments encompassing major, minor, and exotic currency pairs, 22 commodities, 14 cryptos, 32 indices, and many more.

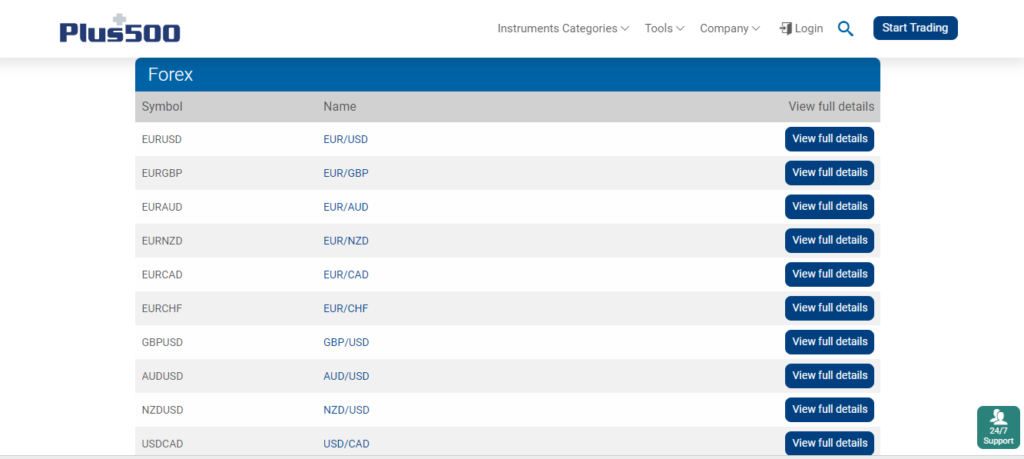

Forex

The FX market opens from Monday to Friday and holds about 72 currency pairs yielding majors, minors, and exotics. The min. spread depends on the currency pair, but the leverage extends to 1:300 on all pairs. These instruments also trade with real-time quotes and customer support.

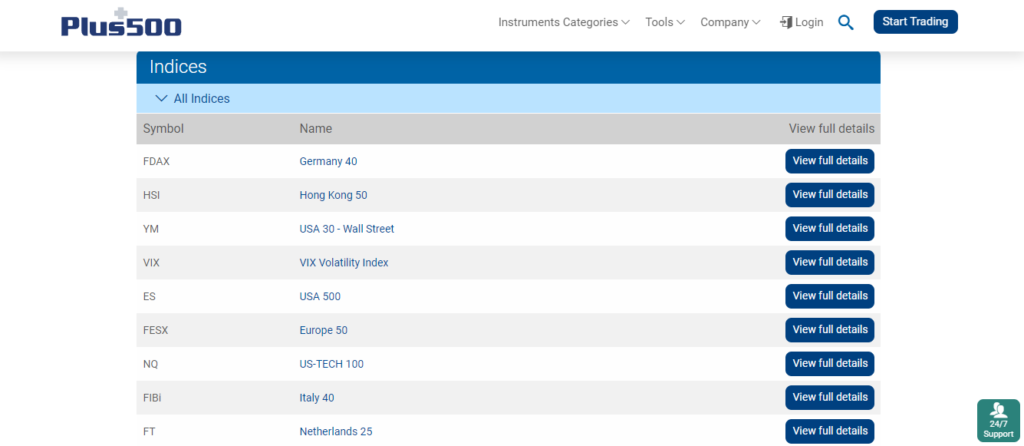

Indices

The Indices market trades through weekdays and holds about 32 products such as USA 500, Europe 50, and China A50. The instruments trade with varying spreads as German 40 shows a spread of 1.97 pips while the USA 500 spread is capped at 0.7 pips. The trading process is also backed by 24/7 multilingual customer support.

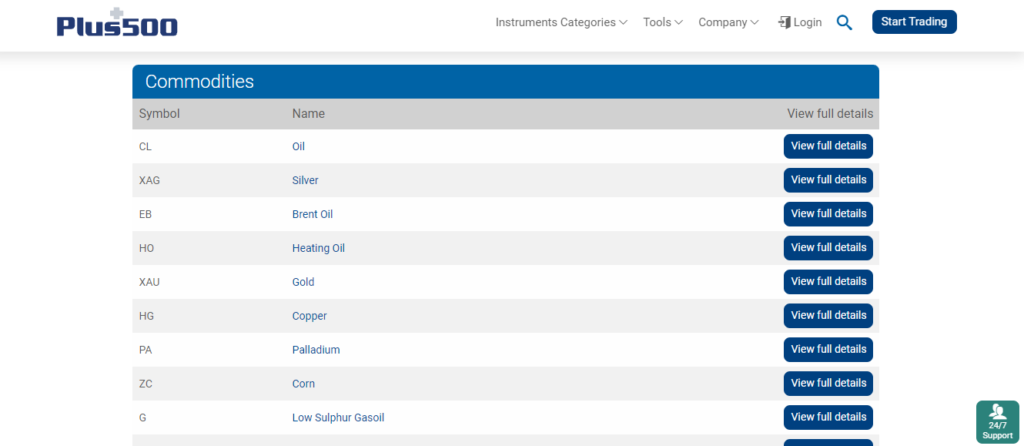

Commodities

Plus500 offers a wide range of commodities made up of both hard and soft commodities. The stream of hard commodities includes all assets mined from the ground, such as precious metals like gold and energy products like crude oil. The soft commodities consist of all goods grown and processed, such as corn, sugar, cotton, among others.

The broker allows clients to speculate on these assets’ prices without owning the underlying instrument from Monday through Friday with fast executions, low spreads, and leverage of up to 1:300. However, the min. spread depends on the type of commodity as the oil trades with a min. spread of 0.04 pips and gold trades with a spread capped at 0.28 pips.

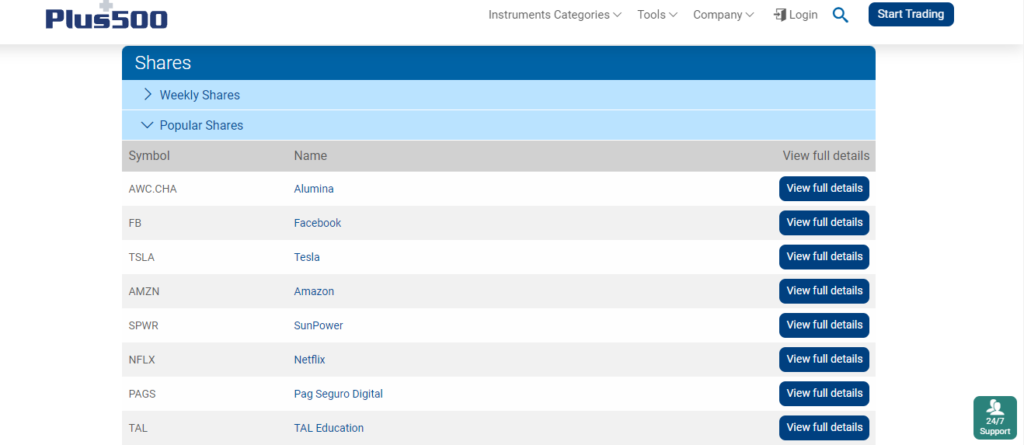

Shares

Plus500’s share market holds over 2000 share instruments trading at global exchanges. The products consist of shares from giant companies such as Alibaba, Amazon, Tesla, and a stream of other companies worldwide, including shares of companies in South Africa like Kumba Iron ore.

The instruments also trade through weekdays aided by real-time customer support with meager fixed and variable spreads and leverage of up to 1:300. Meaning the leverage and spread depend on the type of share being traded. Some products’ spread like FB is capped at 2:43 pips trading with a leverage of up to 1:20 while Amazon trades with a leverage of 1:10 and spread capped at 24.36 pips at the time of this writing.

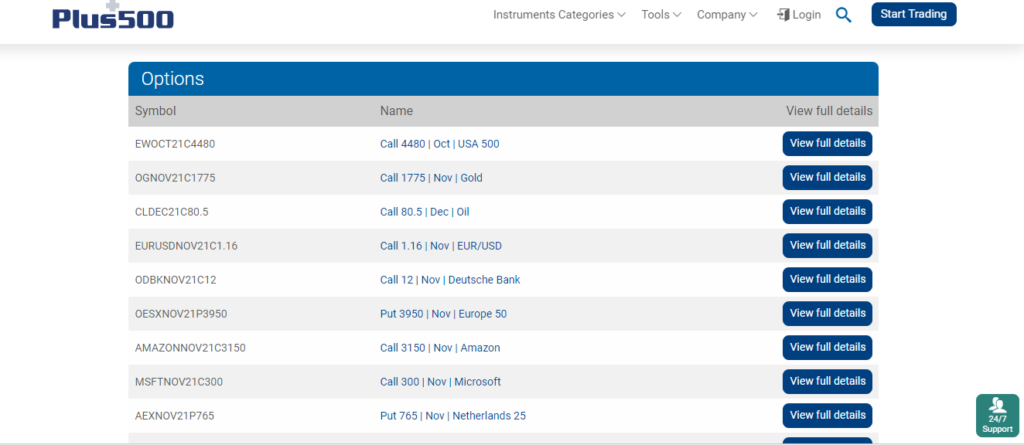

Options

The options market allows clients to speculate on the price of a set of assets at a specific date and time. The broker also offers CFDs trading on options made from diverse markets such as forex, commodities, and shares. These products trade with competitive spreads and margins.

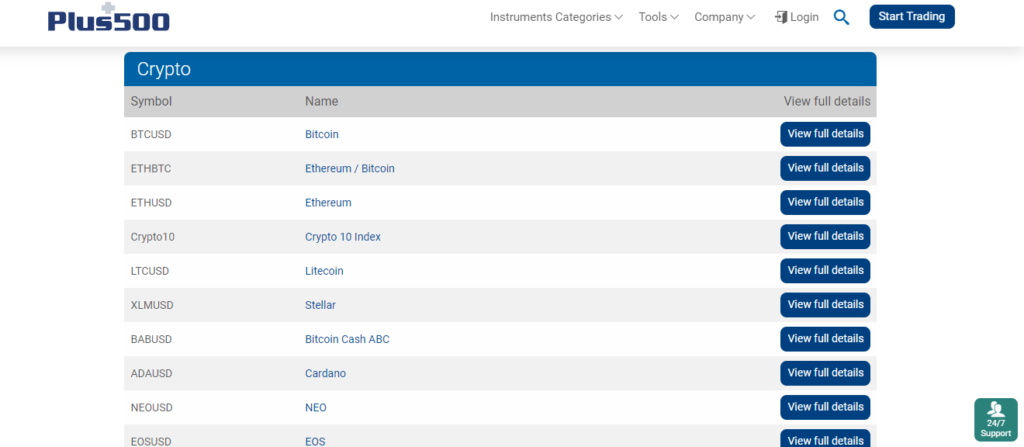

Cryptocurrencies

Fourteen cryptos trade at Plus500 from Monday through Friday with competitive spreads, margins, and varying leverages. Some of the instruments include BTC, Ethereum, Litecoin, and more. Bitcoin trades with a leverage of up to 1:5 while Ethereum’s leverage rises to 1:2. The process is also fueled by expert customer support.

Main features

Pus500 operates as an online CFDs trading platform serving both novice and professional traders. It claims to have won the trust of more than 430 thousand customers from 50+ countries. The broker’s main features fueled the milestone.

Features

- The broker offers an understandable platform and provides a user-friendly trading platform equipped with smart trading tools for profitable trading.

- Offers competitive spreads — although the broker includes fees on the markup spread, it provides meager fixed and variable spreads starting from 0.6 pips.

- No commissions — the broker also mitigates all commissions on trading and promises clients an effective trading environment with no hidden commissions.

- Authorized and regulated broker — Plus500 lies under reputable regulation backed by agencies such as the FCA, ASIC, CySEC, among others.

- Negative balance — you cannot lose more than you invested.

- Offers 24/7 online support — traders benefit from real-time multilingual customer support.

Types of trading accounts

Plus500 only offers two account types to its criteria of clients. Traders can open a retail account or a professional trading account. The broker also allows traders to create a demo account that acts as a learning tool for the new customers.

Analysis of the accounts

The retail account

- Access to all assets

- Negative balance protection — yes

- Commission-free trading

- Four different stop orders

- Access to the proprietary trading platform

- Wide range of deposit and withdrawal options

- Leverage of up to 1:300 on global markets

- Min. deposit of $100 or euros

Professional account

- Access to all assets

- Negative balance protection — yes

- Access to the proprietary trading platform

- Wide range of deposit and withdrawal options

- Min. deposit of $500,000 or euros

- More stop orders

- Own account manager

Opening an account at Plus500

Step 1: Log into their website and click start trading or the demo account.

Step 2: Fill the registration form they provide.

Step 3: Verify your account via email.

Step 4: If it’s a demo account, you can switch it to a real account.

Step 5: The broker will first offer the retail account that you can transform into a professional account later.

Step 6: Make the required deposit.

Step 7: Start trading.

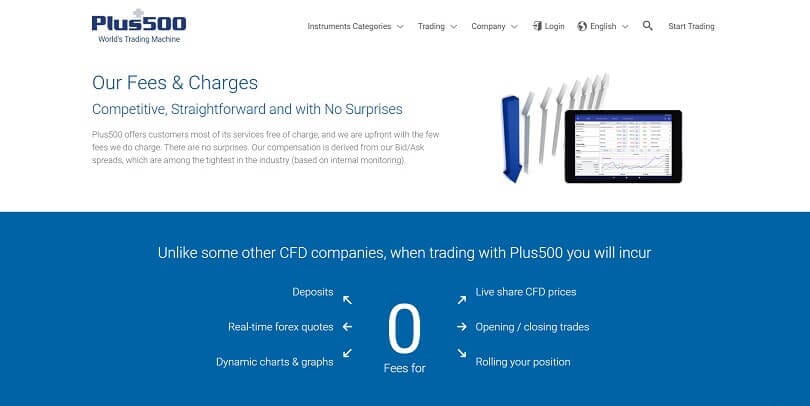

Commissions and spreads

The broker boasts of being a commission-free broker with no hidden fees as it only charges commission on the market spread. However, the broker charges an inactivity fee of $10 every month after three months of account dormancy. Plus500 also charges clients currency conversion fees and overnight fees when trading. Although it says to waive all fees on deposits and withdrawals, some payment options may charge transaction fees.

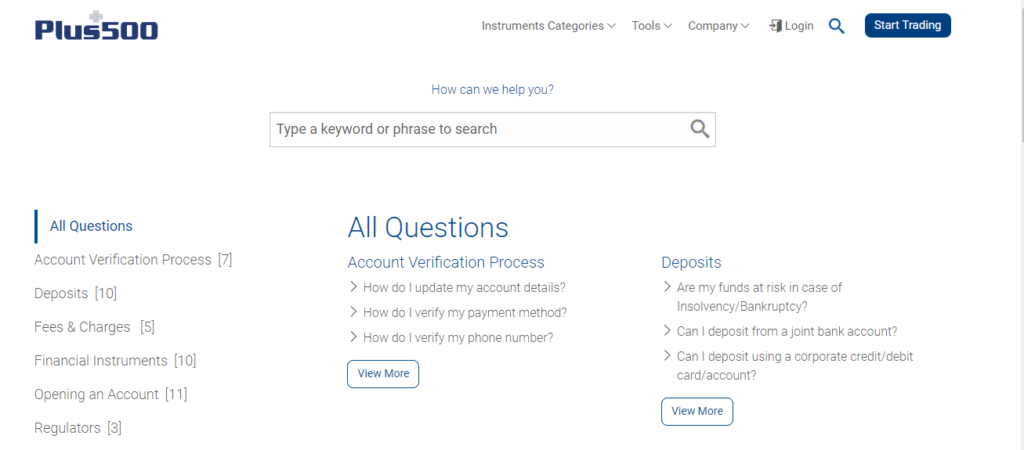

Customer service

The broker notes to provide 24/7 customer support in multiple languages that serve clients from around the globe through calls, emails, and a live chat button. The live chat button connects traders with the support team directly for inquiries. Moreover, the broker offers a FAQ section that answers all relevant questions that traders may ask.

Plus500 Review

What we liked

- Rich customer support resources

- No deposit and withdrawal fees

- Several payments options

- No hidden fees

- Well-regulated broker

- Offers a demo account

What we disliked

- High spreads

- Currency conversion fees

- Inactivity fees

- Not available in the USA

- No copy-trading

- Fewer analytical tools compared to other brokers

The bottom line

Plus500 sums up as a good broker for both novice and veteran traders. It notes to accept a min. deposit of $100 and offers features such as zero trading commissions and negative balance protection. It allows traders to speculate on the prices of multiple assets without owning the underlying instrument, granting them a chance to diversify their portfolio and minimize risk by going long and short.

However, the broker’s spreads are slightly higher than other liquidity providers, which might confuse newbies. Its official website also fails to provide enough content about the broker.