Many people start trading foreign exchange on the side, mainly after the day job or schoolwork. But some transition into focusing on the side job. And as with any other profession, forex trading has rules and best practices.

Although most of these rules are unwritten, they guide traders to avoid potentially fatal landmines. One such rule is knowing the best trading system or setup for trading particular currency pairs. Today, we are going to illustrate this rule when trading the EURUSD forex pair. In other words, we seek to answer the question: what is the best trading system for trading the EURUSD forex pair?

Introduction to the euro dollar

One of the most fun things about forex is that traders have playful names for most familiar currency pairs. This is reminiscent of shepherds who name their herd, mainly to create a strong bond that makes it easy for identification.

For forex traders, nicknaming currency pairs creates an air of familiarity. Most of the currency pairs that have nicknames belong to the “majors” class, where each pair consists of currencies from dominant economies. The most familiar currency pair in this class is the euro/US dollar or EURUSD.

But traders usually refer to the pair as the eurodollar. Even better, traders baptized the pair as the Fiber, although it is unclear when and how the name came about.

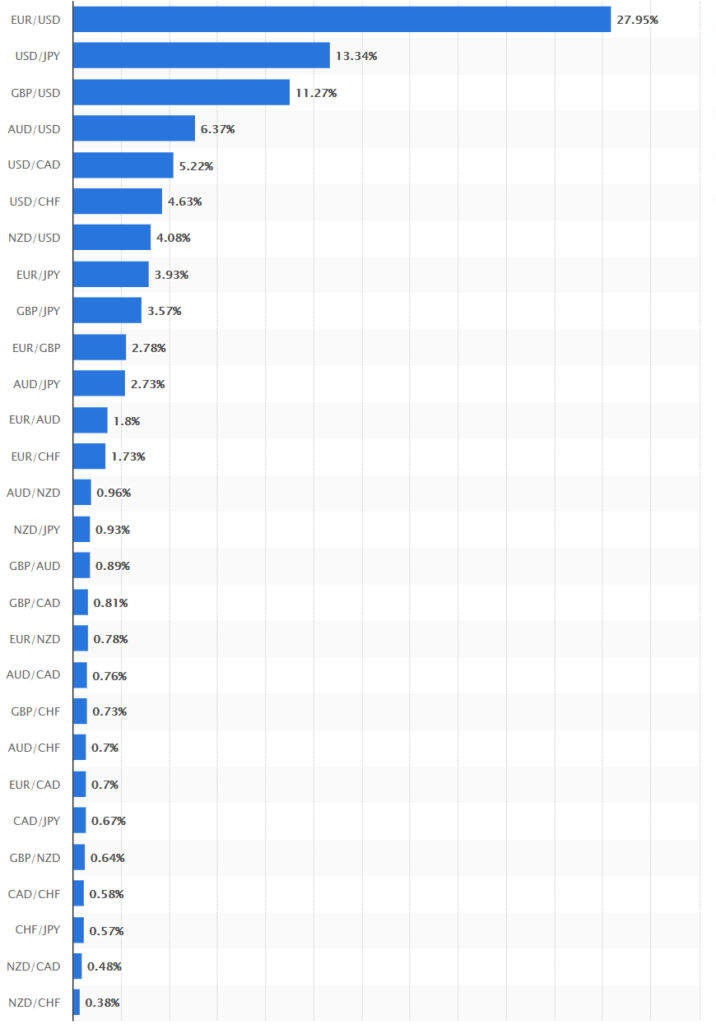

Nicknames aside, the euro-dollar is the market’s most traded pair. The pair accounted for 27.95% of the total trade volume in 2020, according to Statista data. Furthermore, successive Triennial Central Bank Surveys by the Bank of International Settlements (BIS) identify the Fiber as the best liquid forex pair for tens of years.

Because of the high liquidity and substantial daily trading volumes, the eurodollar has the tightest spreads in the market. A currency spread refers to the difference between the price at which buyers are willing to pay to take the pair (also called ask price) and the price at which sellers are willing to relinquish ownership of a pair (also called bid price). High demand for Fiber from both the demand and supply sides makes the spread thinner.

We shouldn’t also forget to mention that the EURUSD’s popularity leads to wide price movements over time. In other words, the pair’s price action often follows a trend, whether downwards or upwards. It rarely ranges across large timeframes.

To understand the point better, check out the monthly EURUSD chart below.

As the chart shows, the EURUSD is either in an uptrend or a downtrend at any point in time, over an extensive timeframe.

Compare this with an inferior currency pair like the Australian dollar vs. the New Zealand dollar (AUDNZD). Going by the chart below, the pair has long periods where the trend is unclear – a ranging market. For example, observe the period between February 2014 and now.

You can see that the AUDNZD market appears to lack a clear direction for over seven years. Of course, the pattern would appear different when we zoom into the chart by observing the price action over smaller time frames. However, the point here is that the EURUSD has wide price movements compared to inferior forex pairs.

And what are trading systems?

Typically, traders approach forex from a broad perspective and narrow it down using insights drawn from market analysis. A trading system comes on the narrow end, whose definition is a set of rules guiding buying and selling decisions. Some traders like to refer to this as the high-probability trade setup or simply a trade setup.

Most importantly, the trading system excludes any subjective elements that could generate ambiguity. Thus, the trade setup aims to increase profitability while managing risk.

There are four primary trading systems – trend following, counter-trend or trend fading, range, and breakout.

Trend following systems

The trend in forex refers to the general direction of price action over a given period. Thus, a trend following system aims to identify and enter a trend at the earliest opportunity and maintain the position for as long as the trajectory lasts.

Trend fading systems

On the contrary, trend fading systems target reversals or corrections. Traders often rely on indicators like RSI to generate sound signals to this end.

But targeting trend reversals poses a higher risk because such movements are not readily apparent in real-time.

Range systems

Sometimes the market is undecided and fails to establish a solid direction. In such a case, traders say the market is ranging.

Currency pairs range most of the time, primarily when the buy and sell sides happen to be equally motivated. Also, actively traded forex pairs like the EURUSD easily range over short timeframes. Thus, range systems aim to exploit price gyrations in a market without a clear direction.

Breakout systems

In forex, a breakout refers to a price movement that goes above existing resistance or below support levels. The move often comes on the back of significant developments, such as unexpected economic data or a sudden political/economic upheaval.

Hence, breakout systems search for scenarios of elevated market volatility and anticipate a price surge (either upwards or downwards). The trade setup is more profitable when the breakout continues for much longer.

So, what is the best trading system for the EURUSD forex pair?

Earlier, we discussed that the EURUSD is likely to establish a definite trend – usually when looking at the pair over large timeframes. Moreover, we illustrated that the Fiber stays in one trajectory for longer than inferior pairs like the AUDNZD.

From the preceding, it appears the trend system is the ideal setup for trading the EURUSD. However, it is worth noting that the pair’s behavior changes with the change in the timeframe. Therefore, it helps to keep this in mind to be able to select the most appropriate setup.

Final thoughts

Forex trading is often more about practice than cramming vocabulary and terminologies in the head. However, once you practice hard enough to trade popular currency pairs like the EURUSD, you’ll soon develop a powerful muscle for ideal trading systems that work best for your temperament.