We Like:

- Over 15 years in the financial trading industry

- Top-tier regulated broker

- Tight spreads starting from 0.1 pips

- 24/5 expert customer support

- Low minimum deposit capped at $0

- No deposit and withdrawal fees

- Clients funds are segregated

- Over 2000 tradable instruments

- Variety of payment options

We Don’t Like:

- Negative balance protection is only offered to UK/EU-based clients

- High stock, ETFs, CFDs fees

- Some payment options charge transaction fees

- The broker does not accept clients from the USA, among other nations

- It charges an inactivity fee of ten pounds after one year of account dormancy

The Verdict:

XTB Group Limited prides itself with over 15 years of experience in the financial trading industry, offering online FX and CFDs trading to retail traders. The liquidity provider launched in 2002 aiming to offer forex trading and CFDs on diverse markets to novice, intermediate, and veteran retail traders.

And now, the thirteen office broker confirms to serve about 300,000 customers trading 40+ Fx pairs and thousands of CFDs instruments in the commodities, stocks, ETFs, and crypto marketplaces with tight spreads starting from 0.1 pips and leverage of up to 1: 500.

XTB also proves to be a safe broker citing to fall under a stringent regulated led top-tier agencies such as the FCA and holds an international trading license from the IFSC of Belize. Moreover, the broker is listed on Warsaw Stock Exchange (WSE: XTB) and boasts of being among the world’s best stock listed brokers.

Company details

Online retail forex and CFDs brokerage company XTB group limited pioneered in the financial trading industry in 2002, envisioning to offer forex trading and CFDs on a wide range of markets backed by state-of-the-art trading technology. Through time, XTB diversified its products and services and extended roots to many regions.

It now operates as a unified entity of 13 offices located in countries such as England, Chile, Poland, among others, with the main office in London, England. XTB claims to serve over 3K clients offering sharp spreads starting from 0.1 pips and competitive leverages depending on the asset classes yielding 2K+ instruments that clients speculate through the broker’s award-winning trading platform, xStation. The XTB’s proprietary platform comes with unique trading technology fueled by powerful trading tools.

The asset classes include:

- FX pairs

- Indices

- Commodities

- Stock CFDs

- ETF CFDs

- Cryptocurrencies

Trading is also guided by a 24/5 multilingual customer support that answers clients’ questions and solves their problems. The broker provides only two live account types that traders sign up for to access the liquidity markets. Each account type is tailored to serve a peculiar client depending on their ambitions, but XTB offers a minimum neutral deposit capped at $0.

Other common conditions on the accounts include inactivity fees, rebates, and access to a spectrum of payment options that help facilitate funding and withdrawing money from the XTB trading account.

Payment options include:

- E-wallets like Skrill, Neteller, and PayPal

- Credit/debit cards like Visa and MasterCard

- Bank transfers

These payment options serve XTB’s clients across many regions, but some methods only apply to particular traders. For example, PayPal is only applicable for EU/UK residents. XTB notes that all deposit methods instantly transfer funds to the broker’s trading account except for bank transfers. The FX and CFDs liquidity provider confirms that bank transfers take 2-5 days to reflect.

However, after funding the trading account, customers explore the broker’s assets using its trading platform fueled by powerful trading tools such as market watch tools, price tables, market calendars, among others. Moreover, XTB guarantees the safety of clients’ funds by segregating the money in reputable banks, giving it traction as a safe broker. Nonetheless, it proves itself to clients as legit by lying under a respected regulation led by top-tier regulatory bodies.

Regulations

- XTB Limited is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license No. 169/12.

- XTB UK is authorized and regulated by the Financial Conduct Authority (FCA). License No. FRN 522157.

- In Poland, XTB is authorized and regulated by the Komisja Nadzoru Finansowego (KNF).

- Internationally, the liquidity provider is regulated by the International Financial Services Commission (IFSC) of Belize.

XTB holds reputable agencies from significant regulatory bodies such as the IFSC of Belize, the CySEC, the FCA, and others making the broker internationally legalized and safe to trade with. Moreover, the conglomerate prides itself on being listed on the Warsaw Stock Exchange, adhering to all financial laws.

Trading platforms

Unlike other brokers, XTB only offers its proprietary trading xStation and fails to offer any of the MetaTrader platforms. The London-headquartered broker claims xStation gives traders the hedge when exploiting its markets with instant executions and the ability to trade from any interface. XTB provides xStation across multiple applications. Customers access the trading platform as a web-based platform, mobile app, and desktop app.

Features

- Available in different versions — yes (web, mobile, desktop)

- Fast executions — yes

- Access to diverse markets — yes

- Integration with powerful trading tools — yes (calendars, market watch, market sentiments)

- Several chart types — yes

- Many pending orders — yes

- Converse with other traders — yes

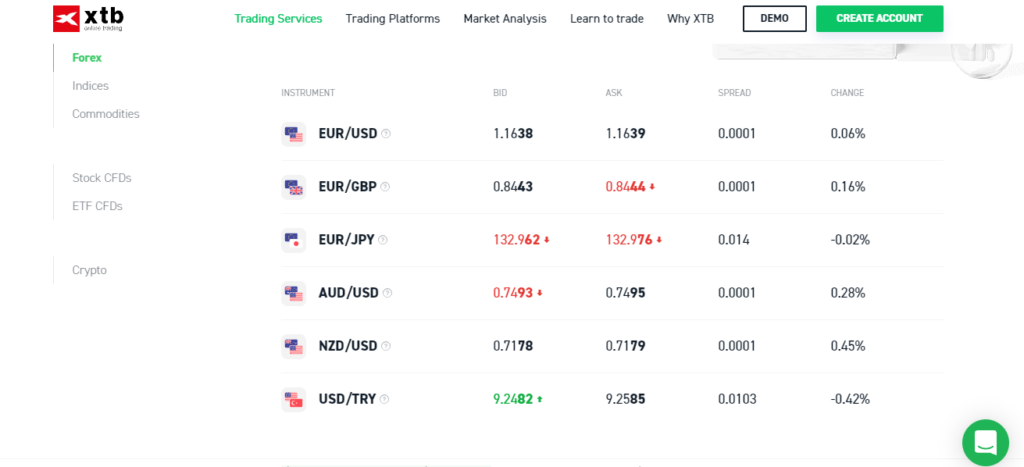

Range of markets

XTB offers a wide range of markets that its clients speculate through forex trading and CFDs. It claims that the markets hold over 2K instruments altogether. These instruments include 40 + currency pairs trading with sharp spreads starting from 0.1 pips and competitive leverage, indices, stock CFDs, cryptocurrencies, among others.

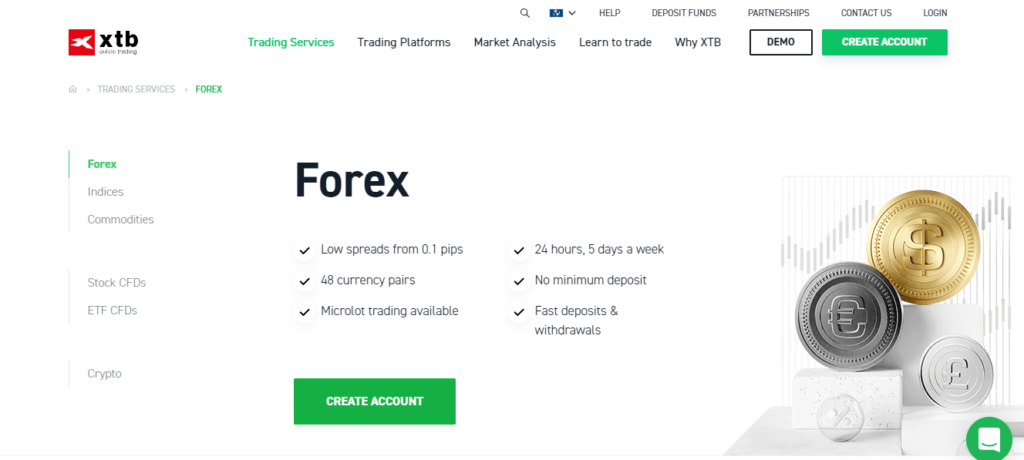

Forex

The FX at XTB trades from Monday through Friday, backed by multilingual customer support. The broker reiterates that more than 40 currency pairs encompassing majors, minors, and exotics trade with speedy executions, tight spreads starting from 0.1 pips, and competitive leverage of up to 1: 500.

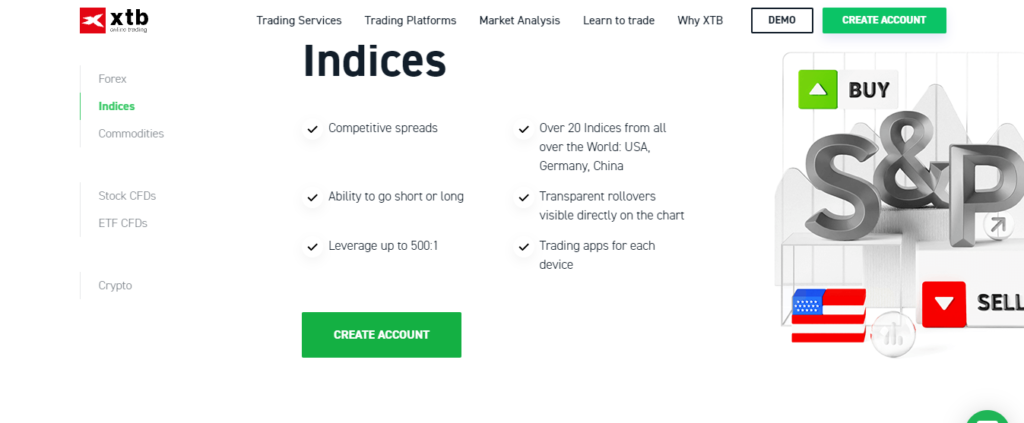

Indices

An index asset is a group of shares from companies on an exchange that clients speculate on its price by going long or short. Meaning they have the hedge even when the price goes down. XTB offers a wide range of indices, including index products such as UK100, US500, and many more.

Overall, about 35+ indices trade on the broker from Monday to Friday, bolstered by expert customer support and fast executions. Their leverage extends up to 1:500, and swap points start from as low as zero.

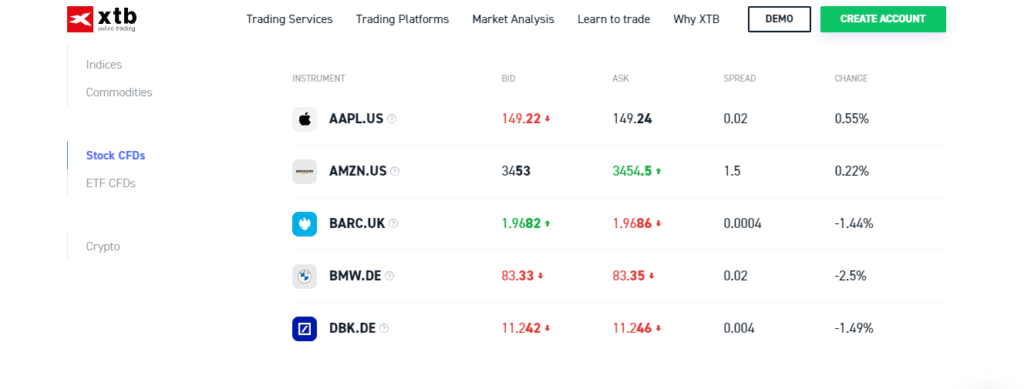

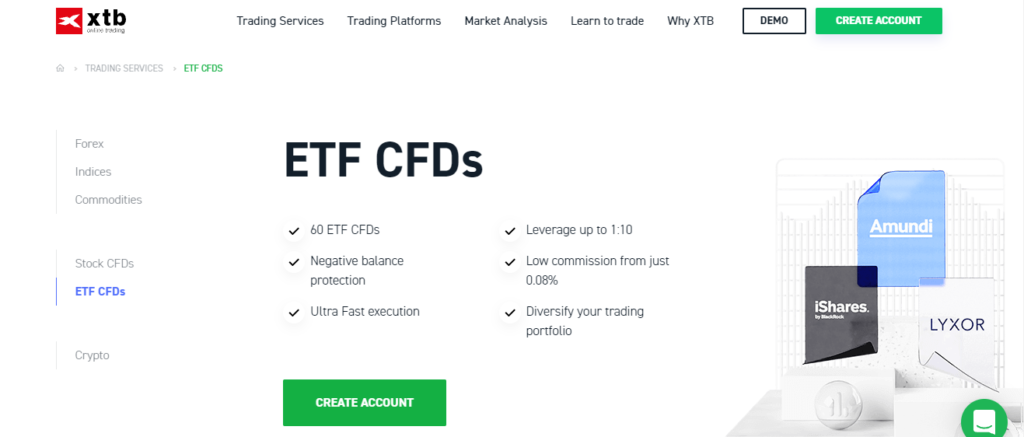

Stock & ETF CFDs

XTB’s stock market holds most of the broker’s tradable instruments. Over 1700 stock instruments of popular companies such as Apple, Amazon, and many trades on the broker through weekdays bolstered by 24/5 multilingual customer support. Customers experienced ultra-fast executions fueled by XTB’s trading platform, competitive spreads, and leverage of up to 1: 10.

On the other hand, about 100 ETF instruments trade on XTB with meager spreads, competitive leverage, and low transaction costs.

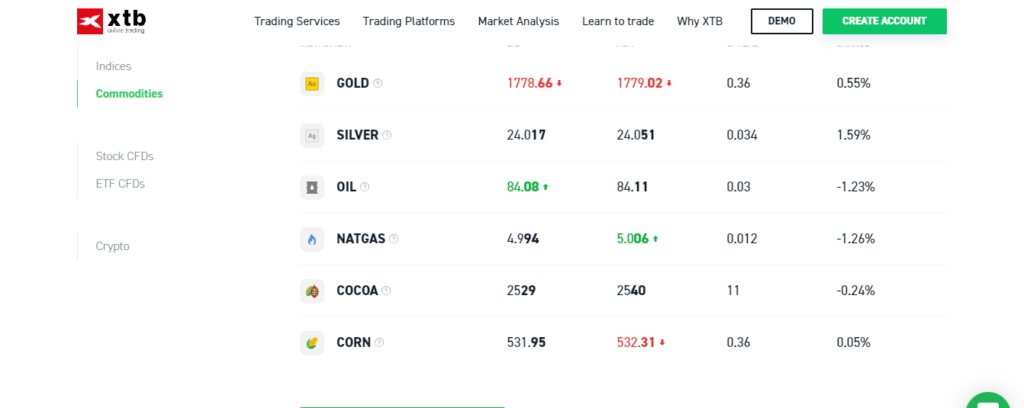

Commodities

Commodities are physical goods either mined or grown that traders speculate on their prices. At XTB, popular commodities like the world’s valuable metals such as gold, and silver, coupled with oil and other products, trade with competitive spreads and leverage of up to 500:1 from Monday to Friday.

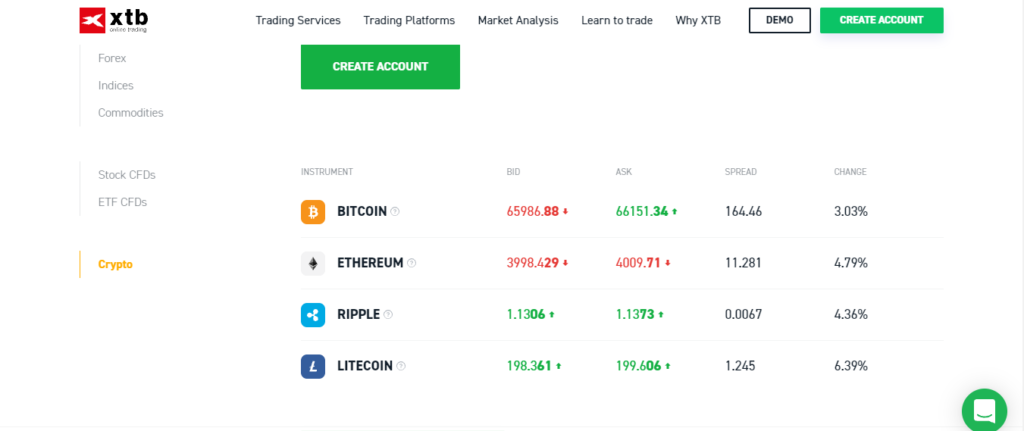

Cryptocurrencies

Being one of the most volatile financial markets, XTB allows clients to speculate the rising and falling prices of 10+ crypto assets 24/7, guided by expert customer support. The instruments include digital currencies such as BTC, Ethereum, Litecoin, and trade with competitive spreads and leverage of up to 1:2.

Main features

XTB operates as an online forex and CFDs brokerage platform. It prides itself with over 15 years of experience in the trading space serving retail traders. However, what features have contributed to the broker’s success?

- Powerful trading platform — XTB offers clients a state-of-the-art trading platform dumbed xStation integrated with powerful trading tools. xStation comes in several versions and provides fast execution of orders allowing clients to trade from everywhere effectively.

- Top-tier regulated broker — XTB holds a trading license from the FCA and is internationally legalized by the IFSC of Belize.

- Offers tight spreads — FX and CFDs liquidity provider claims to offer sharp spreads starting from 0.1 pips.

- XTB is a multi-asset broker — it notes to provide several asset classes supporting more than 2k tradable instruments.

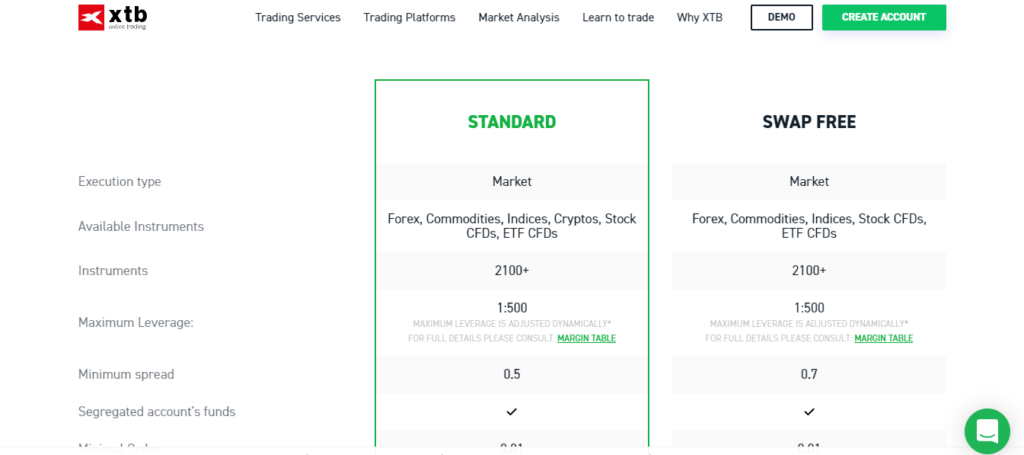

Types of trading accounts

Customers have access to two live accounts tailored depending on their trading ambitions. XTB also provides a demo account that helps traders, especially newbies to gain trading knowledge. The live accounts include:

- The standard account

- The Swap-free account

The standard account

- Execution type — market

- Available markets — all

- Instruments — 2000+

- Maximum leverage — 1: 500

- Min. spread — 0.5

- Segregated account’s funds — yes

- Minimal order — 0.01

- Automated trading — yes

- Account setup & management — free

- Trading platform — xStation (in all versions)

- Commission on forex, indices, commodities — no

- Commission on stock CFDs and ETF CFDs — yes (from 0.08% per lot)

- Cash stocks — not available

- Commission on cryptocurrencies — no

The Swap-free account

- Execution type — market

- Available markets — all

- Instruments — 2000+

- Maximum leverage — 1: 500

- Min. spread — 0.7

- Segregated account’s funds — yes

- Minimal order — 0.01

- Automated trading — yes

- Account setup & management — free

- Trading platform — xStation (in all versions)

- Commission on forex, indices, commodities — no

- Commission on stock CFDs and ETF CFDs — yes (from $10 per lot)

- Swap — Swap-free

- Cash stocks — not available

- Cryptocurrencies — not available

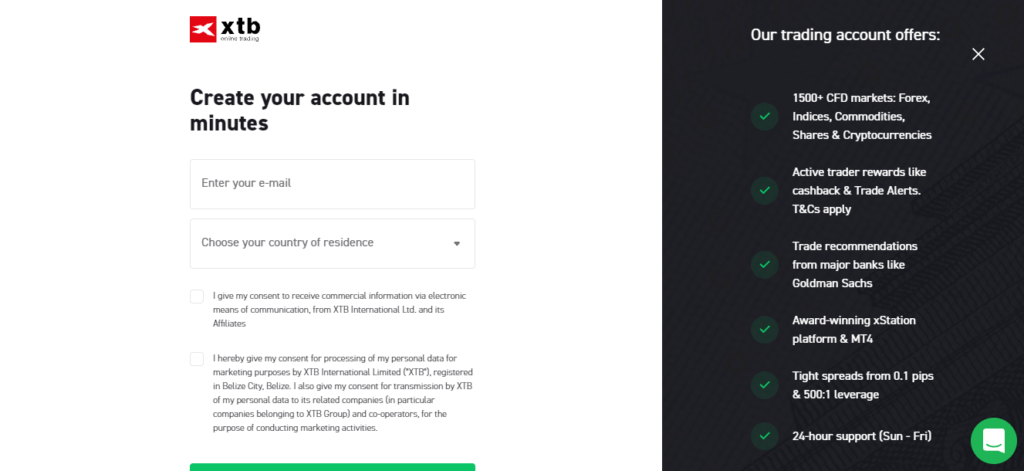

Opening an account at XTB

The account opening process is relatively fast and involves the following steps.

Step 1: Log into their website and click the create account button.

Step 2: Fill the registration form that pops up.

Step 3: Verify your identity.

Step 4: Receive login details.

Step 5: Fund the account.Step 6: Start trading.

Commissions and spreads

XTB boasts of offering competitive spreads starting from as low as 0.1 pips to average around 1.3 pips on a spectrum of its instruments meaning the broker charges little commissions added on the market spread. Also, some assets such as stock and ETF CFDs trade with a commission capped at $10 per lot on the swap-free account. Moreover, clients may incur transaction fees on some payment options and a 10-pound inactivity fee after one year of account dormancy.

Customer service

XTB claims to provide quality customer support in multiple languages from Monday to Friday. Clients access the help support portal on the broker’s websites that holds a wide range of materials, answering the most relevant trading queries. Moreso, XTB assures clients direct assistance from the live support team through calls, email, and a live chat button.

XTB Review

What we liked

- Easy account opening

- $0 minimum deposit

- Top-tier regulation

- 2000+ tradable instruments

- Powerful trading platform offering fast executions

- Multiple payment platforms

- 24/5 multilingual customer support

What we disliked

- Commissions on stocks and ETF CFDs

- No welcome bonus

- Charges inactivity fees

- Some payment options charge transaction fees

- Negative balance protection is only offered to EU and UK-based clients

The bottom line

XTB Group Limited operates as a stream of brokerage companies under the trademark XTB in different regions serving about 300K clients around the globe. It falls under a reputable regulation backed by the FCA and the IFSC of Belize, making XTB a safe broker to trade with. It deals with online retail traders and claims to offer them multiple asset classes to explore FX and CFDs with tight spreads, competitive leverage, and fast executions.

But, some of its services are not that wherewithal. It offers negative balance protection to a group of clients, charges high commissions on stocks and ETF CFDs, and charges an inactivity fee deprives clients the freedom to trade when they want.