The Rate Of Change (ROC) is a momentum indicator that measures the price change percentage of a specific number of look back periods. ROC simply compares the current price with the price of n number of periods ago.

It is a popular technical indicator that is used mostly for short term trading approaches.

Calculation:

The calculation of ROC indicator has given below,

Rate Of Change (ROC) = {(Current Close – Close n periods ago) / (Close n periods ago)} x 100

The default period of this indicator is 14, but many traders use different periods such as 12, 26, 52 etc.

Interpretation:

Most momentum indicators or oscillators are unable to identify trend direction, but ROC can detect trend direction. This indicator can identify trend direction and short term momentum changes of the price at a time. This is why some experienced traders use this indicator individually.

The mechanism and valuation of this indicator are quite different in forex market rather than the stock market. Thus, one should be careful about the values and levels of this indicator while using for forex trading. In the forex market, the extreme value is +1 and -1 while middle line or equilibrium is at 0. A trend can be identified as soon as any pair hit any of these two extreme values.

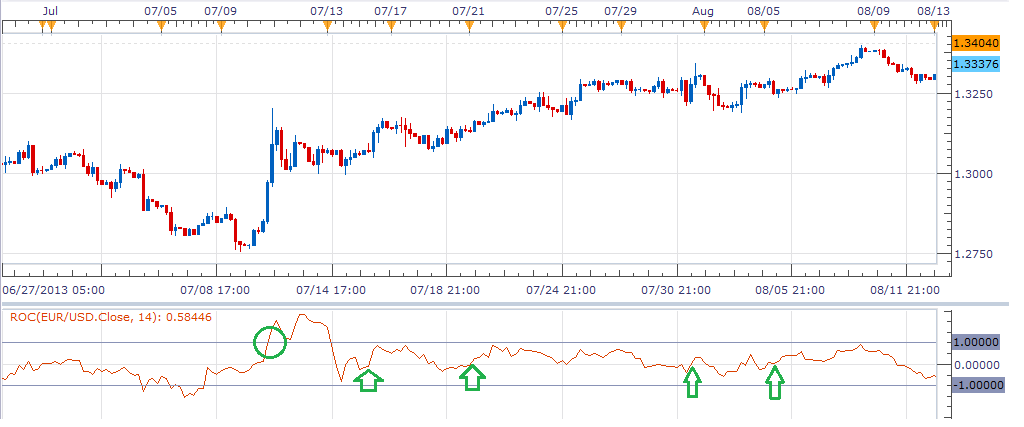

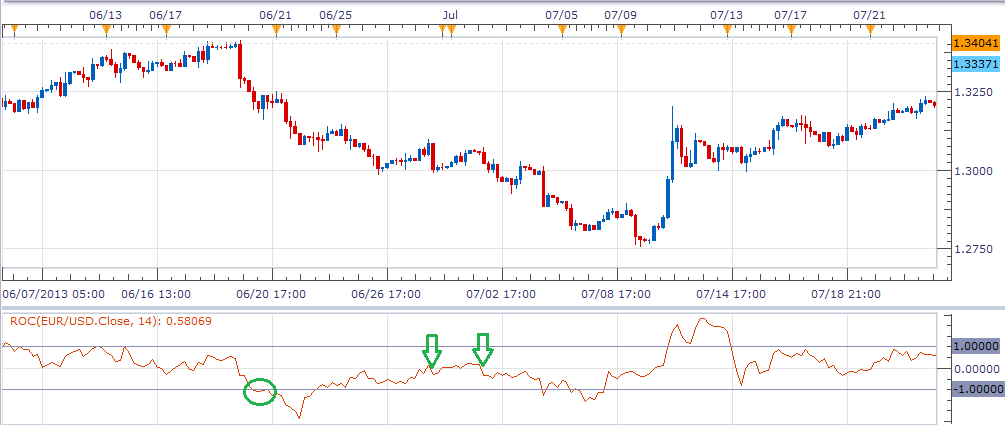

For example, if ROC of a pair moves above +1 then it is considered that the uptrend has started. On the other hand, downtrend starts as soon as ROC moves below -1. After identifying the trend direction, traders should wait for buy or sell signals. The equilibrium line or 0 line crossovers should be taken as final buy and sell signals after identifying the major trend. Buy signal generates as ROC crosses above 0 line and sell signal generate as ROC crosses below 0 line.

4-hour chart of EUR/USD (given above) is showing buy signals or entry signals for long positions. The uptrend has confirmed as soon as ROC moved above +1 (marked as the green circle). In the uptrend, buy signals occurred as ROC crossed above 0 line. Buy signals or entry signals for long positions are marked as green colored up arrows.

4-hour chart of EUR/USD (given above) is showing sell signals or entry signals for short positions. The downtrend has confirmed as soon as ROC crossed below -1 (marked as a green colored circle). In the downtrend, sell signals or entry signals for short positions occurred as soon as ROC crossed below 0 line from above. Entry signals have marked as green colored down arrows.

Summary:

ROC can be combined with other indicators and often carry better results. ROC can be combined with RSI, MACD, Moving Averages or Trend Lines. Many traders use different ROC of various periods at a time. This is also an effective technique of using ROC.