Average Directional Index (ADX) is a unique trend indicator. This indicator can measure the trend strength besides trend direction. In 1978, Wilder described ADX in his book named “New Concepts in Technical Trading Systems”.

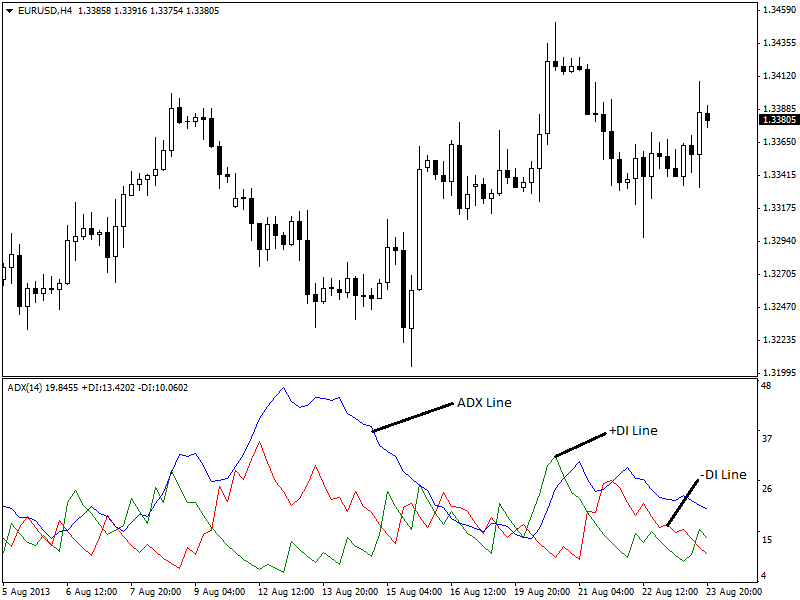

ADX indicator consists three different lines; ADX line, +DI Line and –DI Line.

ADX line is used to measure trend strength and the rest of the lines are used to determine trend direction. Here is an example chart of ADX given below,

4hour chart of EUR/USD is showing ADX indicator.

Calculation:

Welles Wilder developed ADX indicator by combining two indicators. One of these two indicators is positive directional indicator or +DI and another one are a negative directional indicator or –DI. At first, +DI and –DI are calculated,

Up Move = Today’s High Price – Yesterdays High Price

Down Move = Yesterday’s Low Price – Today’s Low Price

If Up Move > Down Move and Up Move > 0, then +DM = Up Move, otherwise +DM = 0

If Down Move > Up Move and Down move > 0, then –DM = Down Move, otherwise –DM = 0

Now,

+DI = 100 times exponential moving average of +DM / Average True Range

-DI = 100 times exponential moving average of –DM / Average True Range

ADX = 100 times exponential moving average of the absolute value of (+DI – -DI)/(+DI + -DI)

Some traders use different types of moving average for the variation such as weighted moving averages instead of exponential moving averages.

Interpretation:

ADX indicator can be used in many ways. These are described below,

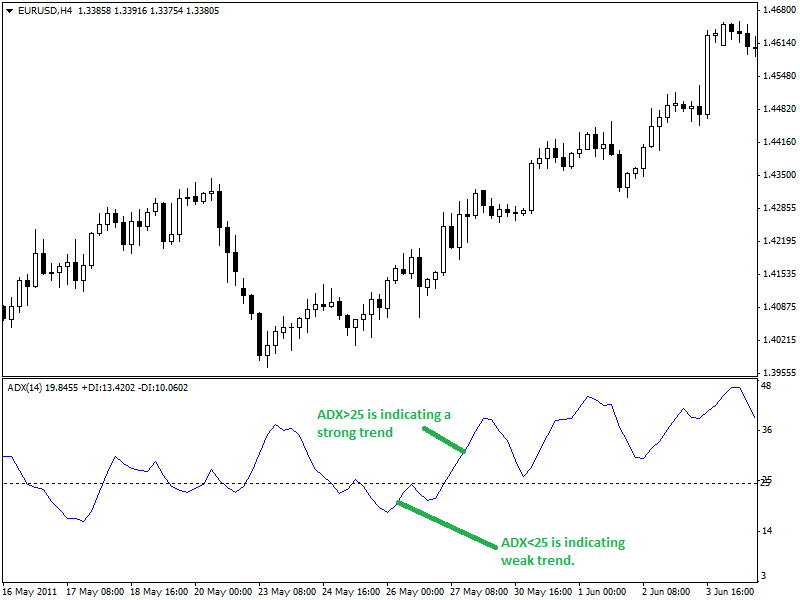

Trend Strength:

The main feature of ADX indicator is that it can measure trend strength which many other indicators can not measure. ADX line value can identify trending and ranging conditions. If ADX Line value is above 25 then the trend is strong. If ADX Line value is below 25, then the trend is weak or in ranging situation. Increasing ADX line also indicates that the trend is strong.

Here is an example is given below,

4-hour chart of EUR/USD is showing trending and ranging situations.

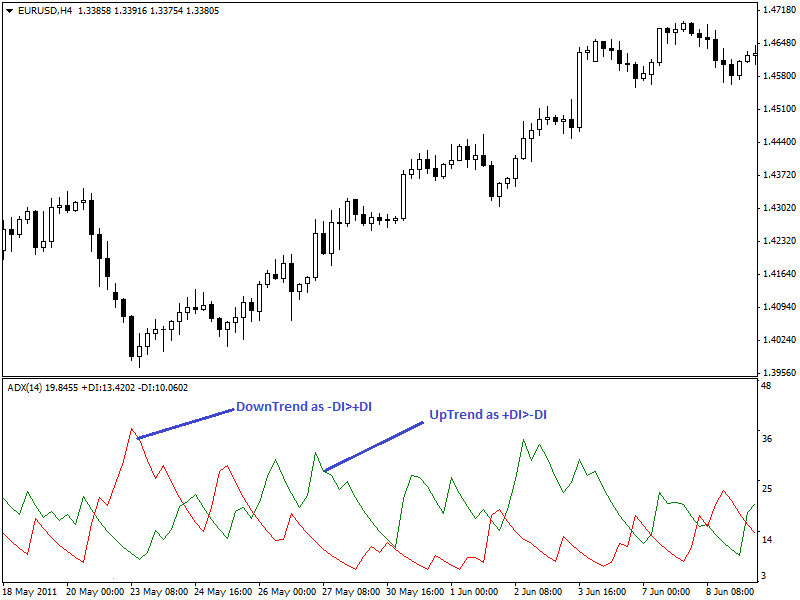

Trend Direction:

ADX line can not identify trend direction. To determine trend direction you have to look at +DI and –DI lines. If +DI line is above –DI line then the trend is considered as an uptrend. Inversely, if the -DI line is above +DI line, then the trend is considered as a downtrend.

Here is an example is given in the chart below.

4-hour chart of EUR/USD is showing uptrend and downtrend. The uptrend has confirmed as +DI>-DI. The downtrend has confirmed as –DI>+DI.

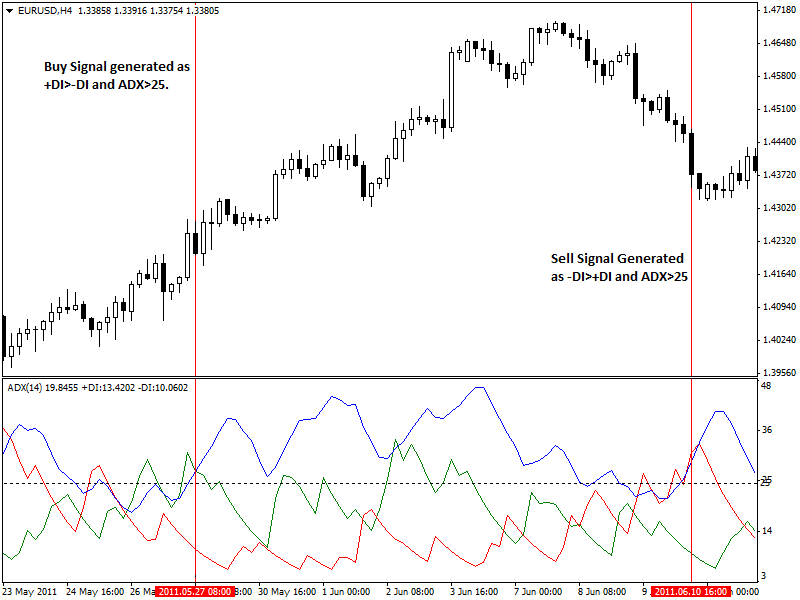

Trading Signals:

The best way to use ADX is to use both ADX line and +DI and –DI crossovers. A buy signal generated as soon as ADX line crosses above 25 and +DI is above –DI in that time. This buy signal is an entry signal for the long position. Inversely, a sell signal generated as ADX crosses above 25 while –DI is above +DI line.

This sell signal is an entry signal for the short position. Here is an example showing buy and sell signals in the 4-hour chart of EUR/USD (given below).

Summary:

ADX is an important indicator in trading and technical analysis as it can determine trend strength and weakness besides trend direction. This unique feature of this indicator made it popular to traders. Most traders use this indicator with other indicators.

However, ADX is more suitable for mid to long term trading methods or strategies.