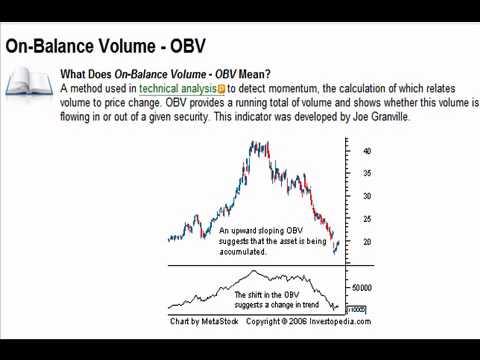

On Balance Volume or OBV is a volume based indicator that measures buying and selling pressure. This indicator focuses on the relation between volume and price. This indicator was described by Joe Granville in his book New Key to Stock Market Profits in 1963.

This indicator has the unique ability to measure the positive and negative volume flow as it compares the volume with the most recent close price to the previous close price.

Calculation:

OBV indicator represents the running total of positive and negative volume. The calculation of OBV is as follows,

If the current close price is above the previous close price,

Then Current OBV = Previous OBV + Current Volume

If the current close price is below the previous close price,

Then Current OBV = Previous OBV – Current Volume

If current close price is equal to the previous close price,

Then Current OBV = Previous OBV

Interpretation:

In the forex market, it is hard to understand the volume as we do not have the volume of the total market. We can only see the volume traded in the specific dealer or broker while trading. OBV is quite effective to represent volume movement as its focus on the volume trend rather than volume numbers.

One of the effective ways to use OBV in trading is to trade divergences. Most of the times, regular divergence can detect trend reversals successfully. Divergence occurs when indicator direction does not match with the direction of price or indicator moves against the price.

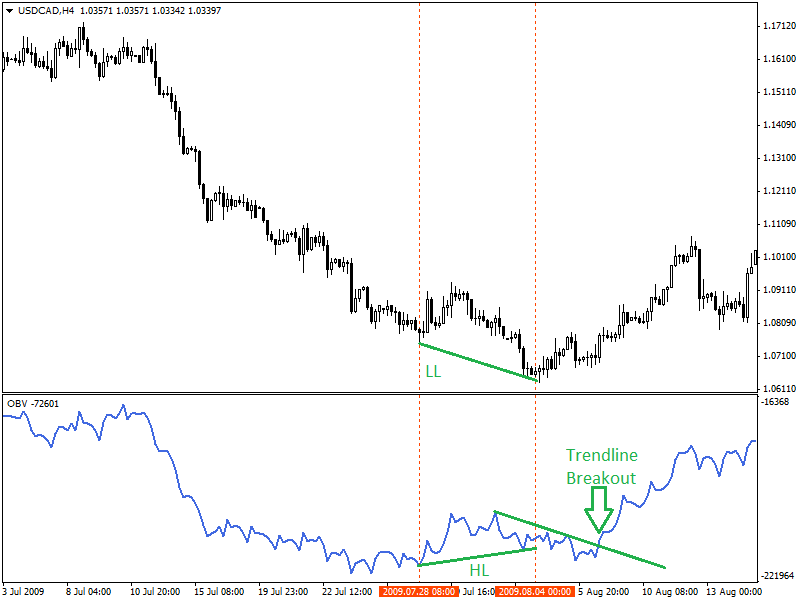

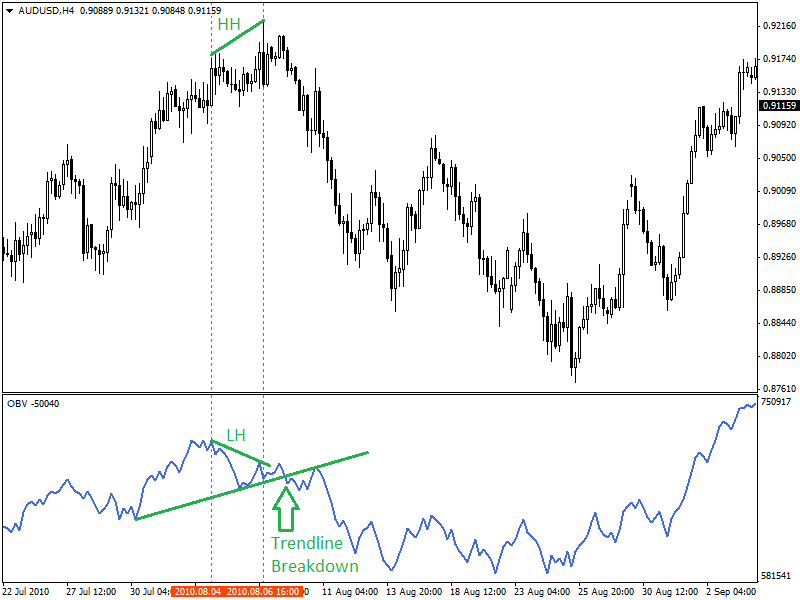

Divergence can be bullish or bearish. In bullish regular divergence, price creates Lower Low (LL) but indicator creates Higher Low (HL). In bearish regular divergence, price creates Higher High (HH) but indicator creates Lower High (LH). OBV indicator is widely used for trading regular divergences as this indicator is a volume based indicator.

4-hour chart of USD/CAD is showing a bullish regular divergence which indicating the possibility of the bullish trend reversal. Here, a price is showing weakness by creating Lower Low (LL) while the indicator is showing strength by creating a Higher Low (HL).

After identifying the bullish regular divergence, trend line breakout of OBV indicator can be used as final confirmation for a buy signal.

4-hour chart of AUD/USD is showing bearish regular divergence as price created Higher High (HH), but the indicator is showing weakness by creating Lower High (LH). Trend line breakdown can be used as a final confirmation after identifying the bearish regular divergence as shown in the chart above.

OBV can confirm the direction of the trend. Increasing OBV with increasing price is a sign of strong buying pressure and bullish trend. Inversely, decreasing OBV is a sign of weakness, selling pressure and bearish trend.

Summary:

OBV indicator is mostly used as an additional indicator to confirm trend direction, price momentum, and buying/selling pressure. However, OBV alone is also useful in case of divergence trading.