Gann Fan is a popular trading tool. It is basically a drawing tool developed by a financial genius William Delbert Gann. This incredible trading tool has used by traders for decades. The most well-known indicator or tool introduced by Gann is Gann Fan.

Gann Fan is basically a series of angles which has drawn from a pivot high or pivot low point. The prime angle of Gann Fan is 1×1 which is essentially a 45-degree angle while in an uptrend and 315-degree angle while in a downtrend. Rests of the angles are 1×2, 1×3, 1×4, 1×8, 2×1, 3×1, 4×1 and 8×1.

Trading Methods:

Gann Fan indicator can be used in two ways. It can be used for trend following and trend reversal trading. Gann Fan indicator functions like trend lines but this indicator can predict the possible trend line or retracement or reversal points.

Trend Continuation:

Like trend lines, Gann Fan indicator works as support and resistance lines depending on the trend direction. In an uptrend, Gann Fan is used to determine possible support areas and pullback zones. Trend lines require two low points in an uptrend, but Gann Fan can be drawn by taking one high and one low point.

It does not require two high points like trend lines. Thus, traders can enter into a trade earlier.

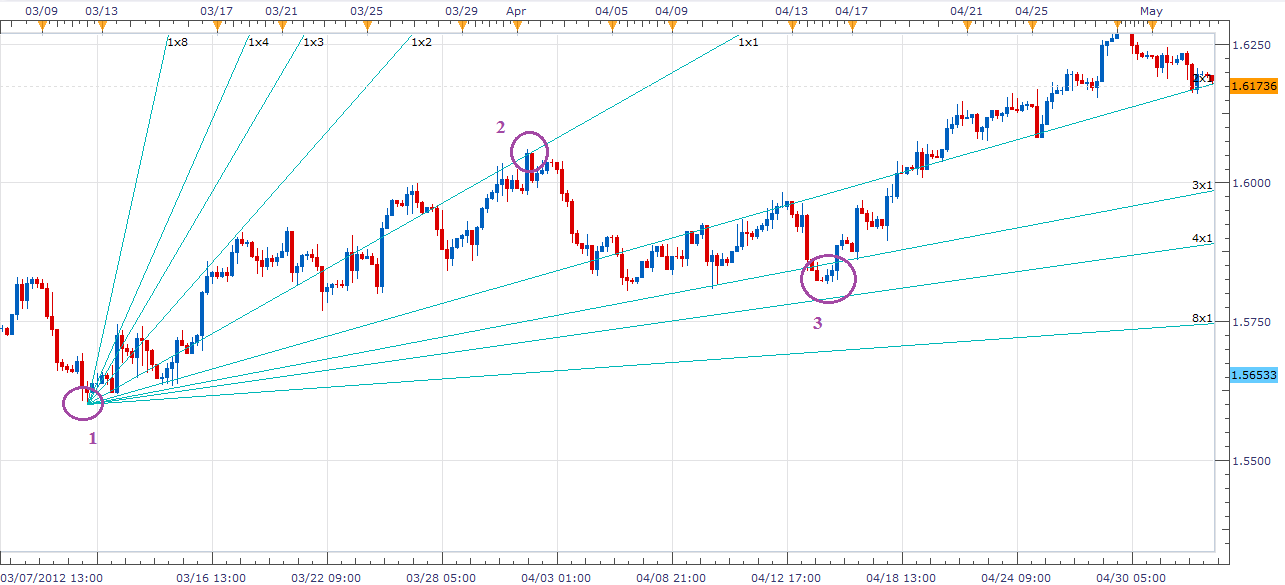

4-hour chart of GBP/USD is showing Gann Fan indicator in an uptrend. The 1×1 line of Gann Fan has drawn by connecting one low point (1) and one high point (2). 2×1 and 3×1 are considered as possible support and reversal point. This pair has got support from a 3×1 line of Gann Fan and bounced back to the prevailing uptrend.

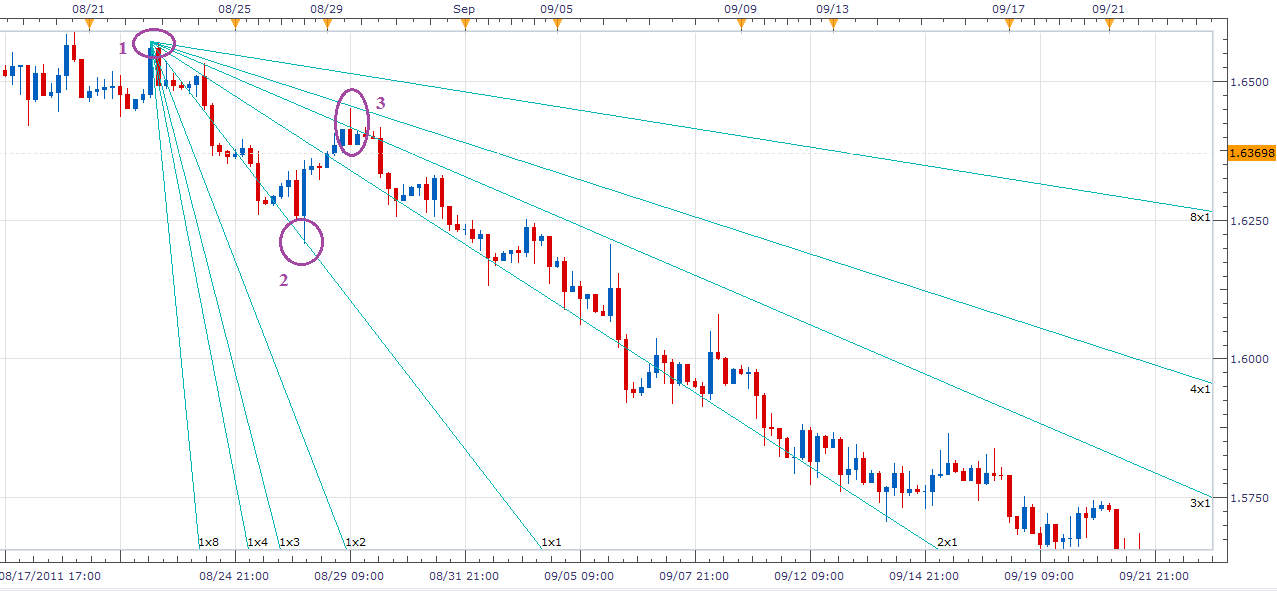

4-hour chart of GBP/USD is showing another example of Gann Fan trend following trading method in a downtrend. The 1×1 line has drawn by taking 1 and 2 points, point 3 is showing a pullback from the resistance (3×1 line of Gann Fan).

The currency pair has continued its prior downtrend after getting resistance from a 3×1 line.

Trend Reversal:

Gann Fan can be used to trade trend reversals. This method is similar to trend line breakouts. A down trend line breakout confirms a bullish reversal.

As Gann Fan lines are similar to trend lines, the breakout of these lines can be used as trend reversal signals.

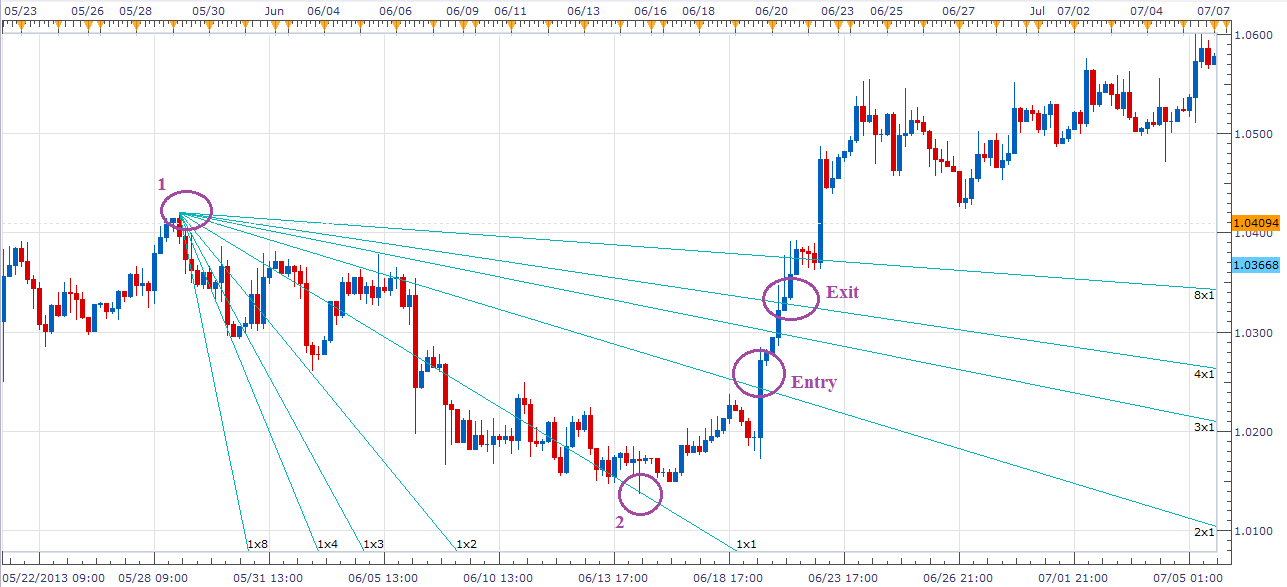

4-hour chart of USD/CAD is showing a bullish trend reversal. Gann Fan has drawn by connecting point 1 and point 2. Entry signal for long position generated as soon as candle breaks out 2×1 line.

Exit signal should be taken when candlestick touches or hits the 4×1 or 8×1 line.

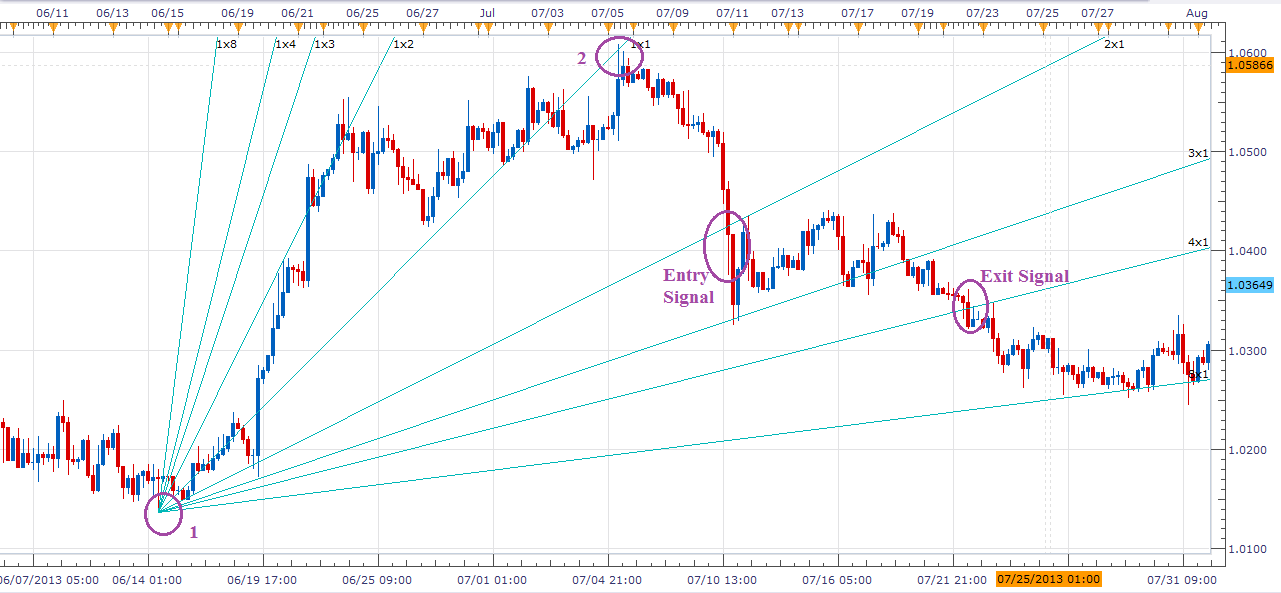

4-hour chart of USD/CAD is showing breakout, entry and exit signal for a short position. The 1×1 line has drawn by taking point 1 and point 2. Traders enter into a short position as soon as candlesticks break down the 2×1 line.

An exit signal should be taken as soon as candle hits the 4×1 line.

Summary:

This indicator or drawing tool can be combined effectively with many other indicators such as Fibonacci retracements, trend lines etc.

It is crucial to identify swing high and low points to draw Gann Fan properly.