- Weakness in the U.S. dollar is fuelling a sell-off on the USD/CAD, down to three-year lows.

- Gold is looking for direction, having hit a strong resistance near the $1900 level.

- U.S. equities are looking increasingly bullish after a solid start to the week

- Cryptocurrencies remain under pressure after bottoming out at the start of the week.

USD/CAD is hanging near three-year lows as weakness in the dollar continues to curtail any bounce back. The pair have struggled to register any meaningful gains as it continues to hover around the 1.2040-35 regions.

USD/CAD sell-off

The pair is looking increasingly bearish as fundamentals continue to work in favor of sellers.

The U.S. dollar plunging to 4 and half month lows on the Federal Reserve speakers soothing inflation fears is the latest catalyst fuelling a slide lower. Softer than expected, economic data has allayed any fears that the FED will tighten monetary policy, consequently fuelling weakness in the greenback.

The White House paring down its infrastructure bill to $1.7 trillion from $2.25 trillion has also averted any bets over inflation-driven rate hike by the FED. The Canadian dollar has also continued to hold firm against the greenback on a hawkish Bank of Canada. An uptick in oil prices has also continued to offer much-needed support.

Euro strength

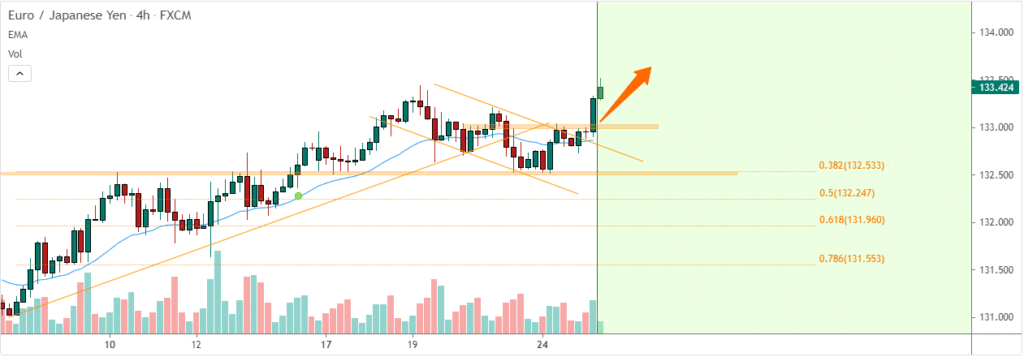

The Euro also continues to strengthen across the board on improving E.U.’s economic outlook. Impressive economic data in some of the biggest economies have continued to offer support to the common currency. The latest economic data from the Eurozone indicate improving the business climate, with German IFO Business Climate coming above estimates at 99.2 points.

Euro strength is the catalyst behind EUR/JPY powering to more than a two-and-a-half-year high. The pair looks set to continue powering high on Euro strength which has rallied to five and half month highs against the dollar.

Gold eyes $1900

Gold is struggling for direction in the commodity market, hitting a solid resistance near the 1894 level. The precious metal continues to trade in a tight range near its four-month highs as investors continue to digest rhetoric by Federal Reserve speakers.

The FED is reiterating that inflation in the U.S. will be transitory and continues to keep short-term bullish momentum for the bullion. With the dollar edging lower to four and half month lows, gold could power through the $1900 psychological level.

U.S. equity bounce back

U.S. equity indices were pointing to continued gains after rallying at the start of the week. Easing inflation concerns is the latest catalyst offering support to equities, therefore, fuelling the bullish momentum.

NASDAQ was up by 1.4% at the start of the week to highs of 13661.17, adding to small gains registered last week. The S&P 500 also turned bullish, rallying 1% to 4197.05 as the Dow Jones Industrial Average gained 0.5% to close at 34393.978

US stocks are benefiting from economic reopening, consequently sending indices higher. Covid cases dropping to the lowest point in the U.S. is helping fuel hopes of accelerated economic recovery. The upbeat sentiment sent stocks higher.

Cryptocurrencies stall

In the cryptocurrency market, Bitcoin bounce back gathered pace on Monday, with the flagship crypto rallying by more than 20% to above the $39,000 level. The rally came after tumbling to just above the $30,000 level.

Bitcoin’s upward momentum appears to have hit a solid resistance at the 39,800 level, where bulls are experiencing strong resistance. Bitcoin came under pressure over the weekend after miners who mint the altcoin halted Chinese operations in the face of increasing scrutiny from authorities.

The 20% plus jump on Monday came on billionaire Elon Musk appearing to soften his stance against the environmental impact of the flagship cryptocurrency.

The second-largest cryptocurrency, Ether has also come under pressure in the aftermath of Bitcoin imploding from all-time highs. ETH/USD has since shed more than 40% from its all-time highs. After plunging below the $2,000 level last week, ETH/USD has bounced back, rallying by more than 20% to the $2,400 level.