- The USD/CHF currency pair has decreased by almost 13% since April 2019.

- The dollar is expected to react positively against the Swiss franc after the Biden Administration enacts the third stimulus package.

- The Swiss franc is weighted at 3.6% against the dollar showing strength into 2021.

The US dollar and the Swiss franc currency pair has slightly risen from the 5-year lows set in Q4 2020 and early 2021 with the hope of a third stimulus strengthening the dollar. The dollar fell 12.90% from a high of $1.0192 in April 2019 to 0.8877 on January 14, 2021. The currency has failed to pick even after the US termed Switzerland as a currency manipulator in December 2020. The successful rollout of the COVID-19 vaccine has also served to improve the status of the dollar. Switzerland approved the vaccine from Pfizer/BioNTech, further boosting its trade relations with the US. However, Switzerland hopes to recover from its downward trend from the second half of 2021.

Switzerland escalated its downward trend from November 2020, with the government admitting that the COVID-19 pandemic cost the European giant a total of 72 billion francs. The country is still hopeful that by 2022 it will have gained 4% economic growth. It is dependent on its robust financial systems to manage the ballooning debt levels, enhance healthcare, and improve social capital.

The US is also gaining steam with the new Biden administration set to roll out another stimulus package upon assuming office later in January 2021. But still, the Dollar is softening as the world becomes more optimistic about growth in 2021.

The US dollar index (DXY) has lost 7.22% year over year to trade at 90.352 as of January 14, 2021. The Swiss franc is weighted at 3.6% against the dollar showing strength into 2021.

Economic recovery in the US

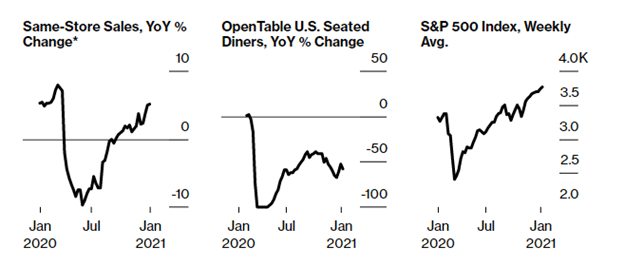

Recovery of the US economy has been hindered by the rising coronavirus cases that weigh down employment income. High application numbers for unemployment insurance, fewer restaurant bookings, and closure of virus-sensitive industries are delaying the US economy upsurge. However, the dollar index may find a reprieve in the growing housing demand and higher retail sales due to the distribution of stimulus checks.

The start of the Biden-administration and a Democrat-controlled parliament is expected to boost the economy. The S&P 500 Index rose to an all-time high entering 2021, nearing the $4,000 mark, with the average same-store sales growing to an annual high of almost 10%. Open-seated restaurants are still operating below expectation, but owners are hopeful that the vaccine rollout will improve margins in the long-run.

It is still unclear as to the real impact of the hundreds of Billions pumped after Biden is inaugurated. It is expected that it will enhance the financial position of American citizens. However, the near-term is still bleak, with the Swiss franc expected to be dominant.

Technical analysis

The relative strength index (RSI) is neutral at 49.707, while the stochastic RSI supported a sell position at 37.809. The ultimate oscillator also supports a sell-position at 43.390. The 20-day SMA is at 0.8877, and the 100-day SMA is at 0.8879. These two indicators all point to a sell position of the USD/CHF currency pair. The 200-day SMA puts support at 0.8844 while the EMA is at 0.8863. Here, the pair has a long buy position.

In the short-term, the US dollar strength may be subject to speculation as investors remain upbeat with the stimulus package. The CHF’s higher weighted power and the successful implementation of financial systems during the pandemic may give it dominance over the dollar.