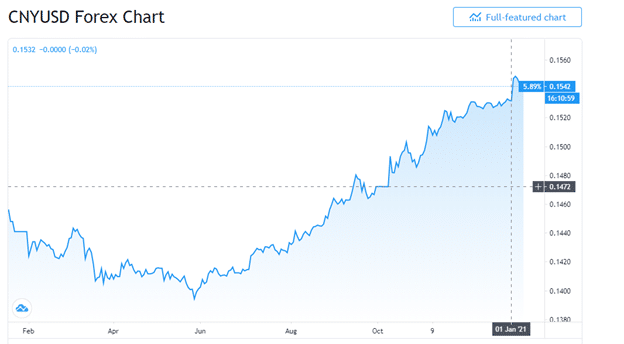

- The Chinese Yuan currency has gained more than 5% YoY against the dollar.

- China’s CPI rose by 0.7%, and the PPI contracted to -0.4%, the slowest in less than a year.

- China’s balancing act is expected to put the currency in a neutral position against the dollar.

The Chinese Yuan is gaining the attention of investors as an alternative currency haven from the dollar’s volatility. The Yuan rose by more than 5% from a low of 0.1453 on January 14, 2020, to a high of 0.1531 to the dollar on January 1, 2021. The bullish run of the Yuan is against a backdrop of gains in Asian stocks, particularly the Japanese Nikkei. China’s consumer price index (CPI) and manufacturers’ prices rose slightly into the new year 2021. The country’s strong economic recovery post-pandemic is strong support for the currency against the falling dollar.

Rising CPI

The purchasing trends of Chinese consumers and the inflation rate rose to 0.7% on January 11, 2021, from a previous low of -0.6% in FY 2019/2020. The CPI beat analysts’ forecasts that had settled on 0.4% as the new CPI into the new year. This higher reading indicates a bullish prediction for the Yuan. Further, the higher CPI shows that China paid higher for imports into the country, indicating increasing spending power.

The overall inflation denoted by the purchasing power index (PPI) into 2021 also contracted to -0.4% from a forecast of -0.8%. The previous reading of -1.5% showed that the country’s economy struggled to recover from the pandemic. The slow contraction of the PPI also shows the rapid pace of recovery of the Chinese economy. The factory prices have fallen at the slowest pace in less than a year.

The People’s Bank of China (PBoC) announced that it would enact a supportive monetary policy for small businesses while watching the economy’s recovery in 2021. The indication of increasing inflation rate shows that the PBoC is in the process of scaling back on the low-interest rates offered until the end of 2020. Additionally, the Bank will update its borrowing regulations to scrutinize internet loan platforms such as Ant Group by Alibaba, Tencent Holdings, and Alipay.

Management of borrowing and spending among the Chinese is crucial at this time. The Bank will want to contract the monetary policy but keep it flexible. It might consider raising the interest rates but, at the same time, stimulate the economy. This balance is essential, keeping in mind that some sectors such as real estate and housing, in general, are yet to recover.

Technical analysis

The 14-day RSI shows a value of 45.951, indicating that the forex is in a neutral position. The stochastic oscillator shows a buy position at 59.869. Both the 5-day and 10-day SMA/ EMA are constant at 0.1543, slightly lower than the day’s trading value at 0.1543. The 200-day SMA also supports the buy position at 0.1540 and the EMA at 0.1541.

However, a sell position of the currency is established by the 20-day to 100-day SMA and EMA. The 100-day SMA indicates a sell position as it stands at 0.1547 while the EMA is 0.1544. The 50-day SMA is 0.1546, while the EMA is 0.1545. The balance between the two averages shows that the currency pair will trade at a neutral position in the short term.

The PBoC’s balance of the economic stimulus and interest position may see the Chinese Yuan remain neutral for some time in the first quarter of 2021.