- South Africa’s consumer spending rose in 2021.

- Increased inoculation across the US will bolster economic recovery.

- The US dollar may rally as stimulus payments increase US spending.

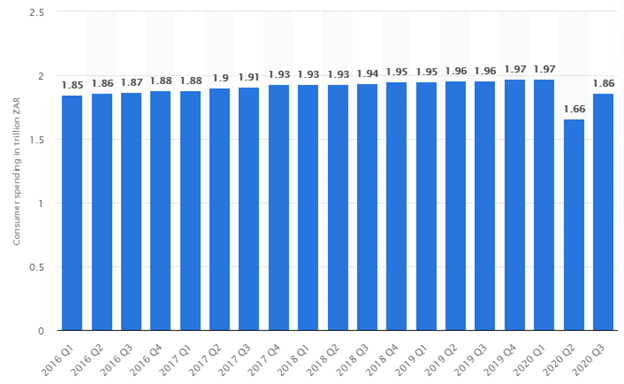

The South African rand has gained 21.93% against the US dollar. The trading pair fell from a 52-week high of 19.3547 to a low of 15.1102 on February 26, 2021. The dollar tumbled despite the South African economy falling 7% in 2020. This decrease was due to the emergence of the new coronavirus variant that initiated restrictions—consumer spending as of Q3 2020 1.86 trillion rands as compared to 1.97 trillion rands in Q4 2019. The US economy, on its part, grew at 4% in Q1 2020, but it shrank at the highest rate in the past 70 years. Growth is projected to rally at 5% in Q 2021 as the country races towards optimum vaccine distributions.

South Africa’s consumer spending

South Africa’s consumer expenditure fell 15.73% in Q2 2020 from the previous quarter. Economic restrictions by the government bit into the economy. At the time, the unemployment rate increased by 30.1% leading to a 7% contraction in the economy. The situation was aggravated by the high social and income inequality existent in the country. Consumer expenditure later rose by 12% in the third quarter as retail sales picked up owing to the government’s relaxing of restrictions and gradual reopening of the economy.

Sales and commodity price

Retail sales before 2020 were 1.2% YoY. They slumped 4% in November 2020 despite South Africa having sub-Saharan largest developed and modern retail markets. Tax revenue rose in December 2020 by close to 10% from revenue of R160.4 billion in 2019 to R176.4 billion despite the strict lockdown. Commodity hike as the global economy recovered helped to bolster the mining sector leading to a rise in income levels. Demand for fuels such as diesel is at pre-pandemic levels into 2021, with petrol at 90-95%. Though the price of spot gold has fallen from a year-high of $2,070 to a low of $1,477.30, it has still gained 94.60% in the past year alone.

The US dollar has gained 4.83% since February 16, 2021, when the pair rose from 14.4143 to 15.1102 on February 26, 2021. January 2021 saw consumers in the US spend 2.4%, the highest increase from July 2020 (from Q2 2020).

Fuel expenditures had also increased by 10% since December 2020, boosted by the stimulus cash payments into 2021. Inflation was also reported to have increased by 0.3% in January 2021, with prices up by 1.5% (about 0.5% below the Fed’s target of 2%).

Although the Fed is not in a hurry to raise rates, traders should consider that the threat of rising interest and inflation rates may bring this scenario sooner than later. A quick rise may derail the recovery of the economy. This situation holds with the high unemployment rate, with up to 10 million lost since 2020. Service expenditures in January rose 0.7%, with restaurants and hotels gaining 5.7%. Falling coronavirus cases and serious vaccination attempts show that tourism in the US is growing considerably.

Technical analysis

Forecast using the Elliot wave triangle shows a slight corrective pattern of the USD/ZAR trading pair. We may witness a short-term bullish reversal as depicted from the uptrend D to E. The pair may reach near-resistance at 16.12738 and support at 14.24143. The disjoint channel from January 2021 to March 2021 predicts two scenarios. The 14-day RSI is bullish at 60.732, while the 5-day SMA gives resistance at 15.1404. The South African rand looks stronger from point C to D. The bear market may continue as the rand continues to strengthen.