- South Africa is scheduled to release its business confidence index on July 14, 2021.

- Retail sales projections for May 2021 dropped to 12.2% from a high of 95.8% realized in April 2021.

- Consensus estimates have put the US core PPI indicator lower at 0.5% for June 2021 (MoM) from a previous index of 0.7%

The USDZAR pair added 1.91% as of 1:16 pm GMT on July 13, 2021, from the previous day’s close. It traded from a low of 14.3831 to a high of 14.6813.

The rand took a hit against the dollar following a series of social protests sparked by the imprisonment of former South African President Jacob Zuma.

South African soldiers outside a damaged ATM

As of July 14, 2021, the death toll from the protests stood at 70, with the violence marked by blockade of trade routes and looting of shops. While former President Zuma asserted that the charges preferred against him are motivated by his political nemesis, the state claims that graft under his rule cost the government 500 billion rands ($35 billion).

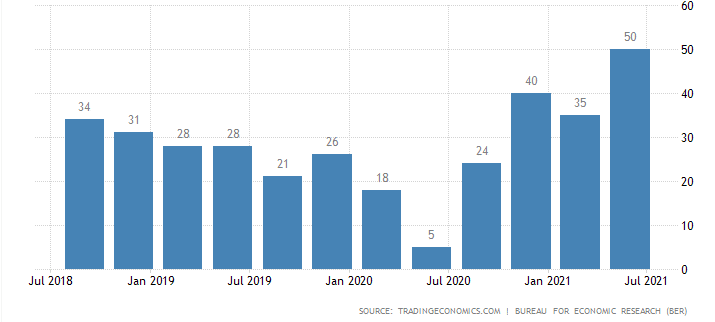

Business confidence

South Africa is scheduled to release its business confidence index on July 14, 2021. The indicator had risen 3.19% in June 2021 to stand at 97.0 from a previous record of 94.0. Sectoral heavyweights in SA comprising manufacturers, contractors of building works, retailing/ wholesale services, and dealers of new vehicles had their RMB/BER rise to 50 in Q2 2021.

RMB/BER Business Confidence Index

South Africa’s main trade sectors, including manufacturing and retail trade, recorded the highest increase in their business confidence rating in Q2 2021 (at 50) since their last rating in Q4 2014. The instability of Eskom’s electricity distribution, lockdowns, and the 3rd Covid-19 wave were seen as the main threat to the country’s economic recovery. However, the Zuma-related protests now appear to derail progress.

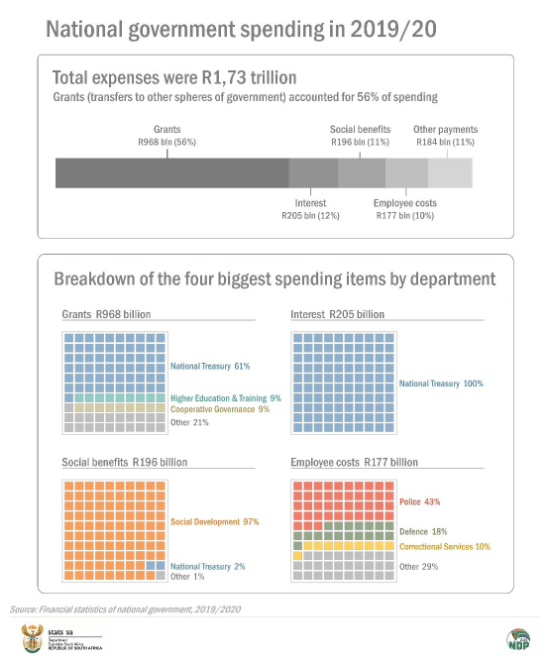

National government spending

Total expenditure of the South African national government in the FY 2019/20 stood at R1.73 trillion. Grants formed the highest expense bracket at R968 billion, followed by interest expenses at R205 billion. Of the R177 billion attached to covering employment costs, 43% were attributed to the police force, defense (18%), Prison services (10%), and other services (29%).

South African Government expenditure in FY 2019/2020

Since the start of the pandemic, South Africa has seen a high involvement of police officers and the army in a bid to quell social tensions. More law enforcers are likely to be incorporated in FY 2020/21 raising the employment costs further into 2022.

Analysts’ projection for retail sales (to be released on July 14, 2021) for May 2021 (YoY) has dropped to 12.2% from a high of 95.8% realized in April 2021. In a property survey by South Africa’s FNB Bank, the high living costs and financial pressures have forced 55.37% of property owners to consider relocation/ selling. In the survey, sales related to upgrading stood at a low of 11%.

The US is expected to release the core producer price index (PPI) indicator as of July 14, 2021. Consensus estimates have put the indicator lower at 0.5% for June 2021 (MoM) from a previous index of 0.7%. The annual index is perceived to rise from 4.8% to 5.1% for June 2021.

Technical analysis

The USDZAR hit the support zone at 13.3762 on June 8, 2021, and proceeded with the bullish reversal. The 14-day RSI shows a strong buying momentum in the overbought zone at 75.57.

We may see price movement towards 15.0510 after the breakout was confirmed at 14.3370. The volume continues to grow, indicating a strong uptrend. Failure to advance higher may push prices back to the range of 14.3370-14.7230.