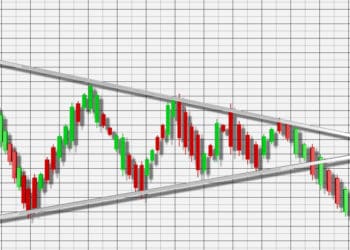

Trendlines are those lines that you can recognize easily. A trader draws trendlines on charts in order to connect a series of prices or show the best fit of some data. You can use the resulting line to grasp a good perspective of the next direction of an investment’s value movement.

You can draw the trendline beneath pivot lows or above pivot highs for showing the prevalent price direction. To put it simply, these lines are a visual representation of support and resistance within any time frame. Not only can you see the direction and speed of price from them, but patterns are also described during price contractions.

Using Trendline for Break and Reversal

When it comes to trading tools, trendlines are the most versatile ones that can be used in day trading, position trading, and swing trading. However, traders often make errors while drawing them. And that is why you need to learn well how you can use trendlines for break and reversal. Let’s begin.

Trendline Breakout Strategy

Sometimes, you may find it difficult to schedule your entries in a trending market due to a deep or shallow pullback. If you enter too early in the case of a deep pullback, you will suffer losses. On the contrary, if it is a shallow pullback and you enter too late, there is a risk that you will miss the move. The trendline breakout technique is the solution to this problem.

What you need to do is wait until a pullback is in an uptrend. After that, you will have to draw a trendline that connects the highs of the pullback. You can enter the trend if the price breaks the trendline. The logic behind this technique is if the price breaks over the trendline, it indicates that the trend will most likely resume and the buyers are in control. If the price does not break, it indicates sellers still being in control, and you must wait until buyers regain control.

Use of Trendlines to Identify Trend Reversal

This is one of those situations that many traders face while following the breakout strategy. So, what happens is, when they see price break over the downward trend line, they think that the market will reverse higher because the trend line is broken. However, a completely opposite scenario takes place as the downtrend resumes, and the market goes lower. This is confusing for many traders.

You have to keep in mind that the trend is not necessarily over just because a trend line is broken. The market is prone to such false breakdowns. This is why a trendline requires regular adjustment. To identify an upside trend reversal, you must wait until the price breaks above the trendline. Now, wait a bit more and give a higher low time to form. When this happens, you can be sure that the sellers are exhausted. If the price breaks the swing high after this, the market is going to reverse higher. The buyers are in control now.

What Is a Saucer Formation?

A saucer formation is also known as rounding bottom. It is a technical charting pattern that indicates a potential reversal in the price of a security. It is formed when the price of the security reaches a low and starts upward trending.

Generally, saucers are formed at the support levels of security. It can be channels, trendlines, or any other alternative that can define the support and demand relationship of that security. These take place when a financial instrument refuses to a low and starts trending upward. As a result of this price action, a U-shaped chart pattern is formed. With a flatting bottom, it is usually very rounded.

Examples of Saucer Formations

You can use several channels in order to chart the support and resistance trendlines around security price. Envelope channel patterns are fluid formations that can help you to follow a security’s price over a long period. When it comes to envelope channels, the Bollinger Band channel is the most common one. This channel draws support and resistance trendlines that are two standard deviations below and above the moving average. Different envelope channels have different methodologies to chart trendlines. Other such channels are Keltner Channels and Donchian Channels.

If you are a trader who prefers tighter support and resistance trendlines, you can also draw channels at the peaks and troughs of the price of a security over a specific time frame. The channels may ascend, descend, or depend sideways on the price trend of the security.

Standard trading channels and envelope channels

Both patterns are equally important for traders who want to use a saucer formation for identifying and placing profitable trades. Saucers are generally formed at the support trendline. It can take place in a high-volume selloff that pushes the price down to its lowest level. This low price level will frequently be in the support zone, the area around the support trendline. You will often see a great extent of uncertainty in price in the support zone.

This zone is known for acting as the floor of security. Hence, traders anticipate that the price cannot fall past this level. However, things can be different due to some factors like trading mechanisms, supply, and demand that can lead the price to fall below the support level. At this point, you can consider volume to be an essential indicator because the pricing sentiment of investors influences it highly.

Saucer Formation

A saucer formation takes place if the price does not trend lower and, instead, starts an uptrend. It follows the traditional investing methodology, and traders anticipate this movement the most. Generally, traders want to buy call options on the security or buy the security when it is at its lowest price. This is the best way to gain the benefits from a saucer formation.

As you can see, trendlines and saucer formations are closely related. To avoid risks and losses, it would be best to learn about them better before you use them in trading.