People are interested in cryptos for a variety of reasons. If you want to trade them, you’ll need to use an exchange. Decentralized exchanges are a popular type of crypto exchange that is completely autonomous. It allows peer-to-peer transactions without the use of intermediaries, as well as a plethora of other advantages. This means that the assets of users are not held by a single entity or company. The user retains ownership over their private keys. They differ in many ways, so you’ll need to analyze features carefully before settling on the best platform for your purposes.

Which are the factors to consider before choosing a DEX?

Usability: DEXs have a steep learning curve and might be difficult to comprehend for new crypto investors. Examine each DEX’s trading interface to discover how simple it is to use.

Security: To assist protect your assets, look for any additional security protections the site provides. Some platforms, for example, allow you to link your hardware wallet to the trade contract directly.

Available cryptocurrencies: Check which coins and tokens you can trade. Ensure every coin you want is available, and check how often new coins and tokens are added.

Trading volume. What is the current trade volume for the platform? Ensure there is sufficient liquidity to meet your trading requirements.

Fees: Do a thorough check on the fine print for information on the platform’s trading fees and any other transaction fees that may apply.

The registration procedure. How simple and quick is it to create an account? Some DEXs ask for more information, and others do not even require signing up.

User feedback. Checking out some independent evaluations is one method to get a better sense of the quality of exchange. This will allow you to learn about other users’ experiences with the site and whether they had any issues or concerns.

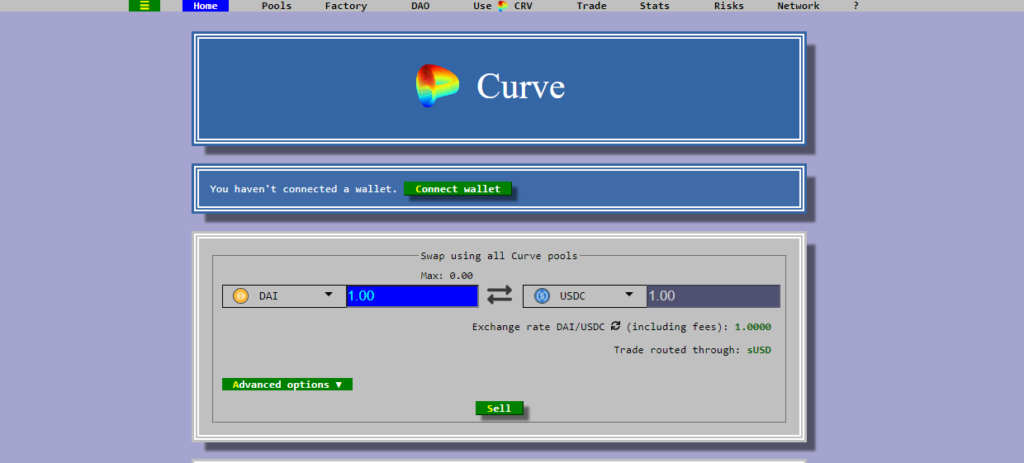

Curve

Curve is an Ethereum-based DEX liquidity pool that attempts to make stablecoin trading as efficient as possible while maintaining low fees. It facilitates trading by using pools of cryptocurrency given by users, who can earn fees through their deposits rather than a central order book.

In 2020, the Curve protocol established a decentralized autonomous organization (DAO) to govern protocol changes. The majority of DAOs are governed by governance tokens, which grant token holders voting rights. The Curve DAO is controlled by the CRV token. The CRV token can be purchased or earned through yield farming, which is the process of depositing assets into a liquidity pool in exchange for tokens.

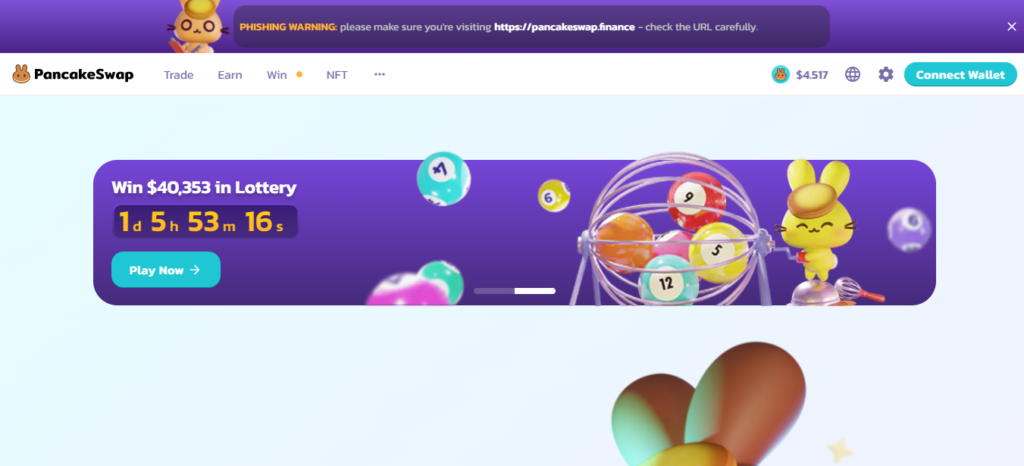

PancakeSwap

It is a Binance Smart Chain-based DEX created by a group of anonymous developers. You can swap tokens and cryptocurrencies without using an intermediary on PancakeSwap and preserve custody of your tokens. It’s used for BEP-20 coins on the Binance Smart Chain. However, you can bring tokens from other platforms through Binance Bridge. It employs an automated money maker (AMM) mechanism to enable crypto trades, relying on user-fueled liquidity pools. In exchange for liquidity provider/LP tokens, users deposit funds in the pool.

You can also farm tokens such as CAKE and SYRUP. After locking your LP tokens in the liquidity providers pool, you will receive CAKE as your first reward. You can now stake CAKE tokens in exchange for SYRUP tokens. You gain more functionality with SYRUP tokens, such as governance tokens or tokens that may be used as lottery tickets.

Uniswap

Uniswap pioneered the Automated Market Maker model, in which users supply Ethereum tokens to Uniswap “liquidity pools,” and algorithms set market prices based on supply and demand.

Users can earn incentives while facilitating peer-to-peer trading by supplying tokens to the Uniswap liquidity pools. Anyone from anywhere can contribute tokens to liquidity pools, trade tokens, and even generate and list their own tokens (using Ethereum’s ERC-20 protocol). On Uniswap, hundreds of tokens are currently accessible, with stablecoins like USDC and Wrapped Bitcoin among the most popular trading pairs (WBTC).

Uniswap developed the UNI token to provide community ownership of the protocol, allowing stakeholders to vote on critical protocol modifications. UNI token holders can also use the token to fund liquidity mining pools, grants, partnerships, and other growth-oriented efforts aimed at increasing Uniswap’s usage and reach.

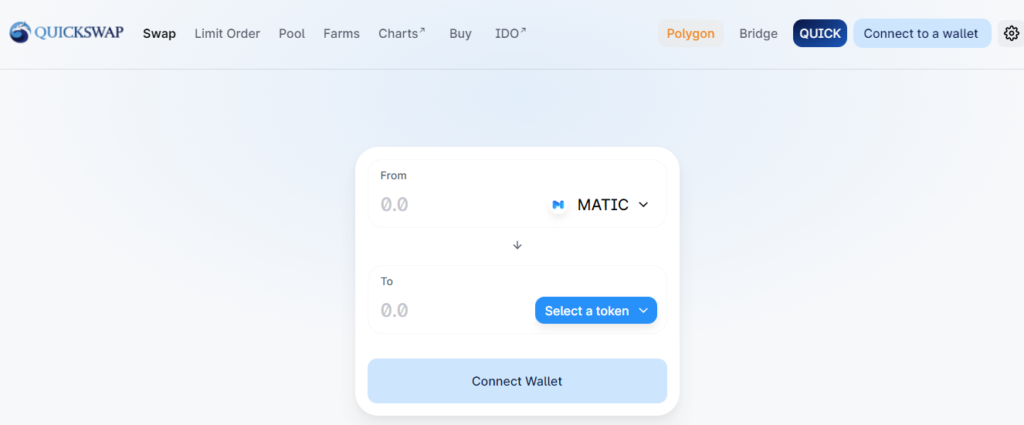

QuickSwap

QuickSwap is an Automated Market Maker on the Polygon Network. The Polygon Network’s speed and low prices have helped it gain popularity. It’s also Ethereum-compatible, allowing you to swap ERC-20 tokens.

It provides a DEX experience for users to exchange tokens utilizing an AMM model. It has no order book because customers trade from liquidity pools, which are pools of tokens. Users can trade any pair with QuickSwap by bridging ERC-20 tokens from Ethereum to Polygon, as long as there is a liquidity pool for it. QUICK is the QuickSwap cryptocurrency. It’s simple to purchase and sell. You can also use QuickSwap’s liquidity pools to exchange other tokens for QUICK.

Trader Joe

Trader Joe is a decentralized trading platform that allows leveraged trading on the Avalanche network. It has a redesigned user interface, a candlestick chart, and stronger farming incentives, such as double reward farming.

Its marketplace now offers over 100 distinct Avalanche-based products and sees a daily trade volume of over $100 million. TraderJoe is regulated by its community of $JOE token holders and is undoubtedly one of the quickest iterating decentralized exchanges operating today.

TraderJoe is unique in that it features a Zap function that allows users to convert a single token into liquidity provider tokens without having to go through the trouble of manually exchanging it for several tokens and providing liquidity.

Summary

A DEX is a crypto marketplace that links buyers and sellers via peer-to-peer (P2P) transactions. DEX platforms are often non-custodial, which means that when transacting, a user retains ownership of their private keys and assets. When choosing one, there are various variables to consider, including ease of use, security, the number of cryptos available, trading volume, and fees. In this article, we have discussed the best 5 you should consider.