Some forex traders trade currencies for the interest gap between two currencies. This is called carry trade. In carry trading, forex traders aim to pull out the interest gap as profit when the price of the pair lies flat.

It includes selling a currency with low interest rate, then using it to buy a currency with higher interest rate.

When you sell a currency with low interest rate, buy a currency with higher interest rate and the exchange rate of the currency pair lies flat, then the interest rate is your profit. For example, you borrowed $10,000 from a bank with 1% interest per year. Now, if you buy a $10,000 bond with that borrowed money which offers 5% interest per year, then you get 4% profit in a year.

This 4% is the difference or gap between interest rates. The percentage of a difference between the interest rate of two currencies is small. But it can provide you a decent amount of profit if you use leverage.

Some traders use this carry trading as an advantage in their normal trading. This type of trading method is helpful only for long term trading as you have to hold an overnight position to get the interest. In the spot forex market, you get the interest for holding overnight positions. This difference between interests can be positive or negative in the case of forex trading depending on your trading position (long or short).

For example, the interest rate of AUD is 4.50% per year, and interest rate of JPY is 0.10% per year. If you hold a long position in AUD/JPY, then you will get 4.40% interest per year as you have bought AUD and sold JPY. On the other hand, if you open a short position in AUD/JPY, then you have to pay 4.40% interest per year as you have sold AUD and bought JPY.

Popular Pairs for Carry Trading: AUD/JPY, AUD/USD, NZD/JPY, USD/TRY, EUR/JPY etc.

Advantages of Carry Trading: Carry trading has two major advantages. One is if you trade in favor of interest difference then you will get the additional profit of carry trading besides the profit of price change. Another is if you trade against the favor of interest rate difference then you will get some profit from the carry trading which will reduce your loss. This advantage in a losing position will help you to minimize your stop loss and trading commissions.

The risk of Carry Trading: Besides the advantages of carry trading, there is a significant amount of risk. The pairs that have best conditions for carry trading are high volatile and can also become extremely trendy. Thus, if you do not have proper money management and discipline then, you might have to suffer from a quick large movement against your trading position. This risk can be reduced by applying proper money management strategy in carry trading.

Trading Strategy: Here is an example trading strategy for carry trading in the forex market.

Entry Conditions:

- Find a currency that has a high-interest differential.

- Find a buy or sell signal in favor of higher interest differential or higher yielding currency.

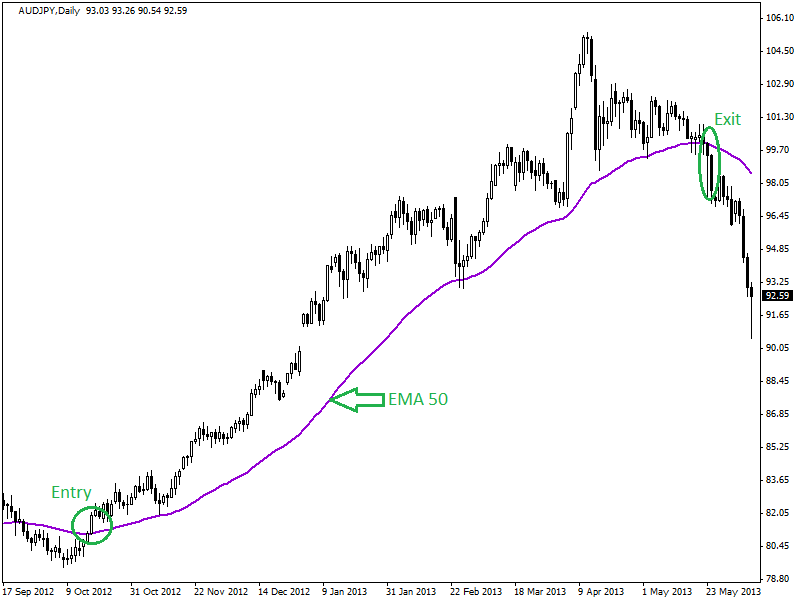

- For long positions, enter when a candlestick cross above EMA50 (buy signal).

- For a short position, enter when a candlestick crosses below EMA50 (sell signal).

Exit Conditions:

- Exit when a candlestick crosses below EMA50 (for long positions).

- Exit when a candlestick crosses above EMA50 (for short positions).

Stop Loss:

- Exit signals (mentioned above) in a losing position.

Here is an example of carry trading strategy for a long position in the daily chart of AUD/JPY.

Summary:

Carry trading becomes risky without proper money management and disciplined approach. A trader should develop an effective trading strategy for carry trading with proper money management. Carry trading can also provide some advantages in case of long term trading strategies.