Fibonacci retracement is very useful in forex trading as it can determine potential support and resistance levels. These supports and resistances are particularly useful to detect reversals and entry opportunities. Fibonacci retracements tool is very useful for both day trading and long term trading with daily charts.

One should use Fibonacci retracements to find trading opportunities near retracement levels and then take entry decisions using technical indicators. We will discuss a day trading strategy using Fibonacci retracement tool. William % R is used in this strategy.

A trading strategy should have both entry and exit signals. Entry conditions are different for a long position and short position. Here, we will discuss on entry signals both for a long position and a short position.

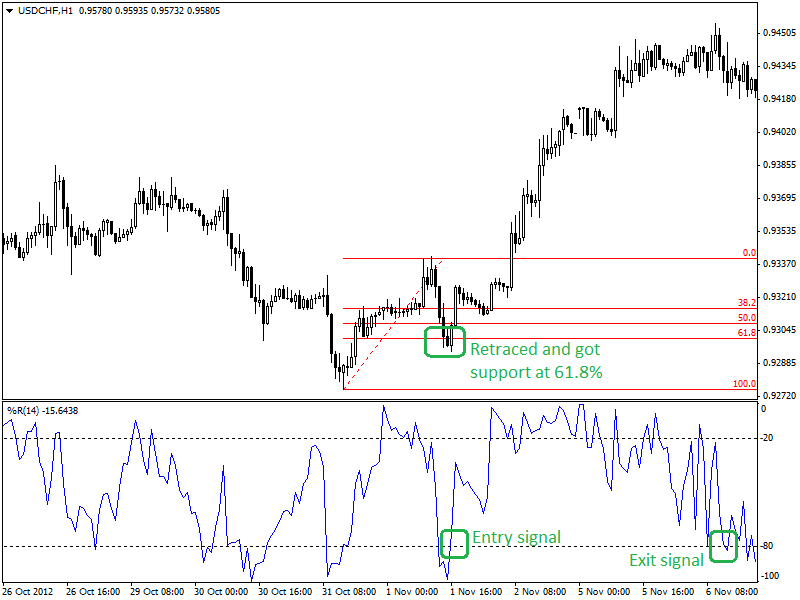

In the 1 hour chart of USD/CHF (given below), entry and exit signal for the long position has given. After a bullish movement, this pair has retraced up to 61.8% retracement level. This 61.8% level is a very important and strong support level. 61.8 is known as the “golden ratio” of Fibonacci. When the pair is at this retracement level after a bullish movement, we should look for an entry signal for the long position.

This entry signal can be detected by using an indicator. Indicators are very useful to generate buy and sell signals. In this strategy, Williams’ % R has taken to detect buy and sell signals. Williams’ % R is a leading indicator containing overbought (above -20) and oversold level (below -80). It is a buy signal when Williams’ % R crosses above -80 line. The entry signal is when a price is at Fibonacci retracement level (38.1%, 50%, 61.8%), and Williams’ % R generates a buy signal. Exit signal when Williams’ % R moved below the -80 line (oversold region). Here is the 1-hour chart of USD/CHF.

Entry and exit rules for the long position are given below.

Entry (for long position):

- The currency pair is at Fibonacci retracement level (38.2%, 50% or 61.8%) after a bullish movement.

- Williams’ % R crosses above -80 line from oversold region.

Exit (for long position):

- Williams’ % R moves into the oversold region after an entry signal has taken.

Stop Loss:

- A fixed stop can be placed at 40 pips below the entry price.

- Or, when pair moves back into the oversold region.

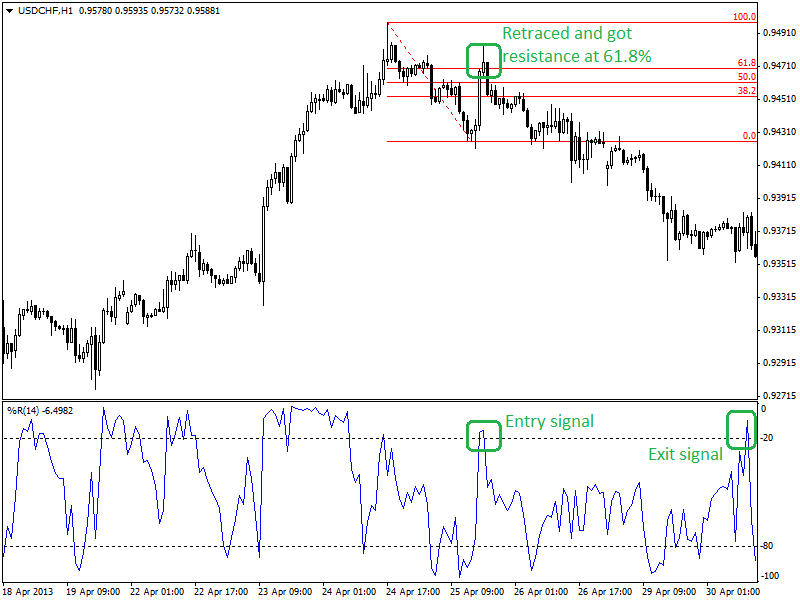

Entry and exit strategy in case of a short position is totally opposite to the long position. In the 1 hour chart of USD/CHF (given below), entry and exit strategy for a short position has described in details. This pair retraced to 61.8% level after a bearish trend. Here, 61.8% retracement level is working as a resistance for this pair, and thus, the pair has bounced back into its previous bearish trend. Williams’ % R has generated a sell signal when the pair has retraced to 61.8%. This sell signal has been generated when Williams’ % R has crossed below -20 line from the overbought region.

Entry and exit conditions are described below.

Entry (for short position):

- Price retraced to Fibonacci retracement level (38.2%, 50% or 61.8%) after a bearish trend.

- Williams’ % R crosses below -20 line from an overbought region.

Exit (for short position):

- Williams’ % R moves above -20 line after an entry.

Stop Loss:

- A fixed stop loss can be taken 40 pips above the entry price.

- Or, when Williams’ % R moves back in the overbought region after entry when in a loss.

Summary: Fibonacci retracement tool can be used in different ways in different trading strategies. Trend lines and other indicators such as RSI or stochastic indicator can be used with Fibonacci retracements. Fibonacci retracements tool is highly effective for trading pullbacks as most of the cases pullbacks occur near these retracement levels.