Here in this section, we will discuss a simple day trading strategy. This is a simple and effective trading strategy to start the day trading.

Indicators used: Bollinger bands (period = 20 and deviations = 2) and MACD (12, 26, 9) indicators used in this strategy.

Currency pairs: This strategy can be used in any currency pair. It is better to trading in the major currencies only.

Time frame: 15 minute

Trading session: A trader should choose the major sessions and overlapping sessions to use the liquidity to his/her advantage. Overlapping session of London and New York holds the highest liquidity.

Entry signal:

For long position entry conditions are,

- MACD histograms turn positive from negative.

- Candlesticks thrust or hit the upper band of Bollinger bands.

For short position entry conditions are,

- MACD histograms turn negative from positive.

- Candlesticks thrust or hit the lower Bollinger band.

Stop loss:

- 15 pips below the entry price (for long positions)

- 15 pips above the entry price (for short positions)

Exit strategy:

- 30 pips above the entry price (for long positions)

- 30 pips below the entry price (for short positions)

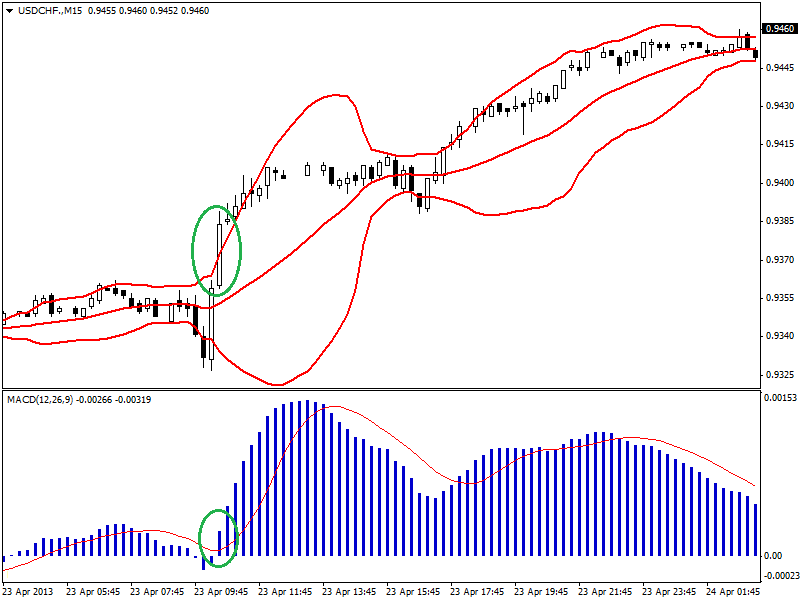

In the 15 minute chart of USD/CHF (given below), entry signal generated when MACD histogram turned positive from negative and at the same time a candlestick hits the upper Bollinger band. This is an ideal entry setup for long positions.

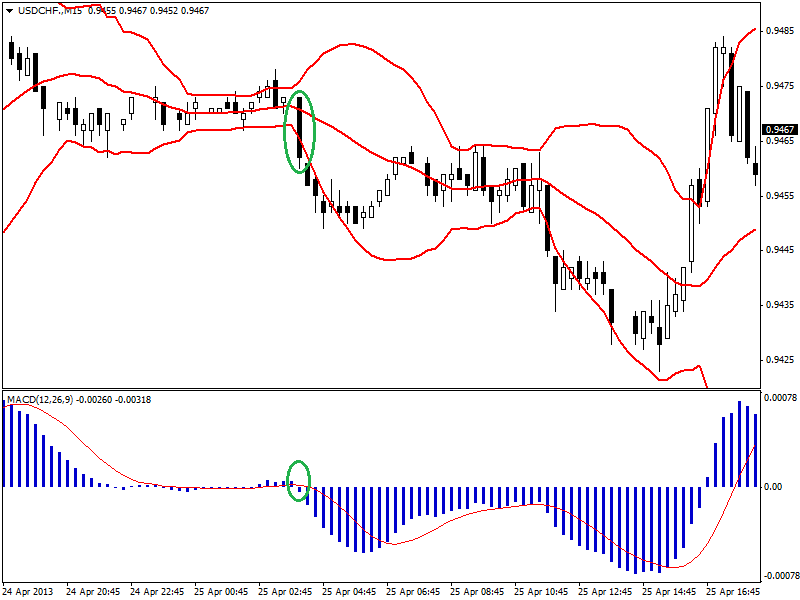

In the 15 minute chart of USD/CHF (given below), entry signal generated when MACD histogram has turned negative from positive and at the same time a candlestick hit the lower Bollinger band. This is an entry signal for a short position.