We have already learned about the formation of Reversal Patterns – Head and Shoulders Top and Bottom.

Now we will discuss on how we can trade these chart patterns.

These head and shoulders patterns can be traded in two ways; breakout and pullback. We already know that there is a neckline in every head and shoulders pattern. When price breaks this neckline, then it is a breakout and an entry signal.

Breakout trading is not suitable for every trader as during the time of breakout price always becomes very volatile and fluctuates a lot. So breakout trading requires higher risk tolerance and patience.

Pullback occurs after the breakout and most of the cases after a breakout price tends to test the broken neckline and then bounce back from this neckline. Here, the broken neckline is working as a support for the price. This pullback gives a better entry signal at a reasonable price as the price is not that much volatile as it was in a case of the breakout.

If you do not want to miss any of these two trading signals then you might take both signals, but you should take position partially. You should take half of your position size in the breakout, another half of your position in a pullback. Position sizing will help you to define how much money you will put into a position.

So you should check the conditions of trading this pattern before making a trade. These steps mentioned below including examples.

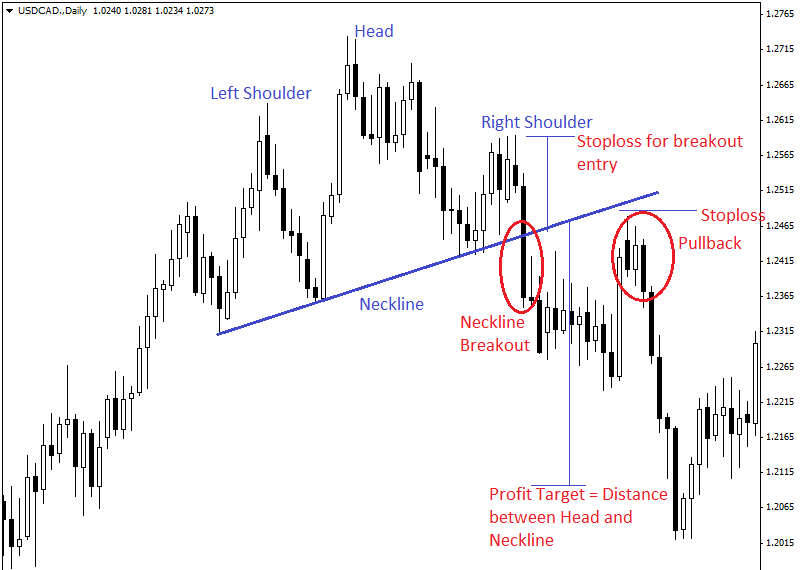

Head and Shoulders:

- Identify head and shoulders pattern. Patterns might not be exact and may vary a little from the ideal pattern.

- Place/draw a neckline.

- Do not jump into a trade before the pattern has formed or confirmed.

- When price breaks the neckline, take a short position (half of your position size).

- If the price comes near the broken neckline and bounce back or show weakness in candlestick then take another short position with the rest of your position size.

- For breakout entry, a stop loss can be placed at the peak of the right shoulder. For pullback entry, a stop loss can be placed at the swing high point or a current high point near the pullback zone.

- Take profit can be placed by placing the distance between head and neckline from the breakout point.

Here is an example.

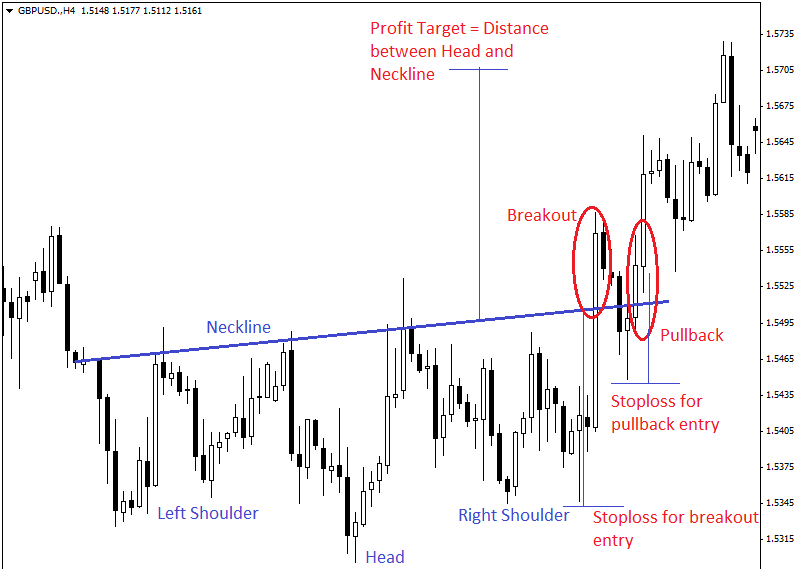

Inverse Head and Shoulders:

- Identify inverse head and shoulders pattern. Patterns might not be exact and may vary a little from the ideal pattern.

- Place/draw a neckline.

- Do not jump into a trade before the pattern has formed or confirmed.

- When price breaks the neckline, take a long position (half of your position size).

- If the price comes near the broken neckline and bounce back or show some strength in candlestick then take another long position with the rest of your position size.

- For breakout entry, stoploss can be placed at the bottom of the right shoulder. For pullback entry, a stoploss can be placed at the swing low point or the current low point near the pullback zone.

- Take profit can be placed by placing the distance between head and neckline from the breakout point.

Here is an example.