A good money management skill and trading psychology always also plays an important role to make you a successful trader with any of this strategy.

Following video presents a very easy strategy for beginners in Forex. He recommends that new traders stick to higher timeframe charts like the daily EUR/USD chart he used in his example.

I will go over the main elements of his strategy with using my own trade example on the Daily chart for the EUR/JPY currency pair.

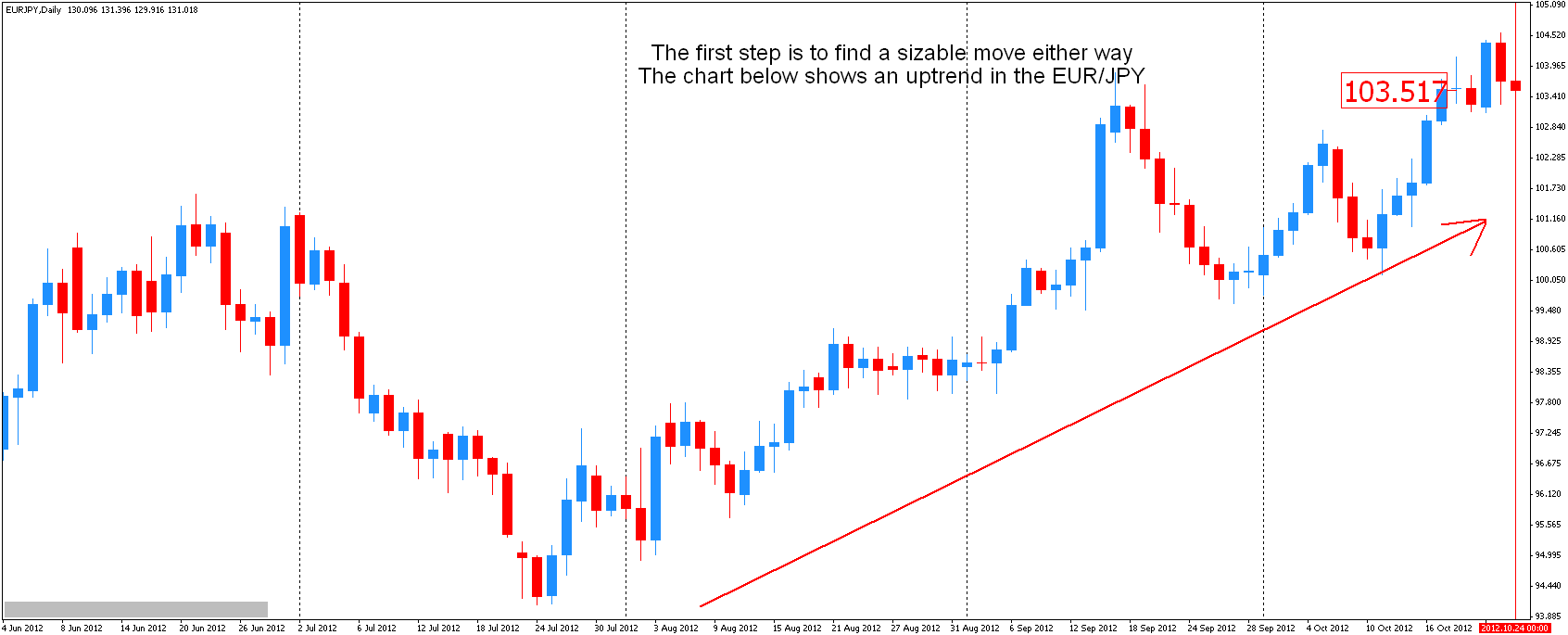

Step 1 – Looking for a sizeable move either way

The first step is to find a sizable move either way in a currency pair. The chart below shows an uptrend that has started in the EUR/JPY since August of 2012 and is still going on at the point we’re looking at the chart, October 24, 2012. The pair has gained over 1,000 pips so far.

Step 2 – Looking for the forming of a price channel

The next step is to look for price to get in a price channel. This step is needed in order for us to have predefined entry-level as well as a stop-loss level so we can limit our risk. We go forward in time until the price gets into a tradable channel.

By the middle of November price has made a nice pullback to the downside and started to move in a sideways range. The top of the range is at 104.58 and the bottom is at 99.62. Look at the chart below.

Step 3 – Looking for a breakout of the channel

We’re now looking for price to make a breakout at the top of the range. We go forward in time some more…On November 20th, the EUR/JPY currency pair finally makes a break above the 104.58 level. We initiate our long position here as shown on the chart below

After we initiate our entry, the next thing we have to attend to is our risk. Where do we put our stop loss? The stop should go on the opposite side of the channel.

In our case, the stop loss would be just below the low range of the channel we marked earlier, at 99.62. Our risk on the trade is 496 Pips.

Step 4 – Trade Management

The next step is probably the most important one, as the exit is where we make or lose money and not the entry. Sadly while the strategy is the video has been solid thus far, it lacks in this area.

The exit presented is very subjective and probably based on hindsight. It is always easy to pick a perfect exit when you’re looking at the left side of the chart.

The exit basically comes down to trailing the stoploss below important swing points that the price makes. Now don’t get me wrong, this is not bad advice at all. But it is subjective and so not really helpful to new traders who lack the experience needed to make the judgment call on what is an important swing point.

The chart below shows my exit on the EUR/JPY trade using the swing point trailing stop method.The red lines that move up with the price represent where the stop would be trailed as the EUR/JPY continued its rise upward.

We tighten our stop loss below each important swing point until we’re finally stopped out on the 21st of February 2013 when price broke below the previous swing point at 122.88. The total pips “gained” in this trade + 1830 Pips.