Forex traders can face confusion, conflicting messages, and false signals when they rely on too many indicators. If you hold out for too many confirmations, you may obtain your information too late and miss out on an opportunity to enter a trade at a good price. Looking for that ideal metric that perfectly indicates your progress could cause you to get fatigued and pessimistic. If such is the case, you should consider stepping back and changing your trading method.

Tips for trading without indicators

Price action trading

With this approach, the objective is to determine how the price behaves relative to the resistance and support levels you’ve placed. Knowing when prices have peaked or bottomed out is one benefit of this strategy. Trades in price action are based on candlestick patterns, which are interpreted differently depending on their shape and patterns.

With price action as your strategy, you will majorly be keen of signs of price rejection or trend reversal

Approach 1: Price rejection

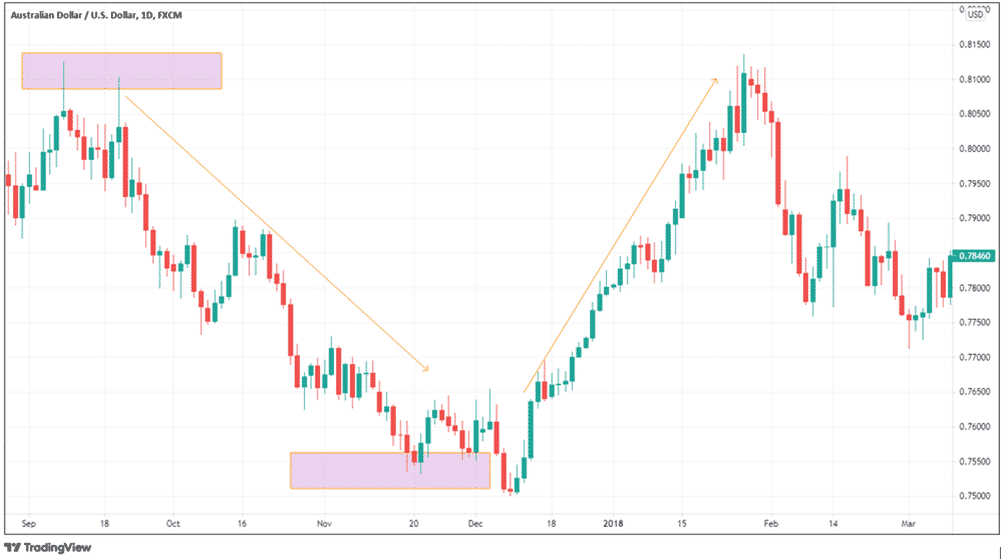

Price action trading can also include looking for signs of price rejection. This is usually a signal that the market has had enough of the current uptrend or downtrend. Therefore, if it is a bullish trend, the price will start reversing from a particular resistance level. If it is a downtrend, the price action will start reversing from a particular low price. Below are the key pointers of a price rejection:

- When the price starts touching critical support or resistance level

- When the candlesticks begin having long tails

- When the market momentum reduces, as indicated by reduced trading volume

- When the price reverses to an opposite trend direction

The AUDUSD chart below shows the price action that follows the long candlestick tail, indicating a failed attempt to sustain the breakout.

Approach 2: Trend reversal

If the higher highs and higher lows transform into lower lows and lower highs, or vice versa, this is a dependable signal of an imminent reversal in price. It heralds an impending end to the present trend and brings in a new trend. Often, trend reversals have transition zones in form of ranges/sideways market action.

On the chart below, the EURUSD price action transitions from a downtrend (red arrow) followed by a range (highlighted section) and an uptrend (green arrow). Going long at the point marked in orange arrow would set you on the path to making a profit.

Pros and cons of price action trading

Pros

By focusing on price movement as the key determinant of decision making in a trading setup, a trader has a clearer view of the market and can make decisions quicker. To this extent, price action trading is a better strategy than employing many indicators, which can be a distraction and cause indecisiveness.

Cons

Trading on price action alone leaves a lot of room for emotion-based decision making. In addition, there is a likelihood of the strategy having a wide margin of error since without indicators, one cannot have a holistic view of the market

Pending orders

In order to place a forex order, one of two options is available:

- Market orders take what the market throws at them, meaning that they buy or sell at the current market price.

Using pending orders can, therefore, be an effective way to trade your assets at a price you deem suitable. As a result, they aid in the reduction of risk and are frequently used as a safety net against poor decision-making.

Below are the commonly used options with pending orders:

- Buy stop: An order to buy an asset at any price available once a price that is higher than the current one is reached.

- Buy limit: A pending order to buy an asset at or below the specified price below the current market price once the market reaches it.

- Sell stop: A pending order to sell an asset at any price available once the market reaches the specified price below the current market price.

To execute this strategy, traders place their sell limit at a resistance level beyond which they believe the price rally won’t go.

For example, on the daily EURUSD chart below, the price begins to fall at the Sell Stop following the formation of the long wick on the candlestick.

- Sell limit: A pending order to sell an asset at or above the specified price above the current market price once the market reaches it.

Pending orders can also include modifications of stop loss and take profit.

- Stop loss: Specifies the maximum amount of money that can be lost on a position. Upon exceeding the loss limit, the order will be instantly closed.

- Take profit: This order helps traders define a level of profit they would be willing to take. It helps them lock in their profit, thus cushioning them from potential market reversals. The order is executed and closed immediately once the profit target is reached.

Pros and cons of using pending orders

Pros

- Pending orders ensure that you only buy or sell at a price that you deem appropriate.

- They protect from losses or minimize traders’ losses.

- With a pending order, there is no commitment until it is executed. You may therefore opt to cancel the trade and set an expiry date.

Cons

- They may take too long to execute, which is a disadvantage if you want quick cash.

- By the time they get executed, they may no longer give you an advantage.

Trading with market psychology

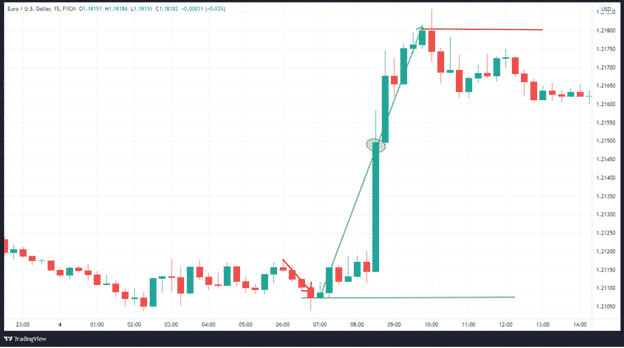

When trading based on reading market psychology, it means that you have to read the market sentiment regarding a particular significant development that affects market fundamentals. Usually, such news is preceded by analysts’ projections, and the traded asset will swing depending on whether the data released meets, beats or is below analysts’ projections.

For example, we see the reaction of EURUSD a few minutes before and after the release of US nonfarm payroll data on June 4th, 2021. We can see the euro strengthening against the USD as a result of the data falling below analysts’ consensus. In this instance, about 550K jobs were created against a projection of 650k jobs.

Going long on the EURUSD pair at the point market by the green line would result in quick profits up to the point market by the red line.

Pros and cons of trading based on market psychology

Pros

- Traders often have analysts’ consensus estimates to guide them in their decision making.

- Traders can evaluate the likely market reaction based on discussions held by other traders and investors on social media and mainstream media.

Cons

- Analysts often miss the mark with their projections, meaning that relying on their data to trade can lead to losses.

- Trading on market psychology only presents a few trading opportunities. This is because not every news item in the market can trigger a shift in price action.

- In the few minutes leading to the release of major economic data, markets can be choppy and difficult to trade in. Often, many traders stay away from the market during this time until after the news release.

In summary

When you decide to exclude indicators from your trading, it means that you will strictly be using your knowledge of market fundamentals and clean charts showing nothing but the price action. With the right understanding of the market, this approach to trading can help you avoid the inconsistencies and confusion associated with using many indicators.

However, trading without indicators has a significantly higher risk of emotional trading. This can lead to trading in a non-objective way, thus potentially increasing losses.