Fundamental analysis and technical analysis are two different methods of analysis. There is a major controversy between these two analytical methods. Some think the fundamental analysis more effective than technical analysis.

On the other hand, some traders think technical analysis is more effective than fundamental analysis. The debate between technical and fundamental analysis is incomplete as it depends on traders or investors choice.

Difference between Fundamental and Technical Analysis:

There are many differences between technical and fundamental analysis. We will discuss some of the major differences here. These major differences are given below.

Definition:

By definition, fundamental analysis is a method of analysis which measures the value of the currency of a country using economic factors or fundamentals. On the other hand, technical analysis gauges the future possible price movements analyzing the price movements and patterns.

Data sources:

Economic reports and press releases are the required data for fundamental analysis. On the other hand, charts are data sources for technical analysis.

Function:

Fundamental analysis is very useful for long-term investment while technical analysis is very popular for short-term trading.

Entry decisions:

Investors use fundamental analysis to take investing decisions based on future value of the currency due to the economic changes. Traders, who use technical analysis to take trading decisions, sell higher than his bought price.

Time frame:

Investors enter into a pair for long term (more than a year), while technical analysts hold a pair for short-term (not more than 90 days).

Concepts used:

Fundamental analysts focus on the gross domestic product (GDP), retail sales, consumer price index (CPI), industrial production etc. Technical analysts focus on trends, support-resistance, chart patterns etc.

Which one should you use?

Now the question is which one should you follow, fundamental analysis or technical analysis. Both fundamental and technical analysis are effective for forex trading. It depends on you and your personality that which type of analysis is suitable for you.

If you are a long term investor then you should focus on the fundamental aspects and if you are a short term trader then technical analysis will fit with you.

Both of these two methods of analysis have advantages and disadvantages, but these two methods can be combined to get better results in forex trading. Every move of the market can be explained by both fundamental and technical analysis.

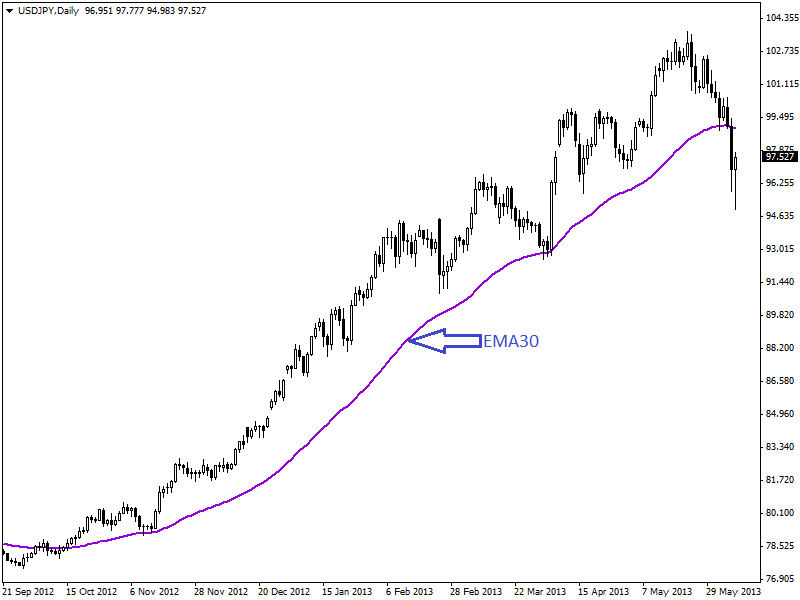

For example, USD/JPY rally of 2012-13 can be explained by both technical and fundamental analysis. Monetary easing were two major reasons for the rise of USD/JPY as JPY got weaker for last one year. This major economic impact leads USD/JPY to a strong bullish trend as per technical analysis.

Upward EMA30 showing the long-term bullish trend in the daily chart of USD/JPY (given below).

Fundamental analysis can help us to predict the direction of the major price movements. Then, we can confirm the major movement by technical analysis using trend lines, moving averages, breakouts and can also detect buy and sell signals.

So, a trader can use fundamental analysis, technical analysis or both in a combination in forex trading. But one should use the method of analysis based on his personality, trading style, and expectations.