Volume is always foremost in the case of financial trading or investing approach. The volume gives us idea about various things such as traders’ activity, volatility, buying or selling pressure etc. It is always better to trade when a large number of trading activity is happening.

In the case of trading, it is extremely important to consider the volume while trading or taking trading decisions. No one wants to trade in a slow market producing low volumes. Thus, we should keep searching highly active market session that is producing a large amount of volume to make some quick large profits.

Simply, the larger amount of volume, the higher the volatility and the quicker the profit would be produced.

Forex Volume and Equity Volume:

Forex volume is different from equity volume. In equities, each traded share is considered as one volume. But it is not possible to measure the total volume of a forex market or any currency pair as it is a decentralized market.

Forex volume is measured as the number of ticks or price change in a given period. This information can give you an idea about volatility and buying or selling pressure.

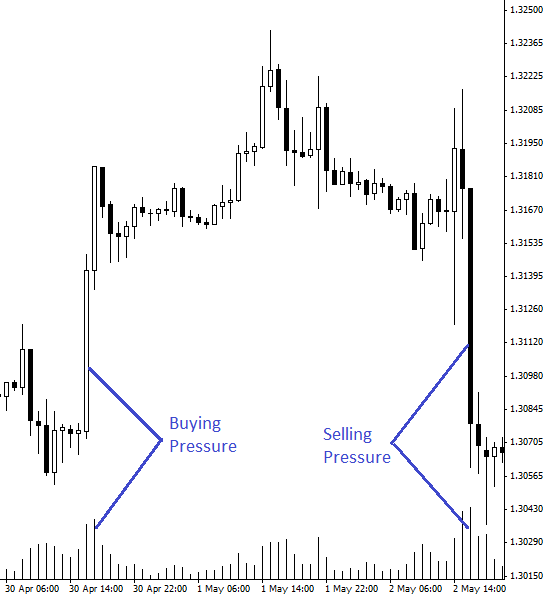

Buying Pressure or Selling Pressure:

Volume can tell us that, is it a buying pressure of a selling pressure. High volume means high volatility or higher trading activities, but you never know who is dominating, buyers or sellers?

To understand the buying or selling pressure you have to combine volume and price action together. If price increases with high volume, then it is definitely due to a buying pressure, and buyers are in control. Inversely, if the price decreases with high volume, then it indicates selling pressure when sellers are in control.

1-hour chart of EUR/USD (given above) is showing buying and selling pressure. Increasing price with high volume has considered as buying pressure and decreasing price with high volume has considered as selling pressure.

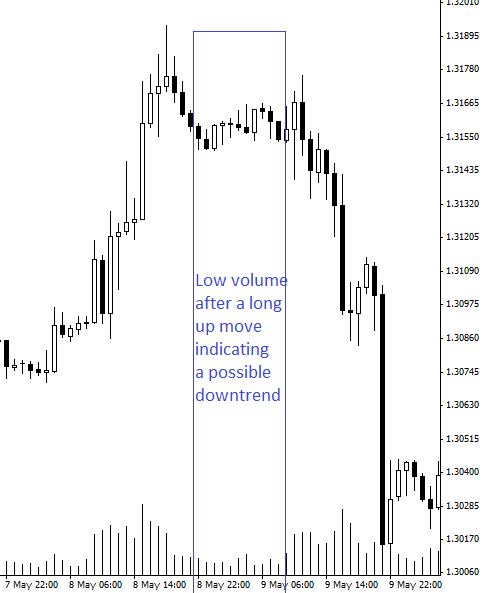

Volume Precedes Price:

Volume often works as a leading indicator which can identify possible reversals. Decreasing volume after a prolonged uptrend indicates a weakness in an uptrend and possible bearish trend reversal. This is also known as a distribution which means that the smart money or large investors are selling this pair.

This selling may lead the pair into a new downtrend. In this situation traders generally take short positions. Here is an example of the distribution phase in a 1-hour chart of EUR/USD (given below).

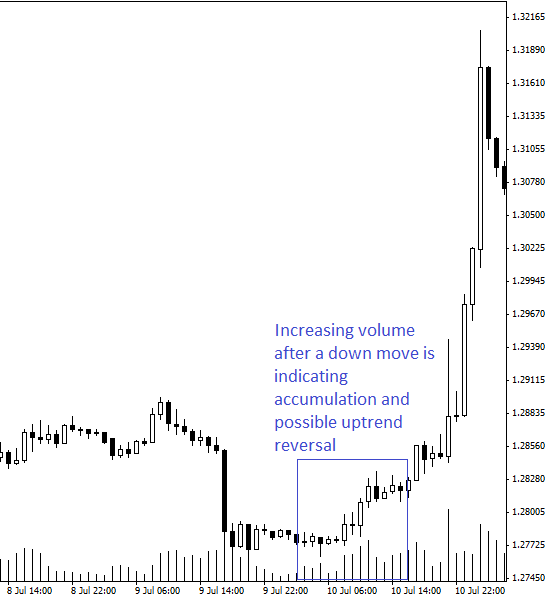

Increasing volumes in a ranging or a flat trend market after a downfall is known as accumulation. This accumulation indicates that buyers are now interested in buying after a downfall. This buying pressure indicates a possible uptrend or bullish trend reversal. Traders take long positions when they find accumulation phase in a currency pair.

Here is an example of an accumulation period in a 1-hour chart of EUR/USD (given below).

Summary:

As forex volume is different from equities, traders may find it difficult to use forex volume effectively in trading.

However, accumulation and distribution is tremendously popular and effective way to use volume in both forex and equity market. Volume is also useful for further confirmation after getting entry or exit signals.