In forex trading, there are two types of analyses on which traders lean to find profitable entry and exit trading points. On the one hand, fundamental analysis focuses on economic data that may influence the price of a currency. Particularly, this analysis identifies the driving force behind the direction of price. On the other hand, technical analysis entails using best forex indicators to identify the direction of the price of an asset.

However, there are different types of indicators, each with a specific function. For example, the momentum indicators tell the trader when an asset is in an oversold or overbought position. With such information, the trader can easily anticipate an impending trend. The relative strength indicator (RSI) is a good example of this group of indicators. Also, there are indicators that depict the volume price movements for a particular asset. The Money Flow Index is a good example of a volume indicator.

Thirdly, there are volatility indicators that identify dramatic changes in price movements and volume of the movements. Lastly, there are indicators that identify the trend of price movements of forex products. A good example of trend indicators is the Parabolic SAR, which is the subject of this article.

Explaining the Parabolic SAR

This is one of the best forex indicators for automated trading. In the first place, the indicator determines the direction of the price movement of a currency pair. This means the indicator facilitates the identification of bullish and bearish trends. In the second place, the Parabolic SAR indicator enables a trader to anticipate reversal of the trend of a currency pair. As a result, traders also know the indicator as a Stop And Reverse (SAR) system.

Nonetheless, such an indicator is only useful in markets that show a distinguishable trend. Since the indicator reacts to trend reversals, it is ideal for establishing the direction of a trend. In addition, the indicator is helpful in terms of identifying potential entry and exit point of a trade. However, the indicator is incapable of determining the strength of a trend. Therefore, it is advisable to use complimentary indicators (like the RSI) to measure the trend’s strength.

On the chart, the indicator appears as a dot. It is one of the easiest forex charting tools to follow. The Parabolic SAR indicator behaves differently during a downtrend and an uptrend. During a downtrend, the SAR appears above the price bars. As such, the indicator is ideal for showing the trader where a trailing stop in a downtrend should be. On the contrary, the SAR appears below the price bars in an uptrend. Similarly, the SAR is a good indicator of where the trailing stop loss should be in an uptrend.

Using the Parabolic SAR

Clearly, the Parabolic SAR is ideal for automated forex trading. This is because it helps to identify potential trading points automatically. Also, forex expert advisors can use the indicator to provide signals with ease.

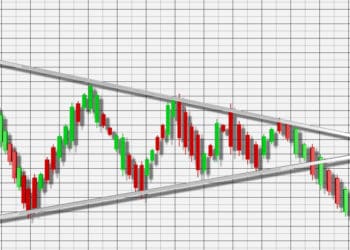

Looking at the chart below, the trend of the SAR changes immediately; the dot touches the price bar. On the green line (signifying the uptrend), the dots progress until the last one touches the red candle. Immediately, the trend reverses into a downtrend. Here, you can enter a new position the moment the dot touches the candlestick. If the dot is on the lower side of the candlestick, it means you can sell. If the dot is on the upper side of the price bar, you can buy.

As you can see, the Parabolic SAR itself appears as a perfect stop loss and target profit marker. In an uptrend, the dots align themselves on the lower side. Apparently, the stop loss trails the trend as far as it goes; hence, the Parabolic SAR acts as a perfect trailing stop loss. Therefore, the indicator prevents you from pulling the trigger too early such that you can squeeze as many pips as possible during a trade.

On the other hand, the Parabolic SAR is a good indicator for the trailing profit level. Usually, human traders are overcome by fear of losing profits or too much excitement, which may lead to an early exit. As a result, the trader may fail to earn optimum profits. The Parabolic SAR, therefore, indicates where the ideal trailing profit level should be for optimum profits. Therefore, you should not exit the trade position as long as the Parabolic SAR dot has not touched the price bar for optimum profits.

What happens when the Parabolic SAR gives wrong signals?

To be sure, the Parabolic SAR indicator identifies the trend, which makes it unreliable in a market that moves sideways. Usually, the indicator shows a long-term trend, which makes it not good for short-term traders. However, you can get around this demerit by complimenting indicator with other indicators.

For example, you can use the Parabolic SAR alongside the 5-period and the 10-period Moving Average indicators. These two are the best forex indicators that identify a trend as well as the trend reversal point. In the screenshot below, you will notice that the 5-period (yellow line) and 10-period (green line) MAs cross before a new trend sets in. Therefore, the indicators help the trader to take caution when the Parabolic SAR is giving false signals.