We should know about momentum strategy first. A momentum strategy is a strategy by which a trader trades in the direction of the major trend of the market or currency pair. Momentum strategy often called Trend Following Strategy.

In the case of momentum traders, they tend to take long positions when the market is in the uptrend, and they tend to take short positions when the market is in the downtrend. Momentum traders may hold a position for short term or mid term or long term, depending on the condition of a trend.

Model Trading Strategy:

There are many momentum strategies also many indicators are useful for momentum trading strategy. Here, we will learn about two momentum trading strategies. In this strategy, we will use two moving averages and William’s % R indicator. Moving averages are very useful to understand and identify trend direction. William’s % R is useful to identify trading opportunities.

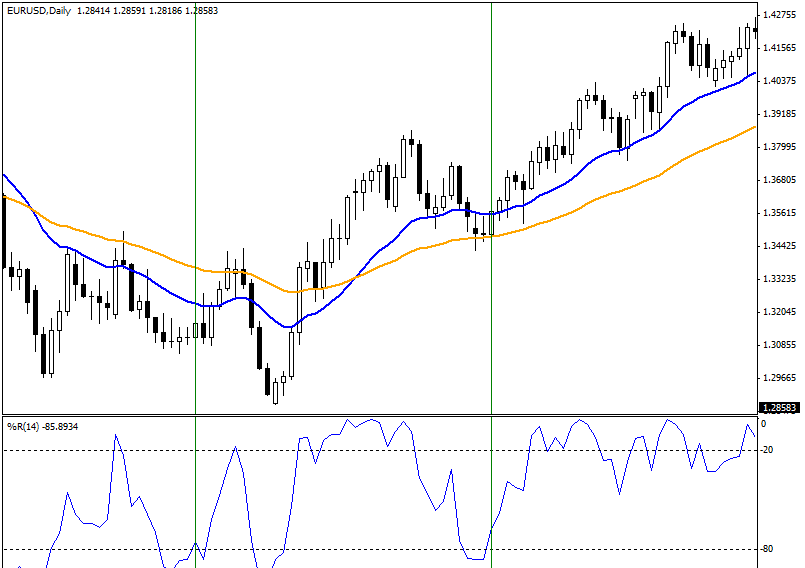

The chart above showing the daily chart of EUR/USD. Here, the blue colored line is EMA20 and the orange colored line is EMA50. We have already learned to identify trend direction and reversals by using moving averages. When EMA20 is above EMA50 and EMA50 heading to upward then the trend is an uptrend. Inversely, if EMA20 is below EMA50 then the trend is a downtrend. There should be a significant gap between two moving averages which signals that the prevailing trend is strong enough.

So, when we will get confirmation of the trend, then we will focus on finding trading opportunities. In this case, William’s % R is important. William’s % R to enter into oversold (below the -80) region in an uptrend is a buy signal. In this situation, when William’s % R moves above oversold region then it is an entry signal for a long position. Inversely we will look for William’s % R moving below overbought region or -20 when the stock is in a downtrend; this is an entry condition for taking short positions.

In the chart above we can see two green colored vertical lines. The first one was not a proper buy signal as the major trend was in downtrend, as per moving averages. We should avoid buy signals in downtrend and sell signals in uptrend. The second one was a proper buy signal as the major trend was in uptrend.