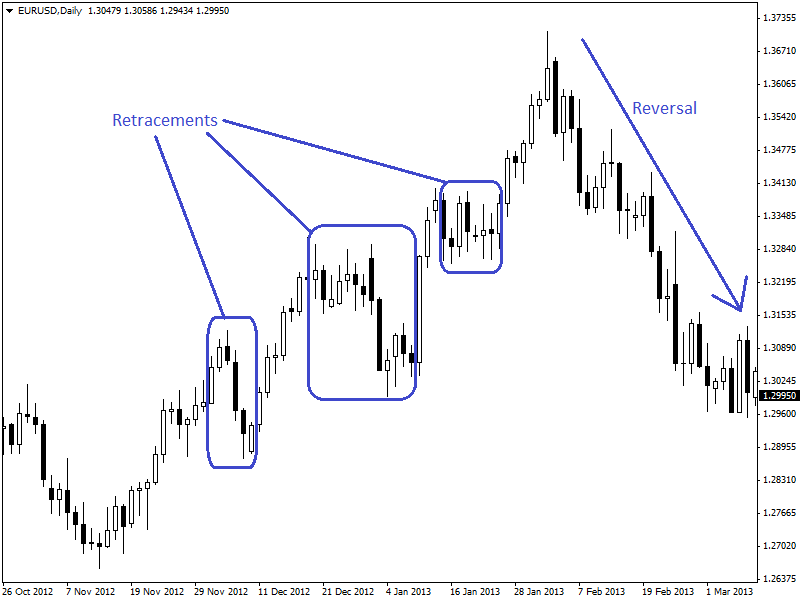

In a major trend, a pair tends to retrace and bounce back. Sometimes these retracements turn into reversals. Retracements are just a small and temporary reversal in a prolonged trend.

In many cases, traders get confused about retracement and reversal in a major trend.

There are many significant differences between retracements and reversals. Once a trader knows these differences then he/she will be able to judge it is reversal or retracement.

Retracements and Reversals:

In the major trends, there might be some short and temporary reversals. These reversals are known as retracements. These retracements can be measured by Fibonacci retracements levels. These retracements are just a short opposite movement to the major trend which is not a trend reversal.

Trend reversal occurs when the major trend is not valid and reversed to the opposite direction. Here is an example of retracements and reversals in a prior uptrend.

Retracements and reversals have shown in the daily chart of EUR/USD (given above).

There are some differences between the formation of retracements and reversals. These are very effective to know whether it is retracement or reversal. These differences are described below,

Chart Patterns:

Retracements and reversals contain different chart patterns. Retracements form continuation chart patterns like flags and pennants. On the other hand, reversals form reversal chart patterns like head and shoulders, double top and double bottom.

Time Frame:

Retracements take a small time to form. It takes less than two weeks in the daily chart. On the other hand, reversals take much time than retracements. Reversals take more than two weeks to occur in the daily chart.

Recent Price Movement:

Retracements generally occur after a rapid and large price hikes. On the other hand, reversals can be found after a rapid price hike or after a ranging condition. Most of the cases, reversals occur after a ranging condition.

Candlesticks:

During retracements, candlesticks are mostly neutral in nature. These neutral candlesticks are doji, spinning tops and bottoms etc. On the other hand, reversals include stronger candlestick patterns like engulfing, soldiers etc.

Determining Scope of Retracement:

The scope of retracement can be determined after identifying retracements. This scope of retracement can be determined by using trend lines, Fibonacci retracements, moving averages etc.

Trend Lines:

Trend lines are very useful to determine the scope of retracements. Trend line also works as a support and resistance for the retracement and thus pullbacks occur from trend lines. In an uptrend, trend line works as a support level. Inversely, trend line works as a resistance level in a downtrend. Here is an example in the daily chart of USD/JPY.

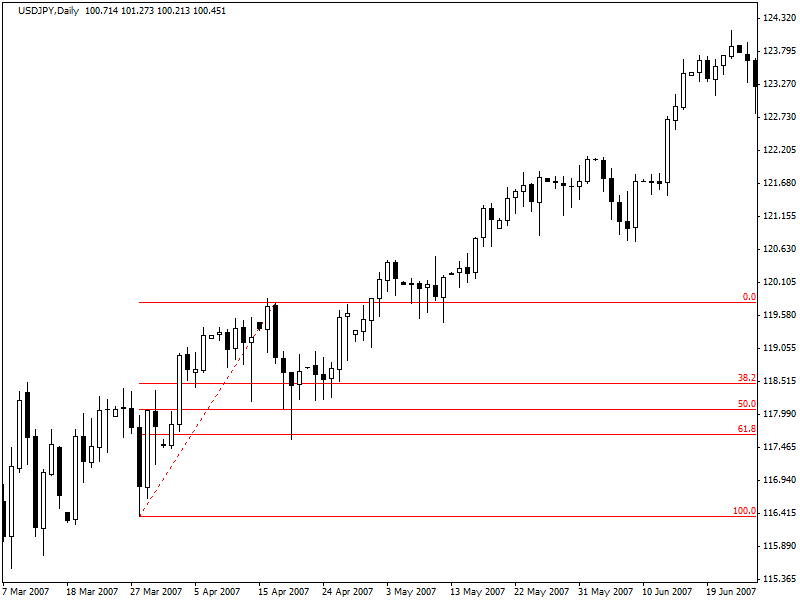

Fibonacci Retracements:

Fibonacci retracement levels are very useful to determine the scope of retracement in the forex market. Most of the cases retracements occur up to 38.2% to 50%. In many cases, retracements may also occur up to 61.8% level. If these levels fail to hold the retracement, then this is an indication of a trend reversal.

Here is an example in the daily chart of USD/JPY.

In the chart, (given above) we can see that USD/JPY retraced up to 61.8% Fibonacci retracement level and then bounced back in its previous trend.

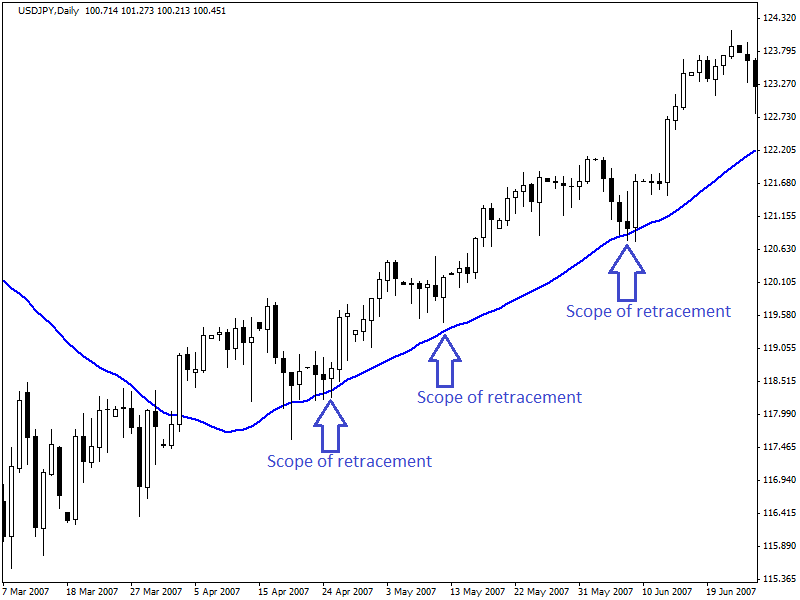

Moving Averages:

Moving averages can also measure the scope of retracement. Moving averages works as dynamic support and resistance. Most of the cases, retracements occur up to the dynamic support or resistance of moving averages.

In an uptrend, moving averages work as dynamic support and work as dynamic resistance in a downtrend. Here is an example.

Minimizing Risk:

Technical analysis is not an exact science, and there is no Holy Grail strategy or indicator in trading. Thus, a retracement can become a reversal without giving a significant sign of reversal. In this situation, you might get a losing trade.

You can not avoid losses totally, but you can minimize the risk or loss. To minimize the risk, a trader should have a stop loss strategy. This stop loss can be determined in various ways. Such as,

- Determine the scope of retracement by Fibonacci retracement levels and place stop loss below these retracement levels.

- Place a stop loss below the long term support/resistance or trend line.

- Or, you can use a fixed stop loss, such as 40 pips below/above the entry price.

Summary:

Differences between retracements and reversals are very important in trading. A trader might miss trading opportunities, trade false signals and hold losing position without knowing these differences between retracements and reversals.

Proper use of drawing tools (Fibonacci retracements, trend lines, support resistances etc) will help a lot to overcome these problems.