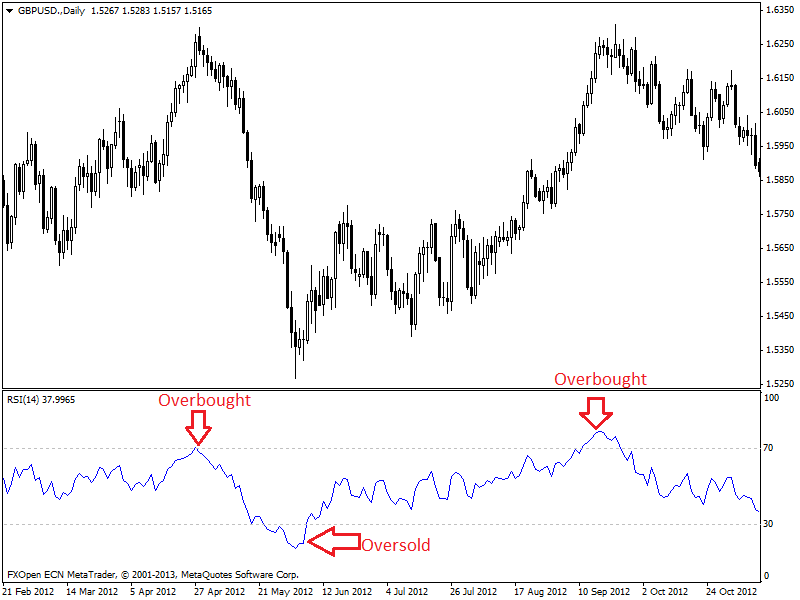

RSI (Relative Strength Index) is an extremely popular and widely used leading or momentum indicator developed by J. Welles Wilder. RSI gauges the speed and change of price movements.

Like most of the leading indicators, RSI has a range. It’s an Oscillator. This means it ranges between 0 to 100 levels. Due to this, the value of RSI can not be lower than 0 and can not be higher than 100. Traders use 3 psychological levels of RSI to take trading decisions. These levels are 30, 50 and 70.

The basic rule to use RSI is identifying overbought and oversold situations. When RSI value is below 30 then it is oversold, and when RSI value reaches above 70 then it is the overbought situation. RSI can also detect trend and divergences.

RSI Calculation :

To calculate RSI, we need to find out the value of RS first.

RS = Average of X day’s up closes/Average of X day’s down closes

Now,

RSI = 100 – 100/ (1+RS)

Default and widely used parameters of RSI are 14. However, many traders use 7 and 28 periods.

Now let’s take a look at RSI indicator,

In the daily chart of GBP/USD given above, we can see the oversold signal when RSI<30 and overbought signals when RSI>70.