There are several trading signals of RSI which can offer buy and sell signals. These signals are

- Overbought/oversold

- Centerline crossover

- Divergences

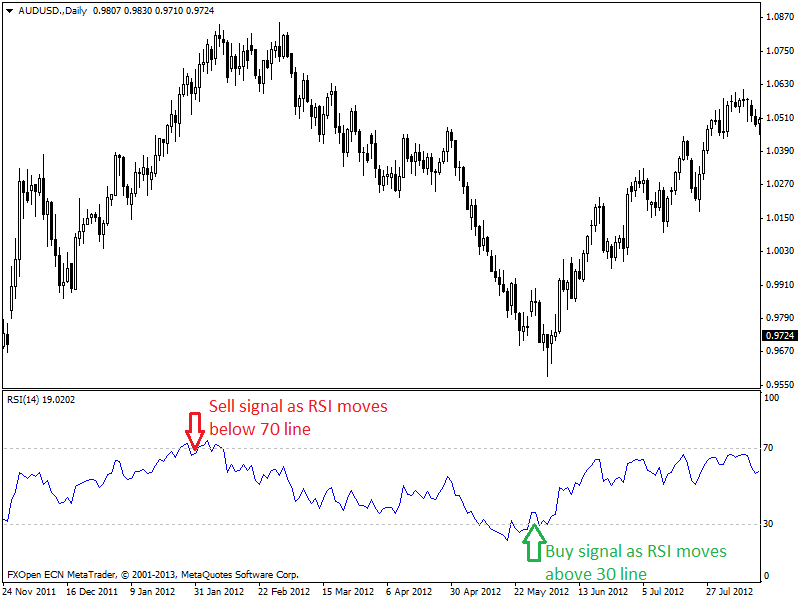

Overbought/Oversold:

This is the basic signal of RSI indicator. Many other leading/momentum indicators also have overbought and oversold signals. This overbought and oversold situation arise due to the presence of a range in the indicator. Different traders behave differently with these signals.

Aggressive traders take a long position as soon as RSI enters into the oversold area (below 30) and take a short position when the RSI enters into the overbought region (above 70). Defensive traders like to enter into a long position when RSI crosses above 30 line.

Inversely, they enter into a short position when the RSI crosses 70 line from above. This strategy gives better trading opportunities with less false signals than the aggressive entry. Here is an example of this strategy given below,

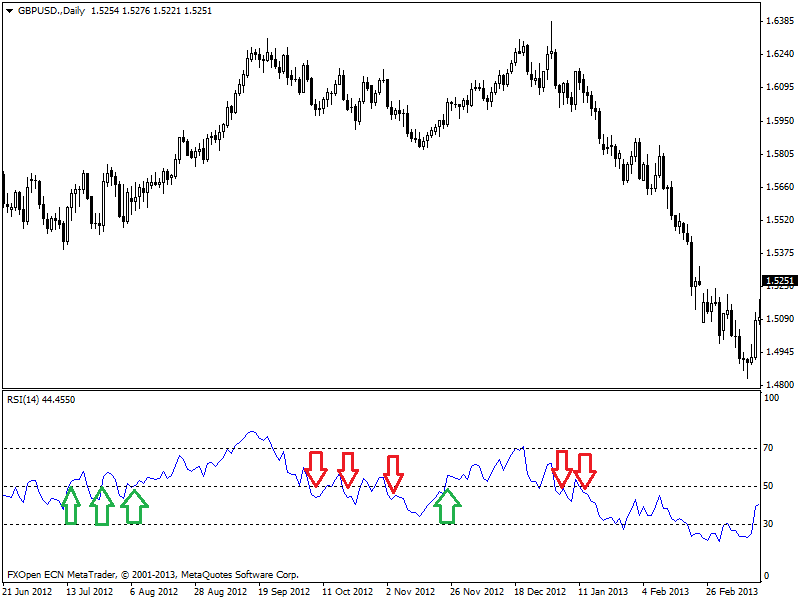

Centerline crossover:

RSI can detect prevailing trend direction by its centerline crossover. This centerline of RSI is at 50. When RSI is above centerline or 50 line, then the trend is in the uptrend. Inversely, when RSI is below this centerline then the trend is a downtrend. Therefore, trend reversals occur when RSI crosses above and below this centerline.

If RSI crosses the centerline from below then, the trend has reversed into uptrend from the downtrend. Inversely, when RSI crosses the centerline from above, then the trend has reversed into a downtrend from the uptrend.

Here is an example chart ( a daily chart of GBP/USD) showing buy and sell signals.

In the chart above, green colored up arrows are buy signals. A buy signal takes place whenever RSI crossed above centerline 50. Red colored down arrows are sell signals. A sell signal takes place whenever RSI crossed below centerline 50.

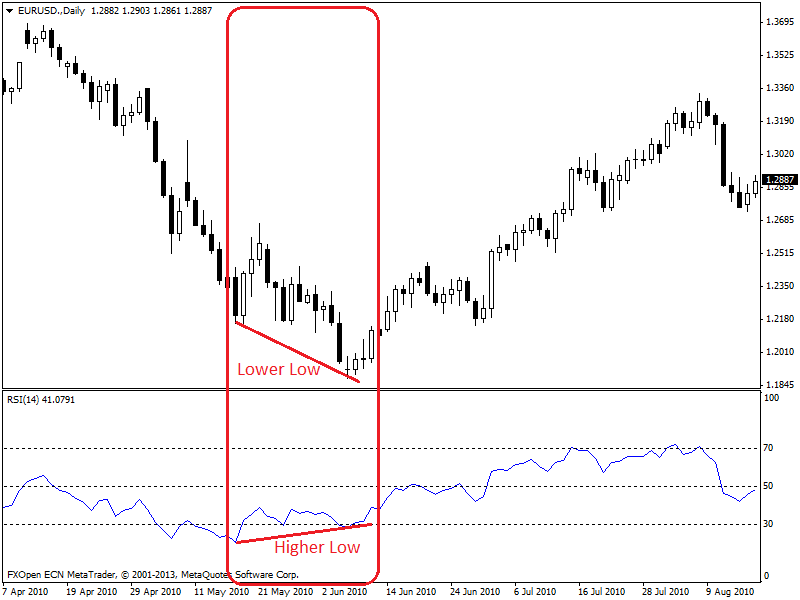

Divergences:

Divergence occurs when the indicator moves against the price action at the same period. This means the price is moving in an upward direction, but the indicator is moving in the downward direction at the same time. Divergences can be found in momentum indicators or oscillators only. Because these indicators have a specified range and these indicators cannot break this limit.

Thus, when the indicator is in its extreme value due to the price fluctuations, then it starts to reverse the direction while the price is still moving in the previous direction. There are different types of divergences.

Here, we will discuss regular divergence as it is capable of identifying profitable trend reversals. Regular divergence can be bullish or bearish.

Bullish regular divergence occurs when after a long downtrend price creates Lower Low ( the current low point is lower than the previous low point) but at the same time indicator creates Higher Low ( the current low point is higher than the previous one).

This is a sign of trend reversal from downtrend to an uptrend. Therefore, we can identify uptrend reversals and can detect entry opportunities for long positions. An example of bullish regular divergence of RSI has given below,

In the chart of daily EUR/USD (given above), we can see a bullish divergence after a prolonged downtrend which leads the price to uptrend reversal.

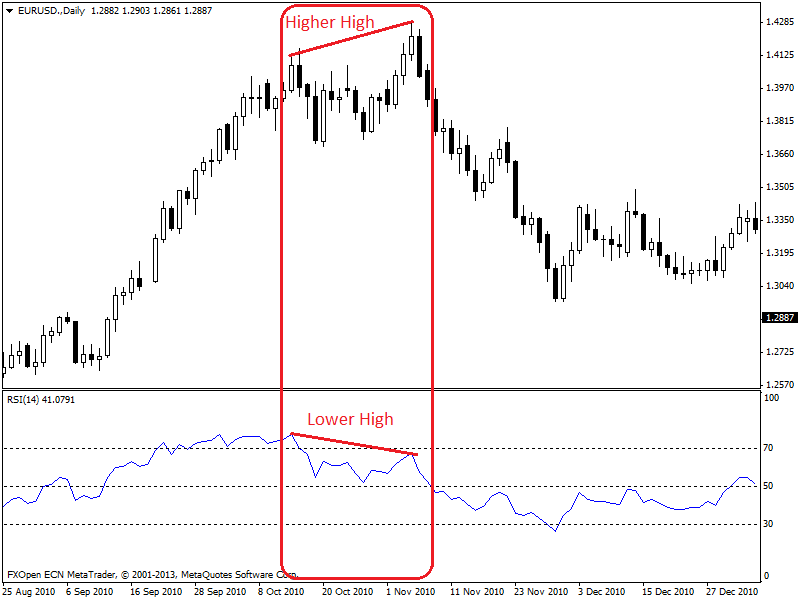

Bearish regular divergence occurs when after a long uptrend price creates Higher High ( the current high point is greater than a previous high point) but at the same time indicator creates Lower High ( the current high point is lower than the previous one).

This is a sign of trend reversal from uptrend to downtrend. Therefore, we can identify downtrend reversals and can detect entry opportunities for short positions. An example of bearish regular divergence of RSI has given below,

In the chart of daily EUR/USD (given above), we can see a bearish divergence after a prolonged uptrend which leads the price to downtrend reversal.