Do you know what the financial assets most used by traders have in common? The correct answer is volume.

If I told you that volume is an essential thing in trading, would you believe me?

When traders analyze different markets, they are guided by technical and fundamental analysis. But, are you able to read a chart using only indicators or news?

For many retail traders, the answer is no because indicators are based on time and not money.

Not taking volume into account before entering the market can be a mistake, especially on high volatility days, making it more challenging to analyze the asset.

We will compare three different volume-based indicators: On Balance Volume, the Money Flow Index, and the Accumulation/Distribution. Then, we will show you a practical and straightforward way to incorporate them into your repertoire so you can start paying attention to volume.

On balance volume (OBV). How does it work?

To understand this powerful indicator, let’s look at an example in the graph:

Notice how the second candle selected with an arrow closes below the previous candle. In this case, the indicator takes the volume of the last candle and subtracts it from the previous one, resulting in the OBV slope going down.

Advantages of OBV

If you combine it with other indicators, it will give you more precision in your purchases and sales in the market.

Disadvantages of the OBV

If you look at it on large time frames, you will not find a good entry point because the indicator analyzes the closing of the candlesticks. Therefore, it will move slower.

How to use the OBV in your trading?

Identifying divergences is one of the easiest ways to use this indicator. Let’s see:

If there is a new high in the price and a new low in the OBV, there was a volume divergence. When this happens, the price usually reverses and produces a change of trend. In the chart above, the EURUSD 5-min price chart peaks between 4:30 and 6:00, forming a higher high, while OBV is forming a lower high.

A tip that you can apply is to wait for the price to touch the new high again, and if it cannot overcome it, you take a position in the next candle.

Place your stop loss just above the previous high, and your take profit can be where you want it to be as, for example, previous support.

Money Flow Index (MFI). How does it work?

If you are looking for an indicator that examines price and volume, this is the one for you. Knowing as a momentum indicator provides information on the outflow or inflow of money in a given time through an oscillator.

Usually, analysts interpret MFI by overbought or oversold levels, but this is not the best way to use it, as a reversal does not always occur when reaching these levels.

Advantages of MFI

It is better than indicators that use only price and time, such as RSI.

Disadvantages of MFI

Overbought and oversold levels are not always accurate in identifying reversals.

You will need other predictive indicators to improve accuracy on entries.

How to use the MFI in your operations?

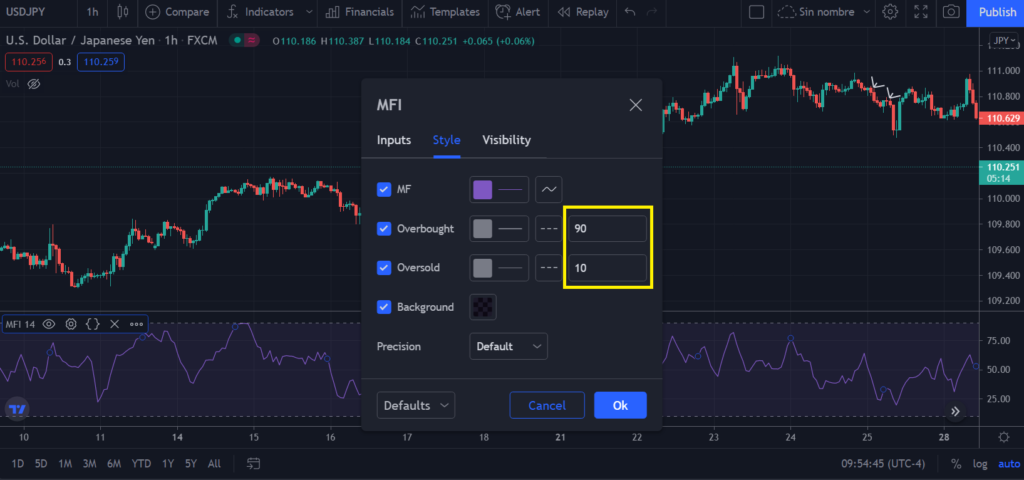

To show you a simple strategy with this indicator, you should modify the overbought and oversold levels from 80 to 90 and from 20 to 10, respectively. It is less common for the price to touch these levels, so the possibility of price reversal increases.

Once set up as recommended, let’s look at an example trade on the GBPUSD pair in a 1-hour time frame.

Notice on the chart that MFI touched the overbought level of 90 on July 4th, 2021, but wait, you should not take positions immediately.

Once it touches the overbought level, you should pay attention to the price action. It would be best to wait for it to make a new high and for the MFI to create a new low. In this way, we will be identifying a divergence correctly.

Although the price made two new highs, the indicator was telling us the opposite, and there was less and less buying pressure.

Waiting for confirmation with a large bearish, or bullish candlestick increases the chances of a successful trade.

Accumulation/Distribution (A/D)

Traders use this indicator to know through price and volume when an asset is being bought or sold in large quantities.

It provides valuable information about market behavior, specifically, what impact supply and demand have on the price. It tells us whether there are more buyers (accumulating) or sellers (distributing).

If we see a rising A/D line, it indicates that the market is in an accumulation phase. Conversely, if the line is falling, it denotes a market in the distribution phase.

With this indicator, we will find two variants:

- Price rises or falls, and the A/D accompanies it: if we see price goes up or down and A/D accompanies it, we are in a good trend with strength since there is still a flow of purchases or sales.

- Price rises or falls, and the A/D does not accompany it: if we see price goes up or down and A/D doesn’t accompany it, the trend is weakening because the flow of purchases or sales decreases.

Advantages of A/D

- It allows us to identify and monitor the flow of large amounts of money into an asset.

- We can use it on larger time frames to capture movements with higher percentages.

Disadvantages of A/D

- It does not consider the gaps between the opening and closing price in the stock and Forex markets; this can affect your short-term analysis.

- It should be used with other types of indicators to improve its accuracy.

How to use A/D in your trading?

Let’s see an example of how you can use it to enter a trend:

To enter the market in an uptrend, we can confirm if we see the price and indicator making new highs.

Conclusion

If you want to take your trading experience to the next level, you must take into account everything related to volume.

Learning about the three indicators we have described in this publication has its benefits. You will draw your conclusions and test to see if you should add any to your repertoire.

An expert recommendation is to combine volume indicators with other time indicators. It can make your strategy have a higher percentage of success because you take into account more aspects that affect the price.

In conclusion, none of the indicators that we have broken down is better than any other. So the first thing to do is to backtest each one separately to see which one is more accurate and effective from your point of view.