What is Volume-Weighted Average Price (VWAP)?

Volume-weighted average price (VWAP) is a technical analysis tool with which traders can make sense of a fast moving market. The tool tracks the average price of a currency pair (or any other market-traded asset) over a given period of time but weighted by the volume moved within the given period. Therefore, the tool enables market participants to account for both the volume traded and the price of the currency pair.

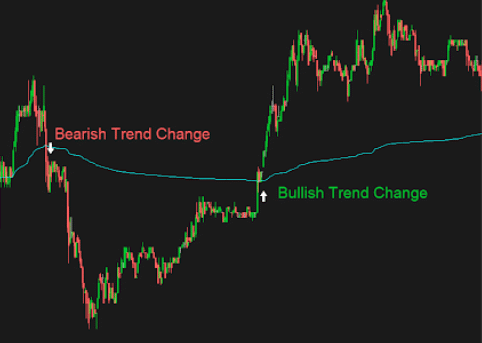

Technical analysis comprises the largest part of the daily activities of day trading. Unlike developing strategies using fundamental analysis, technical analysis produces for short-term trading. In both analyses, forex indicators play a crucial role. Interestingly, VWAP behaves more like the moving average. Both of the indicators show market participants when the market is bearish or bullish.

How does VWAP look like on a chart?

Another similarity between the moving average and VWAP is that both lag the market price. These indicators are calculated based on past data. For example, if one bases the calculation of VWAP/moving average on 1-minute ticker data, the indicators will always lag the price by one minute. However, significant differences exist between these indicators. One such difference is that calculations for VWAP refresh every new trading day. On the contrary, when calculating moving average, one considers even data from the previous day.

To understand how VWAP appears on a chart, one must first appreciate how to calculate the indicator. The formula for calculating VWAP is:

The typical price is simply the average of the High Price, the Low Price and the Closing Price of the period under consideration. However, you would not have to worry about such calculations because many trading software do them automatically.

Using VWAP in MT4

VWAP is one of the best forex indicators for automated trading and day trading because it is more sensitive to price movements. Once activated, the indicator begins to calculate at trade opening and stops at closing. If you are focusing on a 1-minute period, then the opening period is the first second and the closing period is the sixtieth second. This sensitivity of the indicator makes it ideal for day trading.

To use the indicator, follow these steps.

Step 1:

Open your MT4 platform and on the “Indicators” window, identify the tool. If it does not appear, then you need to download it.

Step 2:

Drag and drop the indicator on the desired chart. It is always advisable to leave the parameters as they are. However, experts can adjust the parameters as they like.

Using VWAP in day trading

For starts, day trading is a high-speed trading activity where market participants focus on scooping small profits within a day. Unlike position trading and other trading long-term strategies,day trading entails holding positions for no more than a day. Again, day trading is not like scalping because one actually holds positions for longer but not more than a day. This strategy earns small profits but over time, one ends up making huge returns.

VWAP is crucial in day trading because it identifies/confirms trends within a short time-frame. Similar to the moving average indicator, VWAP shows market entry and exit points based on the position of price action relative to the VWAP line. As a forex strategy, VWAP tells you the market is bullish when the candlesticks are above the VWAP line. Conversely, the market is bearish when the candlesticks are underside of the VWAP line.

Day trading is quite involving especially if you trade manually. As such, one must have hours of time to analyze the market. Thankfully, indicators like VWAP enable one to practice automated trading. The indicator computes volume-weighted price averages continuously for the period that the market is active. Therefore, one can safely term VWAP as a moving indicator.

Alternatively, various forex expert advisors whose strategies are based on VWAP exist. The indicator helps the robots to confirm market trends to provide the best trading signals. This way, you would carry on your day trading activities successfully without having to sit at your desk for long hours.

Best practices when using VWAP

VWAP is easy to follow and, unfortunately, this is why some may go wrong. The following trading tips should help you to best utilize the indicator.

- VWAP is more than just a trend indicator

As saw earlier, VWAP considers both the average price and the trading volume of forex products. If, for example, a currency pair closes extraordinarily higher but the volume is low, then one can interpret this as evidence of thinner liquidity. Thin liquidity exists when the market pays a low average price for a currency pair. Otherwise, one would interpret such a price spike as huge demand, which might wrongly lead one to buying rather than waiting for a better signal.

- VWAP is ideal for news trading

VWAP resets at every opening trade. This means yesterday’s prices cannot mislead one into making a wrong decision today. Say some big news just came out early in the morning when US trade was just about to open. An indicator like the moving average would not factor in such news. As such, it will continue to indicate in a certain direction that could be far from the reality. VWAP, on the contrary, is quite sensitive to news. It makes adjustments the moment a big story breaks.