There are two main schools of thought in the foreign exchange (forex) industry. There are those professionals who strongly believe in forex trading, while others believe in investing. This article will look at the difference between forex trading and forex investing.

What is forex trading?

Forex trading is the process of buying and selling currency pairs with the goal of making a profit. Traders typically open their trades and hold them for a short period. Some, who are known as scalpers, usually open their trades and close them within a few minutes.

Other traders, using the swing strategy, open their trades and leave them open for a few days. The goal of forex traders is to identify opportunities, take them, and then exit when the currency pair reaches a target. Forex traders are similar to the so-called Robinhood traders who use the popular app to day trade stocks.

What is forex investing?

Investing is different from trading because participants have a longer-term view. Forex investors are people who analyze currency pairs and then buy those they think will rise. They also short-sell pairs they expect will decline. After placing their orders, forex investors tend to hold them for a few months or even years. For example, if you expect that the EUR/USD will rise in the next 12 months, you can buy and hold the pair.

Forex trading vs investing differences

We have looked at the main difference between forex trading and investing. Still, there are additional differences. For example, most day traders focus on technical analysis, while many investors focus on fundamental analysis.

Technical analysis is the process of looking at charts and then using technical indicators to predict where the price will move to next. Some of the most popular technical indicators used by forex traders are Bollinger Bands, Average True Range (ATR), Average Directional Index (ADX), and Stochastic. These indicators are excellent in predicting where a currency pair will move in the short term.

Fundamental analysis, on the other hand, is the process of looking at macro data and predicting what will happen in the future. For example, a forex investor can look at the economic data from the US and then predict the actions of the Federal Reserve. For example, if the labour market is tightening and inflation is rising, they assume that the Fed will move to tighten market conditions. They then model the price action of a currency pair, say EUR/USD.

Therefore, while the two market participants use these two types of analysis in the market, traders mostly focus on technicals, while investors look at fundamentals.

Second, forex traders use candlestick patterns more than investors. Examples of the most popular candlestick patterns are doji, bullish and bearish engulfing, hanging man, hammer, and the three black crows. These patterns have been used by traders for decades. Yet, they are barely useful to long-term investors. For one, a doji means less to a macro trader who wants to hold the trade for several months.

Third, the next difference is the charts that the two market participants use. In most cases, day traders use shorter-dated charts for their analysis. Scalpers typically use charts that are less than 5 minutes, while many day traders use 15-minute to 30-minute charts. On the other hand, many investors use daily, weekly, and even monthly charts. This is because they believe that shorter charts tend to be noisy.

Costs of trading and investing

There are costs associated with both investing and trading. For one, most forex and CFD brokers don’t charge a commission. Instead, they benefit from the spread that happens between the bid and ask prices. Therefore, forex traders spend more money in terms of a spread than investors. This is because they make money by opening more trades than investors. Investors are only charged a commission when they open a trade.

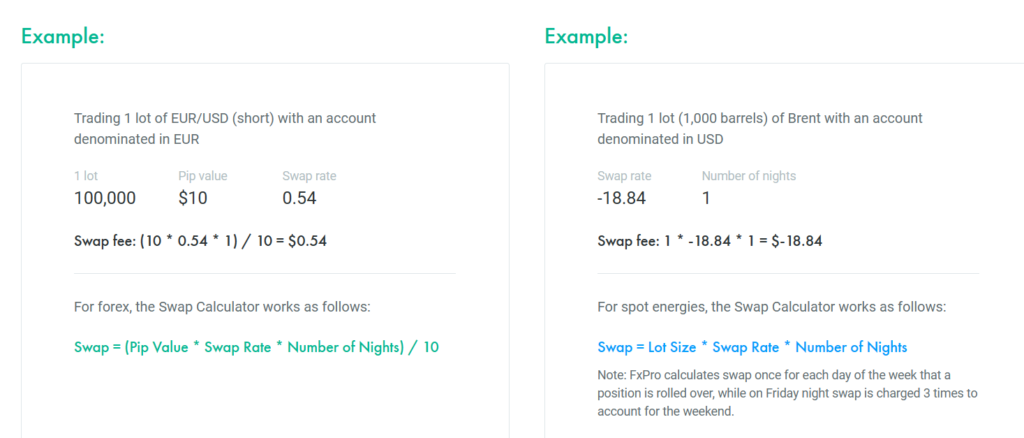

Still, there is an additional cost that investors pay. This cost is known as a swap. Swap is the interest rate differential between one currency and the other. The fee is charged whether you are long or short on the pair. The example below shows the swap rate for when you are trading EUR/USD and Brent.

Swap example

Therefore, forex investors pay more money in the form of swaps than traders. Still, the average swap is usually a relatively small amount.

Forex trading vs investing: which is better?

So, which is better between trading and investing? There are pros and cons to the two strategies. First, forex trading is better because it allows participants to take advantage of daily swings in the market. For example, if a currency pair is in an overall bullish trend, it allows you to take advantage of the short pullbacks.

Second, trading solves the challenge of the long-term view. For one, in a market as dynamic as forex, it is difficult to predict what will happen in the next month or week. For example, in early 2020, it was impossible to predict what would happen in March when the World Health Organization (WHO) declared Covid-19 a global pandemic. Also, it was almost difficult to predict what the Fed would do to intervene.

On the other hand, investing has its advantages. For example, it is a relatively cost-efficient method to take advantage of the financial market. Also, it allows you to take advantage of long swings in a currency pair. For example, investors who bought the EUR/USD after its dip in March 2020 benefited as it rose to a multi-year high. Further, investing is an easy way to make money if you have a job since it does not involve a lot of screen time.

Summary

Forex investing and trading are two different concepts in the financial market, and there are people who strongly believe in each of them. In this article, we have looked at what they are and their differences. We have also looked at some of the benefits of each of the approaches to the forex market.